Business Tax Relief Malaysia

A labuan entity can make an irrevocable election to be taxed under the income tax act 1967 in respect of its labuan business activity.

Business tax relief malaysia. Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment. Let s start from the perspective of the rakyat then zoom out to how it affects business in particular visit malaysia year 2020 and the economy at large. The expenses for the renovation work must be incurred between 1 st march up to 31 st december 2021. 5 000 limited 3.

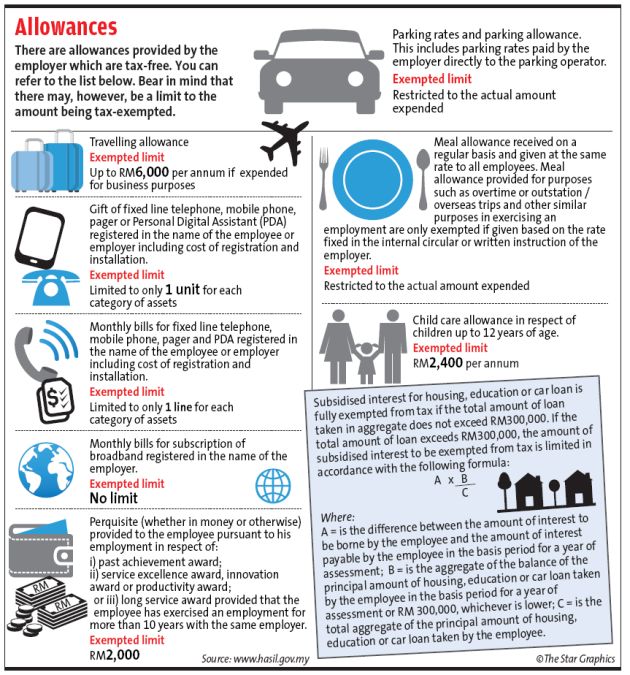

If you digest this by dec 2019 then in april 2020 you don t need scramble around to find the receipts for items you purchased the year before. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Tax relief is given for covid 19 related purchases image from forbes. How does budget 2020 impact the rakyat.

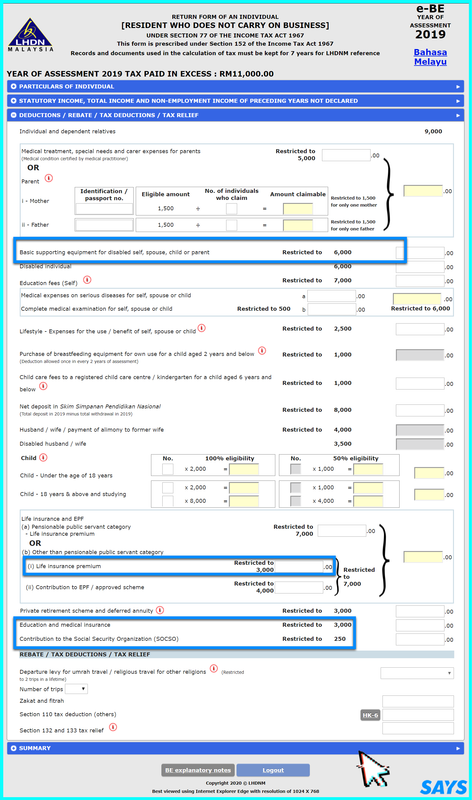

Business records include profit and loss account balance sheet sales records purchase records stock receipts bills and bank statements. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. This relief is applicable for year assessment 2013 and 2015 only. Amount rm 1.

The branch or subsidiary of a malaysian bank in labuan is subject to tax under the labuan business activity tax act 1990 instead of the income tax act 1967. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less are taxed 18 for their first rm500 000 and 24 for earnings in exces of rm500 000. The impact on the man in the street 1. Income derived from sources outside malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings.

Income tax scale rates the income tax scale rates remain at 0 to 28 for the first rm2 million in chargeable income. Now for existing businesses there are tax deductions given up to rm300 000 if the company proceeds with renovation works and refurbishment. Because this is the most comprehensive and practical guide on income tax relief in malaysia for the non tax savvy you yes you. Medical expenses for parents.

Basis of assessment income is assessed on a current. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.