Define Settling Vat

Click for more sentences of settling well.

Define settling vat. Vat is defined as an abbreviation for value added tax. The collective bargaining agreements were usually settled well in advance of the season. Bilateral netting is the process of consolidating all swap agreements between two parties into a single agreement with one net payment instead of multiple transactions. Don t forget vat if appropriate.

For income tax purposes the lease payments of both a finance lease and an operating lease are deductible under section 11 a. A range of possible options include settling. For vat purposes during the term of the swap there is a continuous supply of services and to the extent that any money changes hands there is an exempt supply under the vat act schedule 9. Value added tax is commonly known as vat.

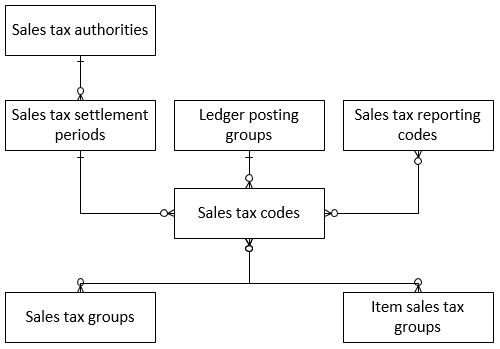

Settling well in a sentence use settling well in a sentence 1. See secondary settling tanks. In the vat statement window you define the vat statement based on the accounts in the chart of accounts window or based on entries in the vat entries window. Defining value added tax regime.

Revenue is raised for government by requiring certain businesses to register and to charge vat on the taxable supplies of goods and services. The advantage of using the vat entries option is that you can close these entries by posting the vat settlement. When dealing with lease agreements care should be taken to determine whether the agreement refers to a finance lease or an operating lease for tax purposes. A settlement agreement should also address how the parties will co operate to bring an end to any extant legal proceedings.

Some were high ranking officials in their respective professions and settled well in their lives. Geneva from the lake the waters of the rhone are very limpid and blue as it has left all its impurities in the great settling vat of the lake so that byron might well speak of the blue rushing of the arrowy rhone childe harold canto iii. The underlying asset is therefore not capitalised for. Define vat document sequencing.

The registration would be the basis for all recovering credit on input tax settling tax liability and tax reporting. Some or all of the particular claims set out in the claim form a narrow definition. Depending on the mass of sludge to be removed there are several scraped circular settling tanks based on the design of the bottom scraper system single continuous blade or multiple blades in a slatted arrangement and of the bridge radial with or without overhang or diametral.