Auto Insurance Prices By State

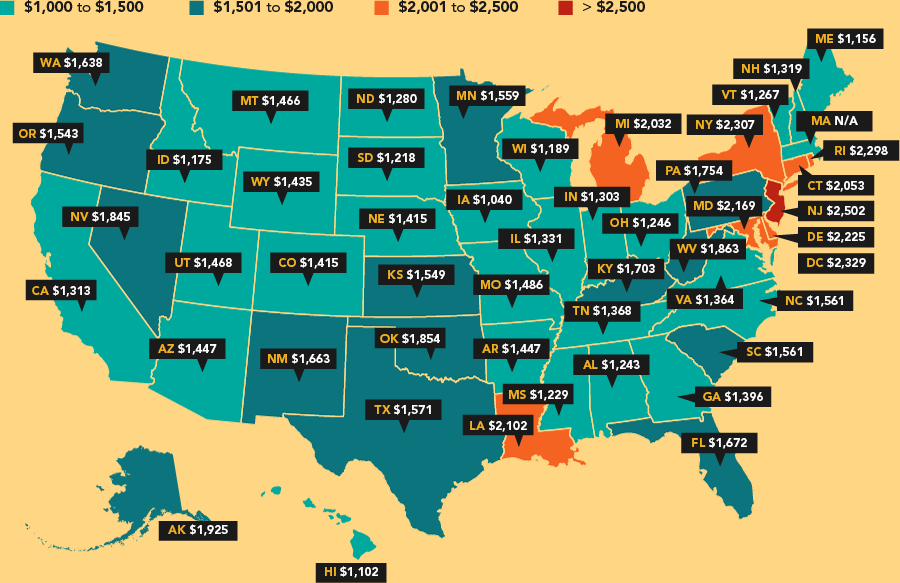

Auto insurance is regulated differently in each state leading to average prices for a full coverage policy ranging from just under 1 300 maine to over 8 700 michigan.

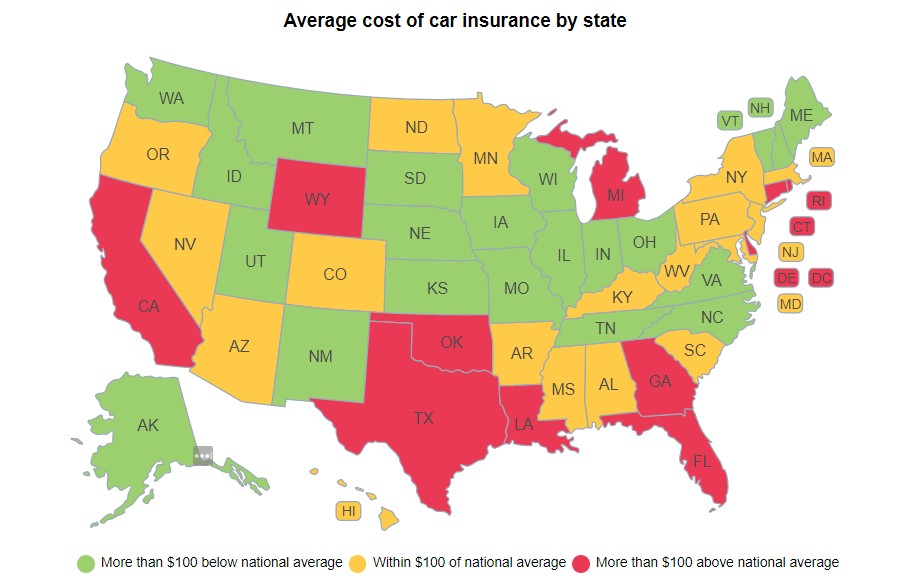

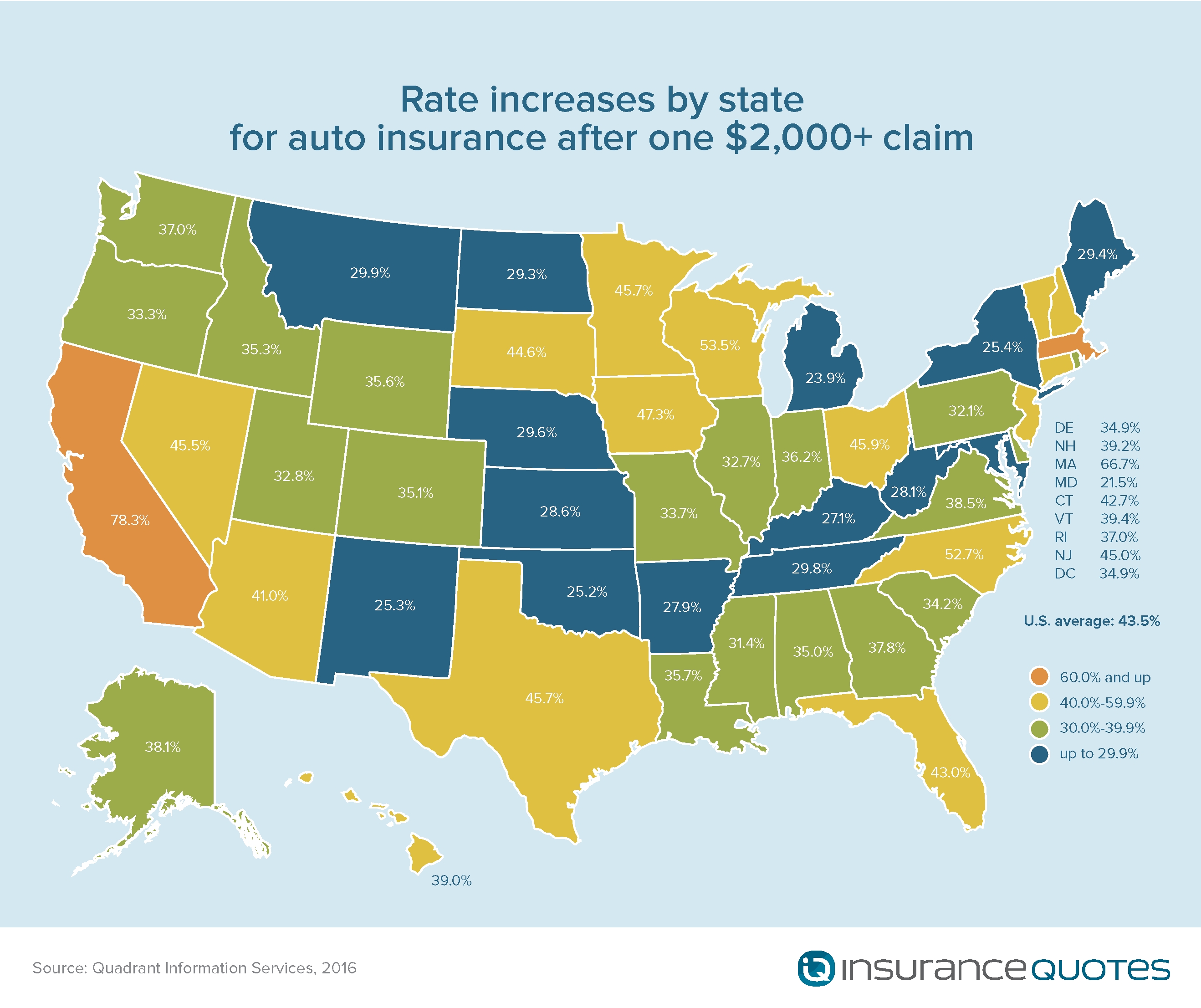

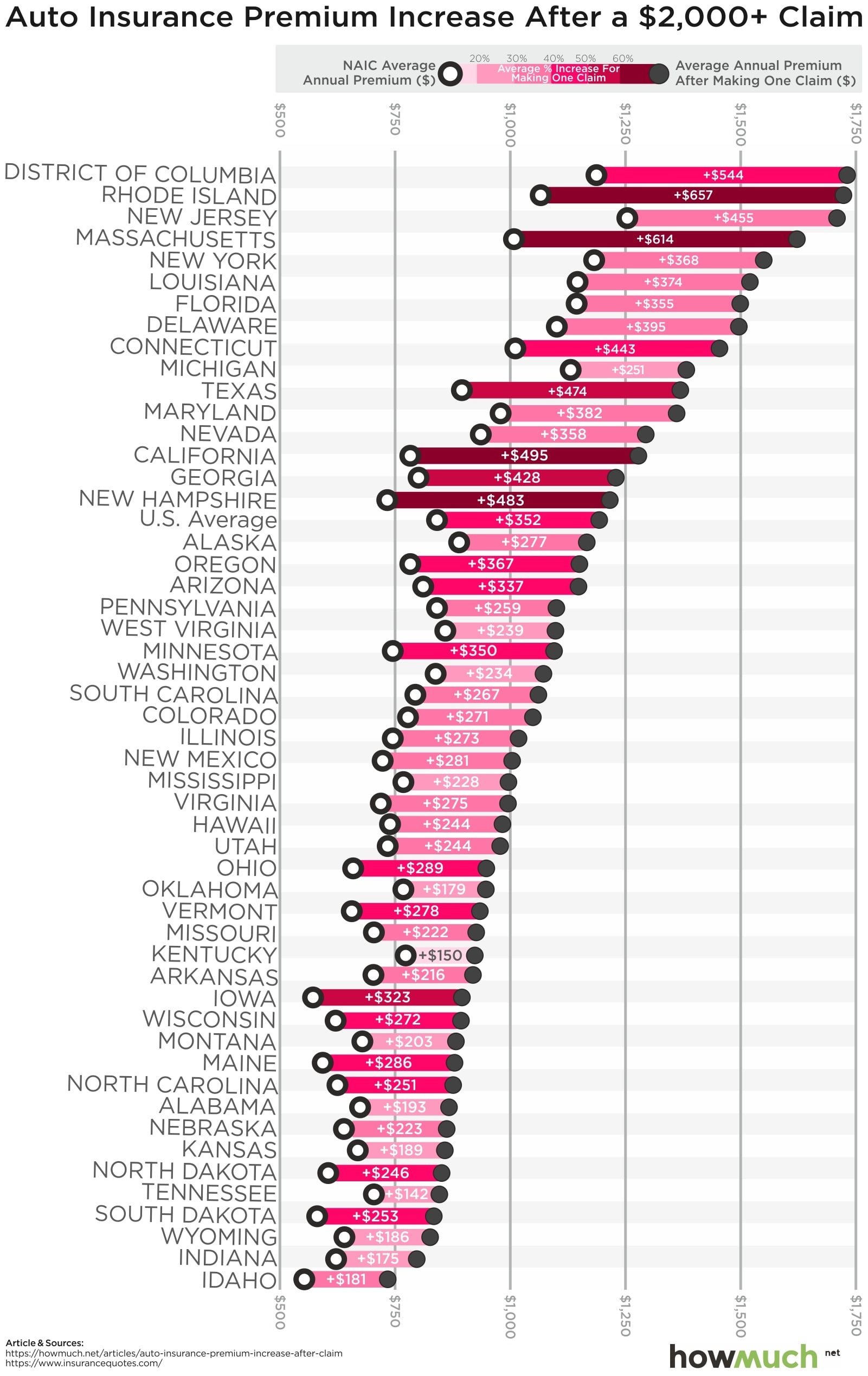

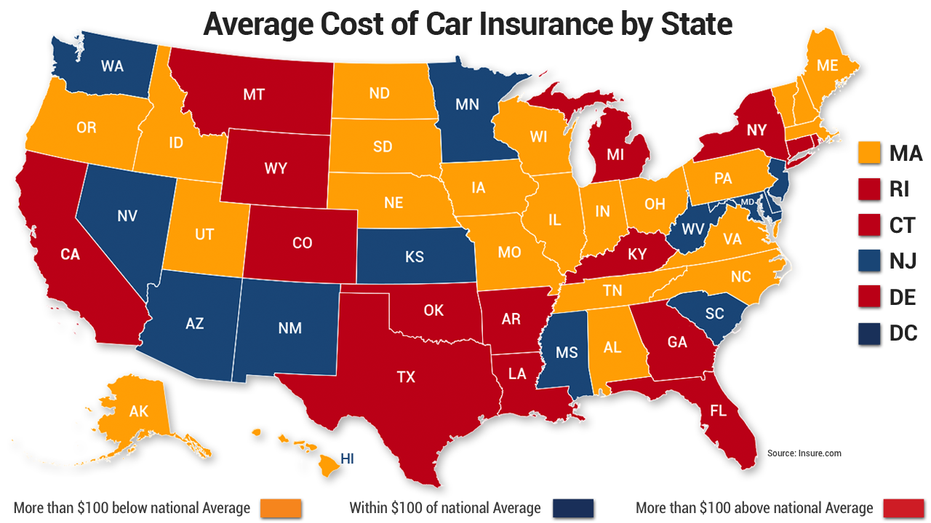

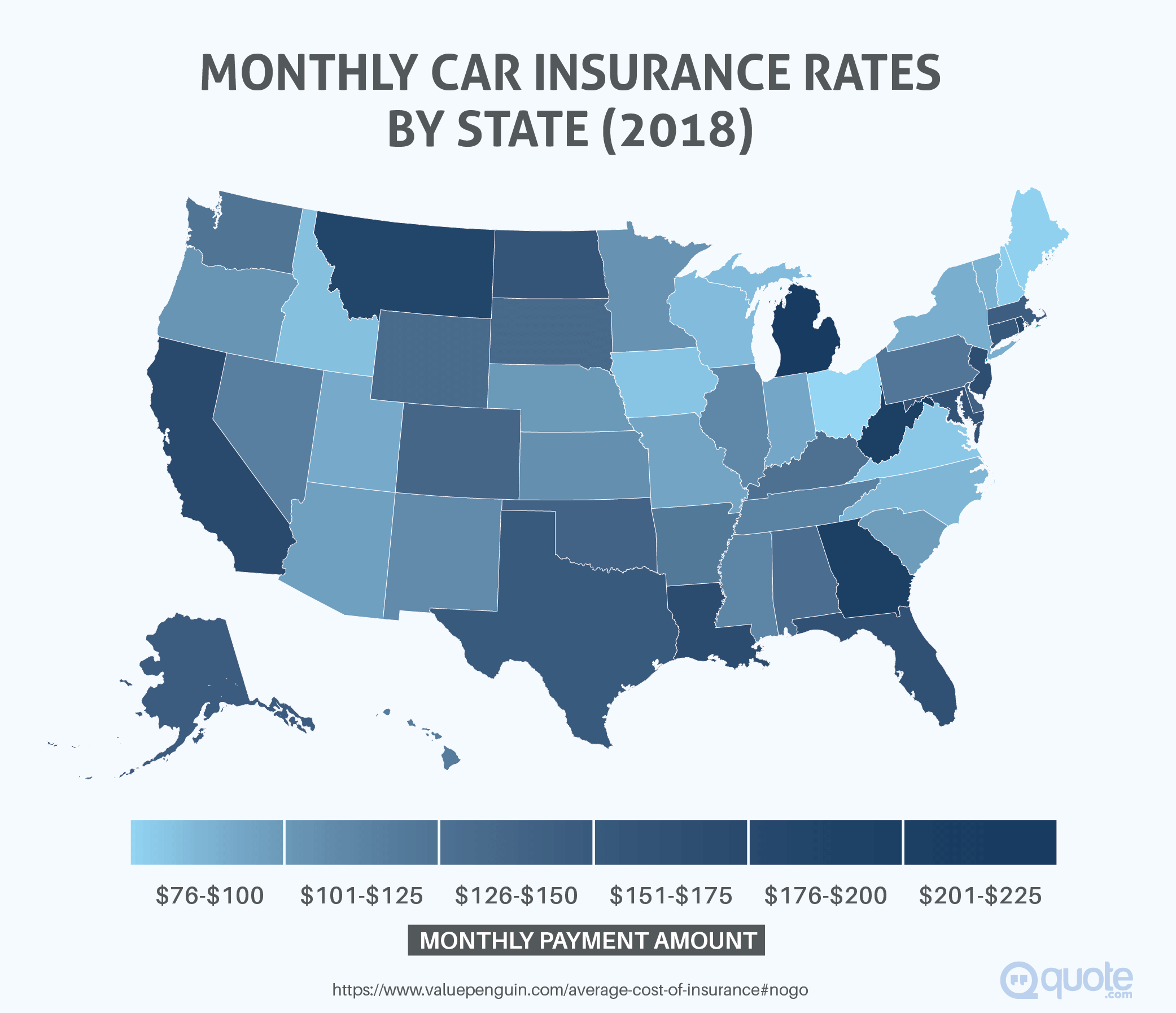

Auto insurance prices by state. How where you live impacts auto insurance rates one of the primary factors used in car insurance pricing is location. State car insurance rates change dramatically by state and between cities. You d think that safer cars would mean lower car insurance costs but as the wall street journal reported in august 2017 new cars loaded with high tech crash prevention gear are having a perverse effect on car insurance costs. Car insurance by state also varies with the zip code taking into consideration the prevalence of vehicle theft and other crime rates where the insured lives compared to the rest of the state.

Why safer cars aren t always less expensive to insure. Again let s compare the average price of car insurance in these states to the u s. But even within a state insurers considered certain locations or territories in insurance terms to be higher risk. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums.

Get a car quote. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. State required insurance minimums can also raise or lower insurance costs. Location within a state.

See car insurance rates by zip code plus state laws. Call us toll free. Insurance rates may vary from state to state so it makes sense to understand what factors affect insurance costs where you live. Some states have unusual car insurance requirements such as high limit personal injury protection which can significantly raise rates.

Whether it s high minimum coverage requirements or tough uninsured motorist coverage mandates it pays to understand what makes your state unique. We ll provide a hire car and if we re unable to arrange this we ll pay 50 a day for up to 14 days while your car s being repaired or if it has been stolen. For instance drivers in no fault states such as michigan and florida often pay more for insurance than do drivers in. Auto insurance fraud such as staged crashes false medical claims and repair scams is more common in certain states.

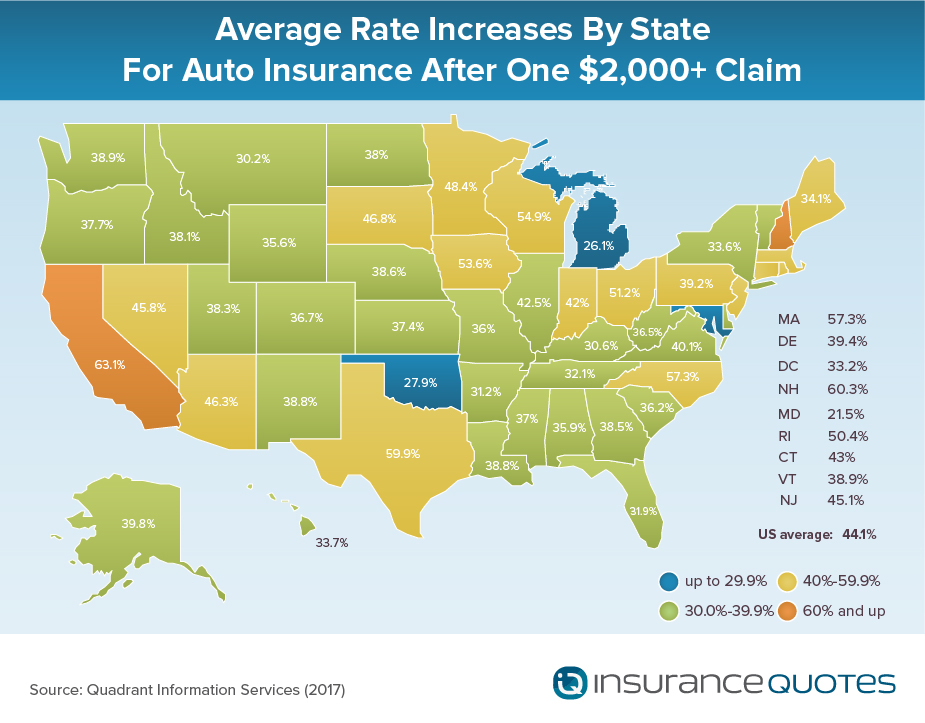

The average american driver pays 1 555 for full coverage insurance which means the rate among the top 10 most expensive states is about 37 higher than the national average a significant increase.