Debt Taxation

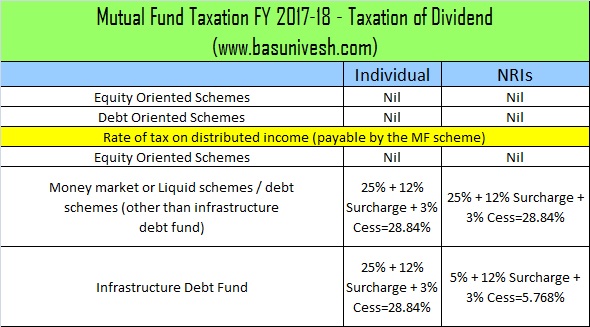

Tax liability on dividend returns of such funds is not levied on investors directly.

Debt taxation. If your tax debt is more than 100 000 phone us on 13 11 42 during our operating hours to discuss your options. In general you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on form 1040 u s. Release from your tax debt. Sometimes the internal revenue service will allow.

You will need your australian business number abn or tax file number tfn and the full details of your outstanding amount to set up a payment plan. Unpaid tax debt can cause stiff penalties and even jail time in the united states. The government also has the ability to garnish wages and place levies on property for unpaid tax debt. According to the latest tax slabs for the year 2016 17 sunil falls in the tax bracket of 20.

For example sunil is an it executive who earns rs 10 00 000 per annum. Instead they are paid by the asset management company themselves. If the equity exposure in a hybrid fund is less than 65 or is equally exposed to equity and debt instruments i e. Individual income tax return pdf form 1040 sr u s.

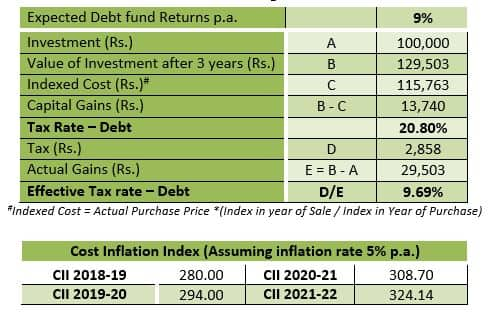

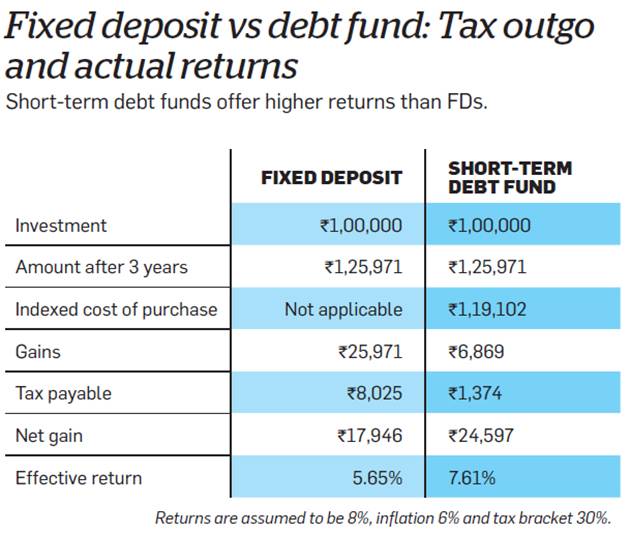

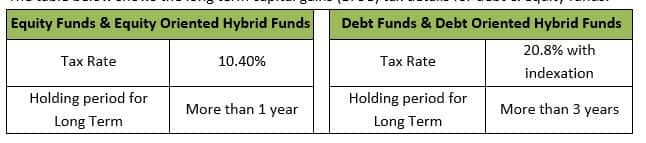

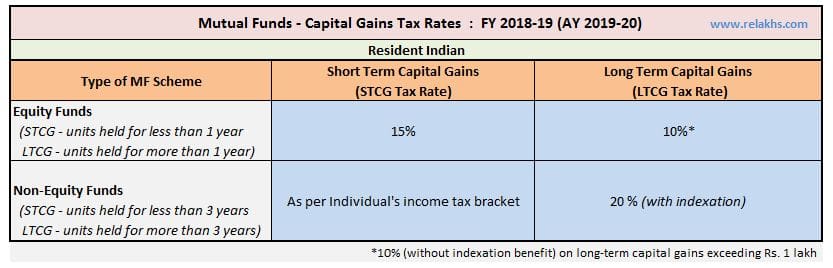

The tax on debt fund held for less than 3 years is calculated as per the income tax bracket for that individual. How much is the tax liability on debt mutual fund earnings. Nonresident alien income tax return pdf as other income if the debt is a nonbusiness debt or on an applicable schedule if the debt is a business debt. In certain circumstances we can permanently remove some or all of an individual s tax debt.

50 equity and 50 debt then it is considered as a debt fund for taxation. We can only release you from payment of particular tax debts where paying those debts would leave you not able to provide for yourself your family or others for whom you are responsible. In the context of corporate finance the tax benefits of debt or tax advantage of debt refers to the fact that from a tax perspective it is cheaper for firms and investors to finance with debt than with equity under a majority of taxation systems around the world and until recently under the united states tax system citation needed firms are taxed on their profits and individuals are taxed. There are exceptions to this rule however so a careful examination of one s cod income is important to determine any potential tax.

Debt associated with the failure to pay taxes to the federal or state government on earned income. This is commonly known as cod cancellation of debt income according to the internal revenue code the discharge of indebtedness must be included in a taxpayer s gross income. All forms of income through debt funds are subject to taxation as per the income tax act of 1963. We call this release.

Tax return for seniors pdf or form 1040 nr u s.