Apply For Business Line Of Credit Online

The traditional lenders like banks and nbfc offer line of credit primarily in two forms.

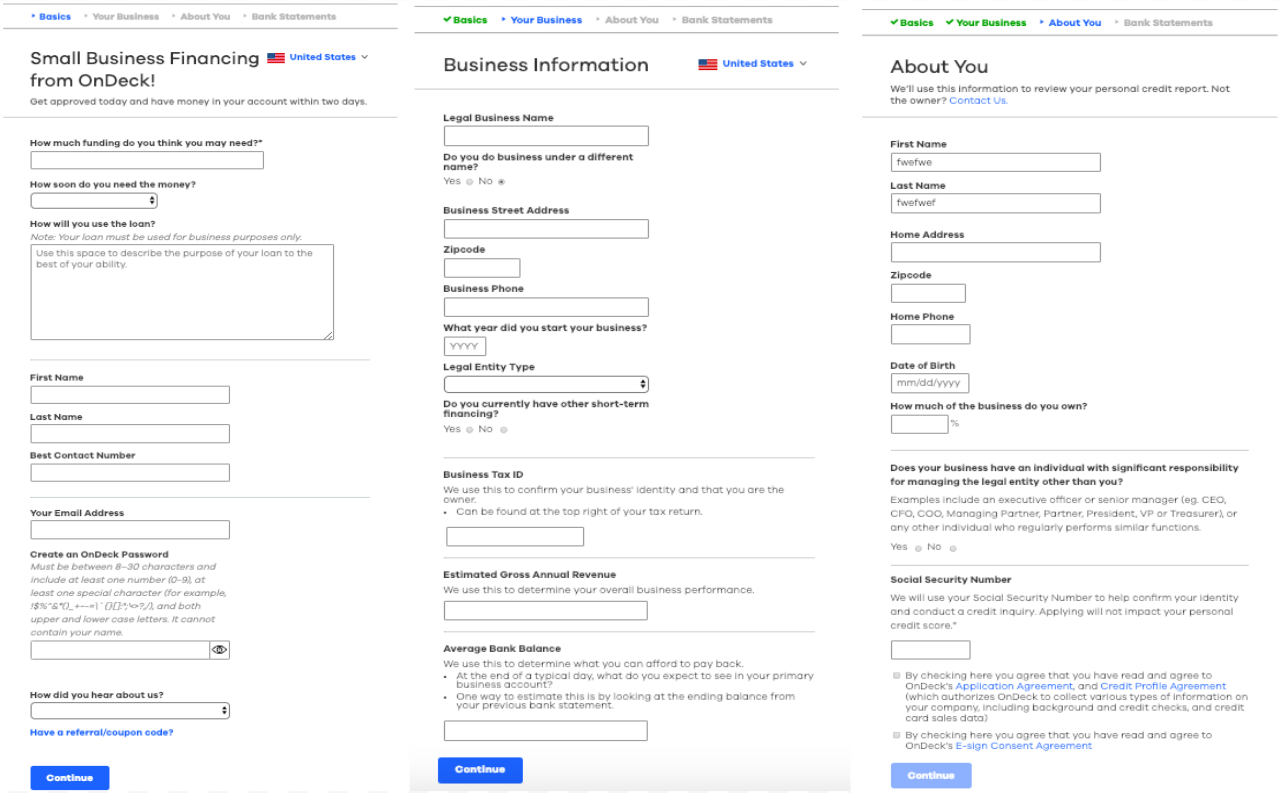

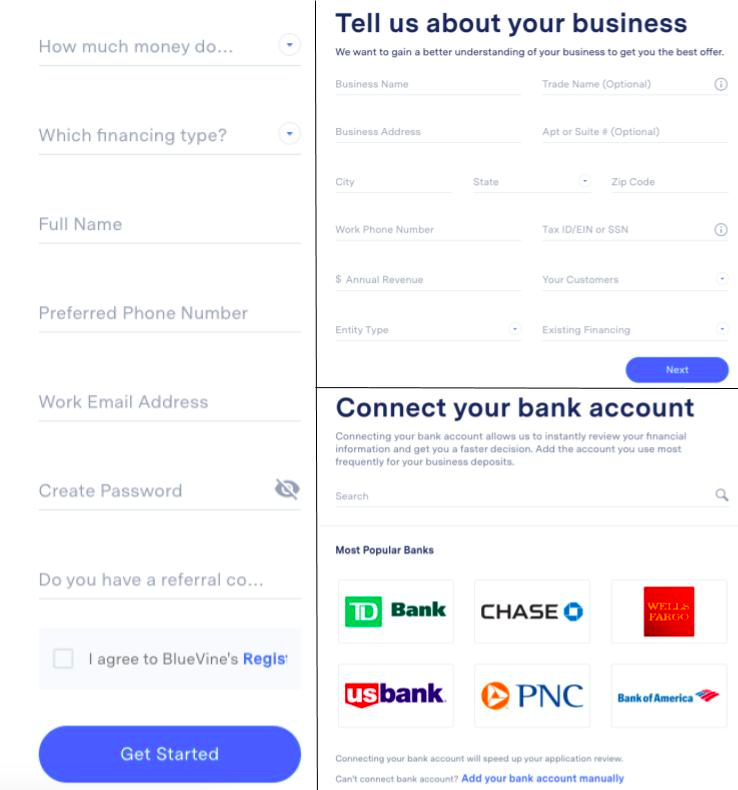

Apply for business line of credit online. However applicants must be located in a state with a u s. Eligible businesses must be in business for at least six months and have a minimum credit score of 550. You must also be able to prove that your business is currently earning a profit. Compare between business and commercial line of credit options for your business working capital needs.

They are secured and unsecured. As you repay your credit becomes available again letting you borrow as needed. Some common features of a line of credit include. How to apply for a business line of credit.

While it s ideal to have savings to help your business weather storms the next best thing is to apply for a line of credit. A business line of credit can be a lifeline of financing for small businesses which allows to meet payroll pay bills and operate their business in tough situations. Fill out our quick online application in minutes to check eligibility for a line of credit up to 100 000. A line of credit is an open end financial product that lets you borrow up to a predetermined credit limit and repay based on what you borrowed.

If approved you can get funded in 1 3 business days. You may borrow money up to your available credit limit. Apply for a small business loan or line of credit online with u s. Business line of credit is the most popular form of business loans especially for budding entrepreneurs.

Bank online over the phone or in person and get an unsecured line of credit up to 250 000. Line of credit india offers. A business line of credit is a flexible financing option used by small business owners as a solution for working capital needs. The very nomenclature of the type of advance is indicative of its basic features but it is imperative to learn about it in greater detail to have a clear insight into the nature of the line of credit loan you are getting into.

We ll ask for information like your time in business annual gross revenue and purpose for funds. Business credit lines were designed to help you meet short term cash needs such as purchasing supplies or additional inventory or covering operating expenses. Bank branch to qualify. Business owners can apply with u s.

Get a quick loan for a one time payout or cash flow manager line of credit for ongoing access to funds.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)