Auto Insurances In Usa

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

1 auto insurer in the us.

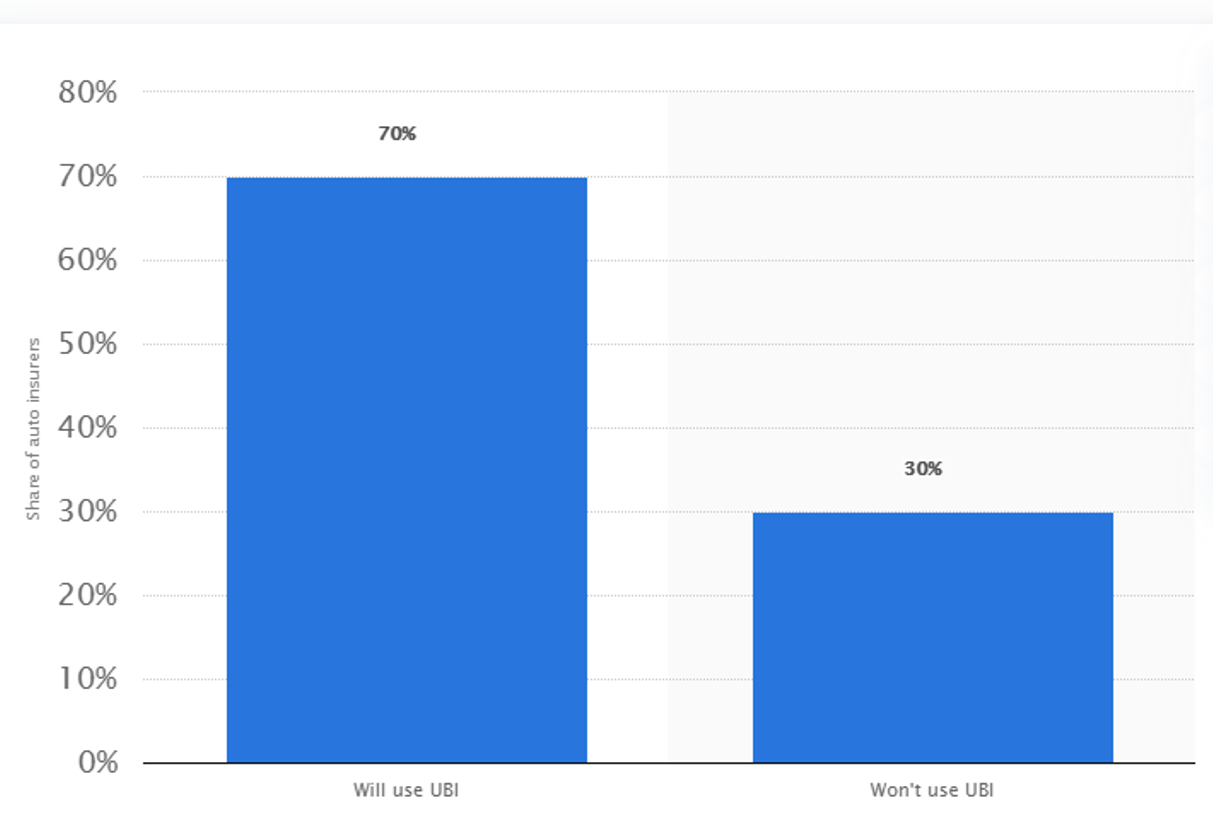

Auto insurances in usa. Vehicle insurance in the united states and elsewhere is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage most states require a motor vehicle owner to carry some minimum level of liability insurance. To enable all participants to shift gears from insurance to protection and become digital customer centric businesses. Once you have a better idea of the type of coverage you re looking for in a policy this will be easy. Power rates usaa as the second.

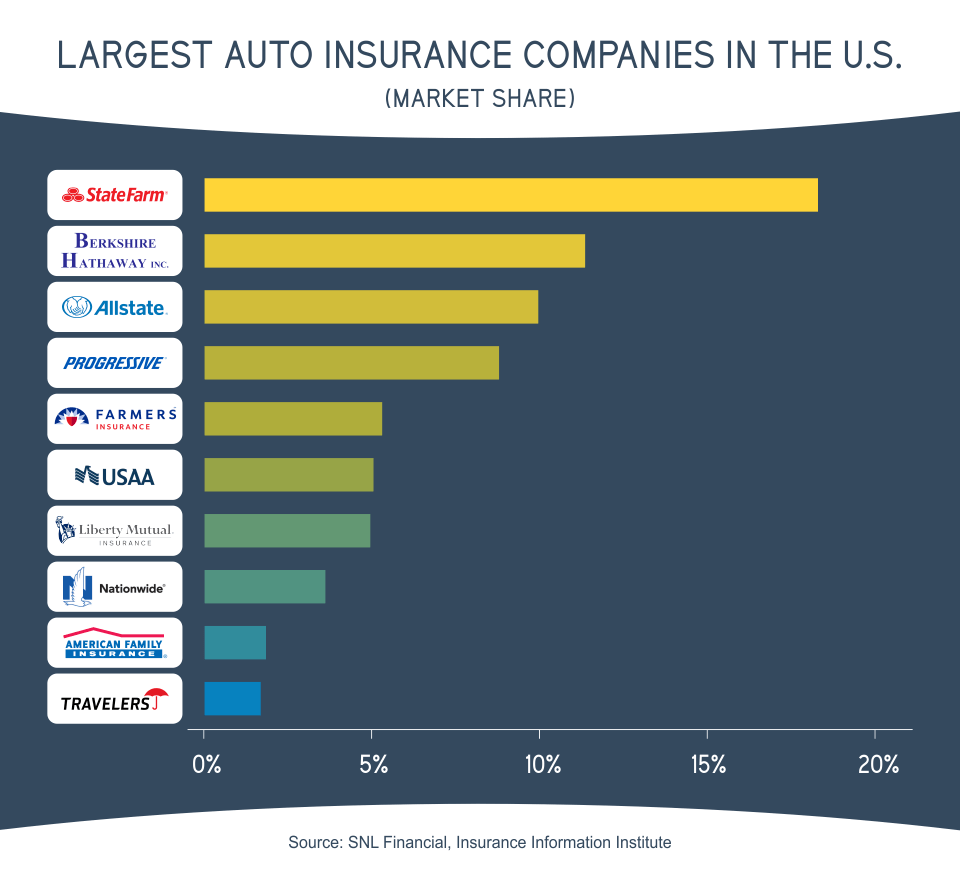

The 1 auto insurance company in the country in terms of market share and premiums written is state farm followed by geico progressive and allstate. Top rated auto insurance. 26 7 the percentage of drivers without car insurance in florida the state with the highest. Guy and women also may have far better luck searching for low cost vehicle insurance if they have a high credit report score.

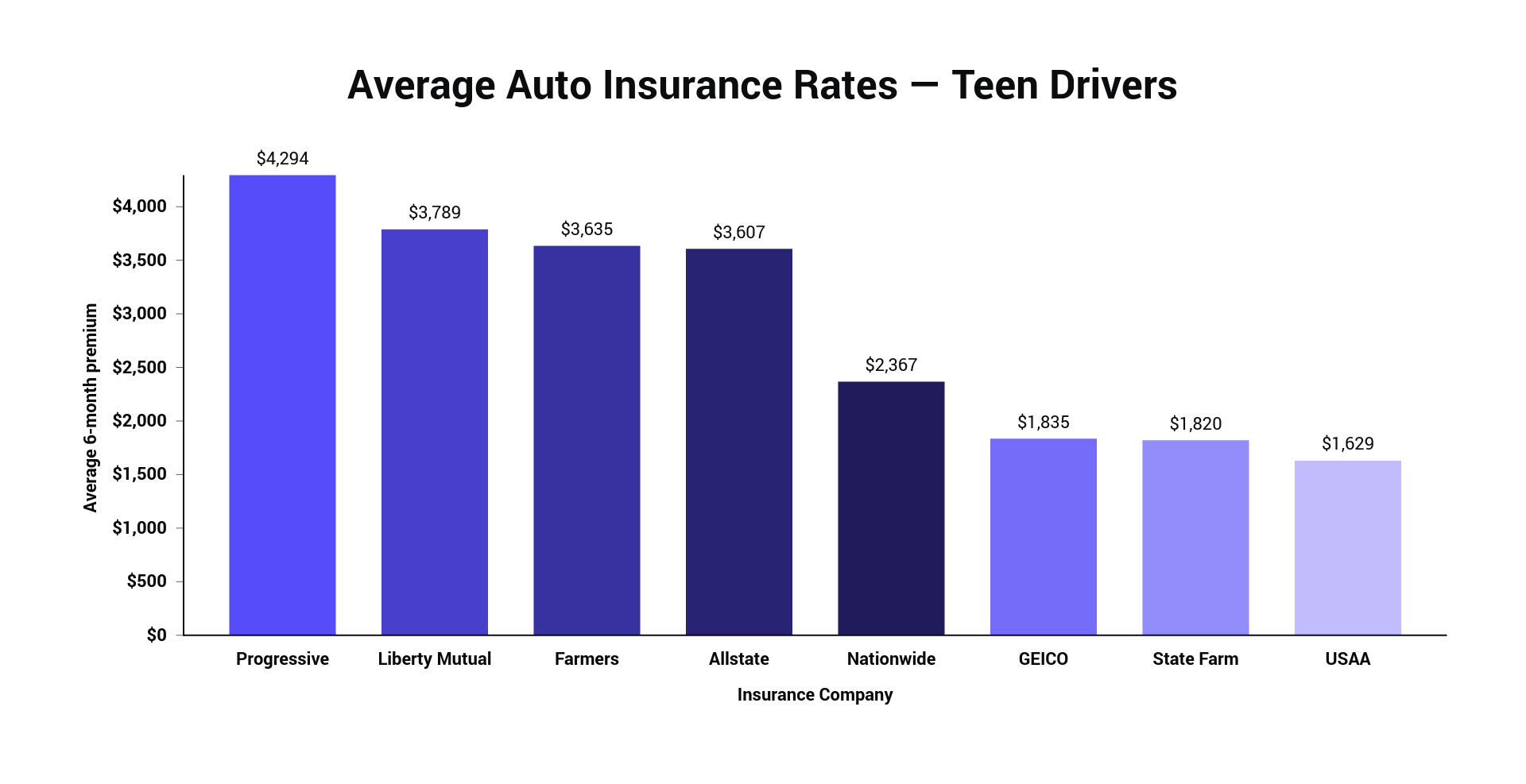

In other words you want to be sure that the quotes you get are for identical or at least very similar auto insurance policies. The top scoring auto insurance policy overall was geico reporting high customer satisfaction levels in all regions of the country and making it the no. Drivers who were uninsured in 2015 that s one in eight drivers 3. That created typical annual rates to spike by 1 000 or even more in some states while others leapt without a doubt less.

Car insurance by the numbers. Premiums insurance premiums are high particularly for men under 27 and those who live in inner cities where driving conditions are more hazardous and where car theft is endemic. When comparing car insurance quotes it helps to compare apples to apples. Usaa is the fifth largest auto insurance provider in the united states according to the insurance information institute with a market share of 5 9 percent.

It just takes one mishap to disrupt life as you know it. Some small vehicle insurance business just supply policies in a couple of states. If you frequently use rented cars you may be interested in a policy that includes collision damage waiver cdw for rented cars which may also be provided free by a credit card. 13 the percentage of all u s.

285 billion the amount the auto industry was predicted to have generated in 2019 1. Compare auto insurance quotes from over the top rated auto insurance brands and see how much you could save today. 1 099 the average annual cost of auto insurance in the u s.