Cashing Out An Annuity Before 59 1 2

A retirement annuity may have been created by an.

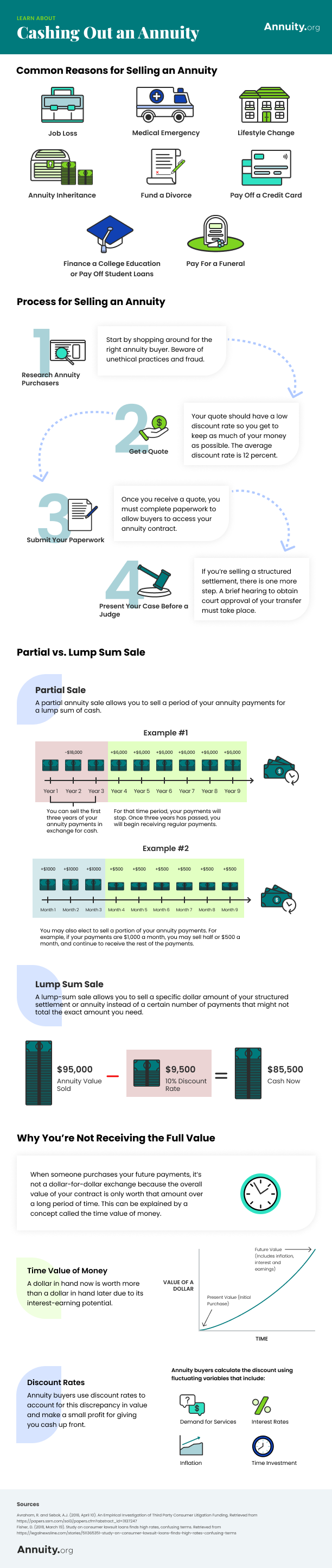

Cashing out an annuity before 59 1 2. If he decides to do so the irs will tax any gains on the annuity at his regular income tax rate and he will pay a 10 percent tax penalty for cashing in his annuity before age 59 and 1 2. You may also owe surrender charges from the insurance company. In this case a different set of. To cash out your annuity contact your insurance company or agent.

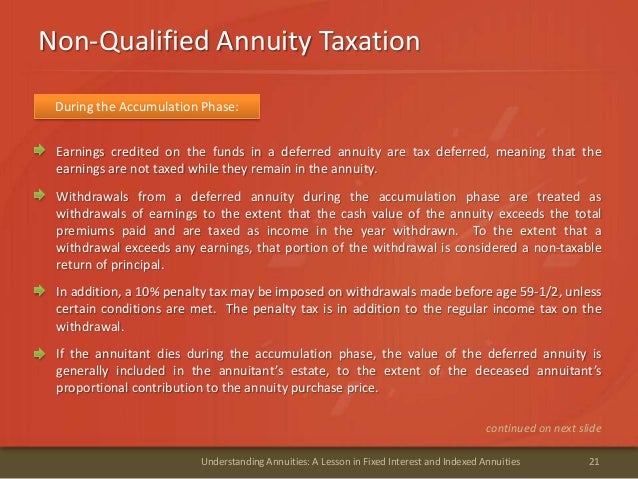

The 10 federal tax penalty on pre 59 1 2 distributions is imposed when the account from which the money is withdrawn had previously been favored with income tax deferral. Take the above example where the deferred annuity has a withdrawal before age 59 but assume the contract is held individually in a non qualified annuity. For example if you withdraw 500 you will pay a penalty of 50. An annuity is a tax deferred retirement product sold by insurance companies.

In that case the irs exempts certain distributions from the penalty tax if the account that is making the distributions is a lifetime immediate annuity. Returns of contributions and earnings. You should never withdraw funds from your annuity before you reach the age of 59 1 2. If you re younger the irs will levy a 10 percent penalty on the taxable portion of those funds in addition to charging any regular taxes.

When you cash out your annuity the money you receive gets split into two categories. How to cash out a retirement annuity. If you take money out of an annuity before you turn 59 1 2 and you don t qualify for any exceptions to the general rule then you will have to pay an additional 10 penalty on the withdrawal on. Even if you re well past your contract s surrender period if you take money out of an annuity before you reach the age of 59 1 2 you ll be assessed a 10 early withdrawal penalty the same.

Unlike immediate annuities a person who owns a deferred annuity may cash it in with the annuity company before reaching age 59 1 2. Wait until you re 59 1 2 to withdraw from your annuity. If you do the internal revenue service will charge you a federal income tax penalty of 10 percent of the amount of money you take out. However if you cash out before you turn 59 1 2 you could face not only taxes and penalties from uncle sam but also surrender charges from your financial institution.

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png)

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)