Direct Subsidized Loans For Graduate Students

You may receive more than one loan under an mpn over a period of up to 10 years to pay for your educational costs as long as the school is authorized to use the mpn in this way and chooses to do so.

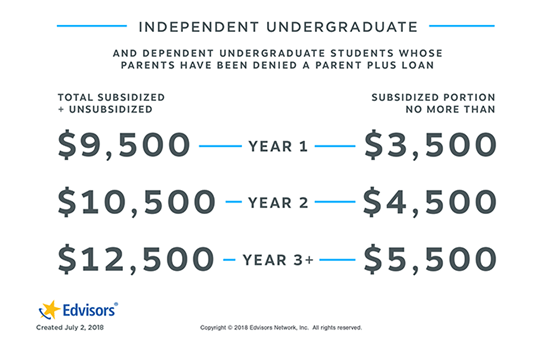

Direct subsidized loans for graduate students. Direct subsidized and unsubsidized direct loan maximum eligibility for teacher certification is 12 500 for the academic year. Methodist university participates in the william d. Due to federal statute eligibility is based on fifth year undergraduate loan limits even though you are required to have a bachelor s degree and your admission is administered by the penn state graduate school. As of july 1 2012 students attending graduate school or professional school are eligible only for the direct unsubsidized loan.

Graduate or professional students are not eligible to receive a subsidized loan. Grad students are now and will still be able to take up to 20 500 in stafford loans a year. These are low interest loans for eligible students to help cover the cost of higher education. Direct unsubsidized loans for graduate students.

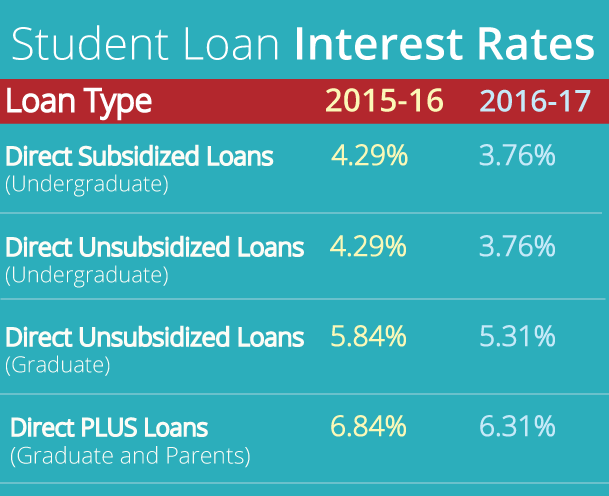

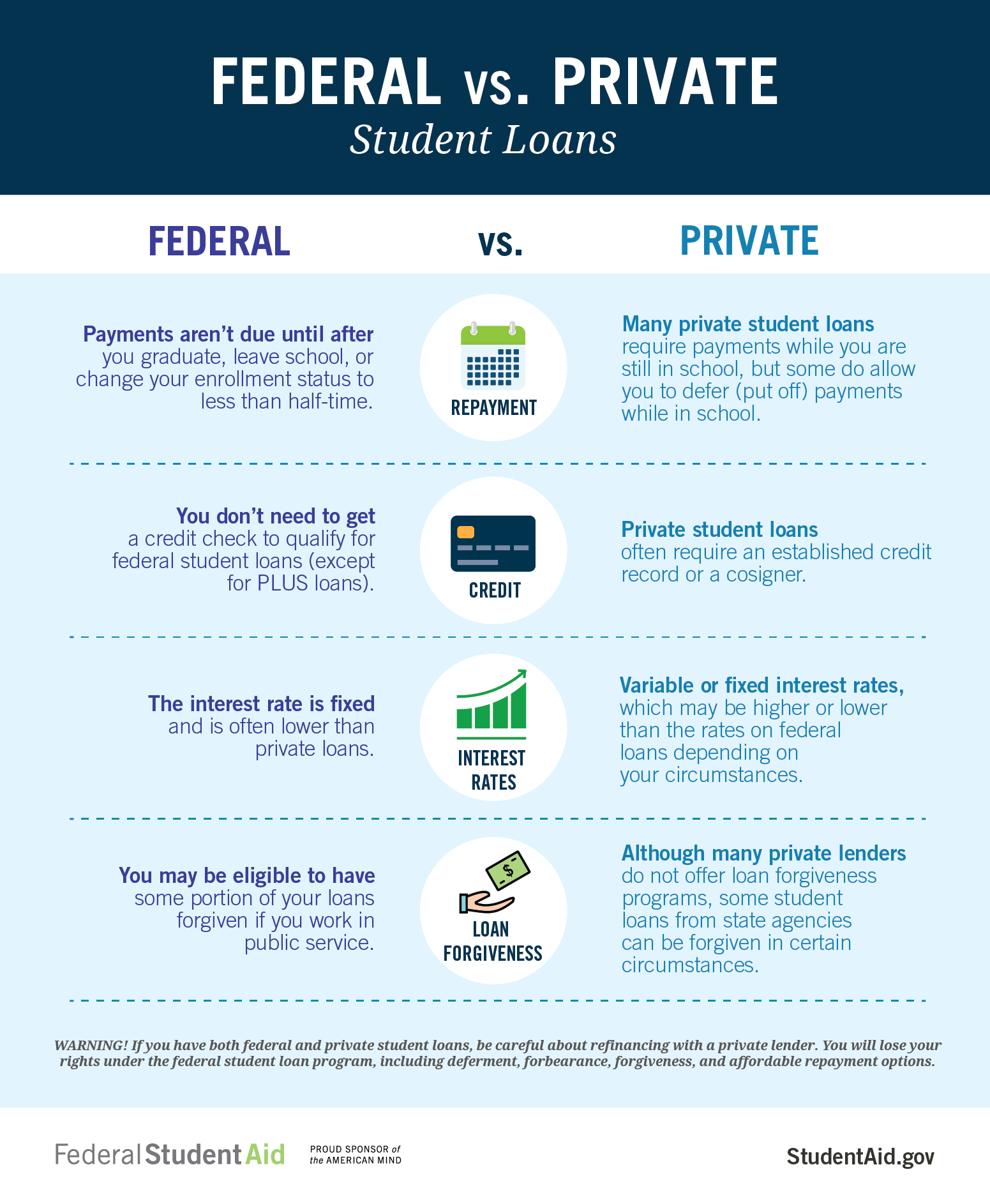

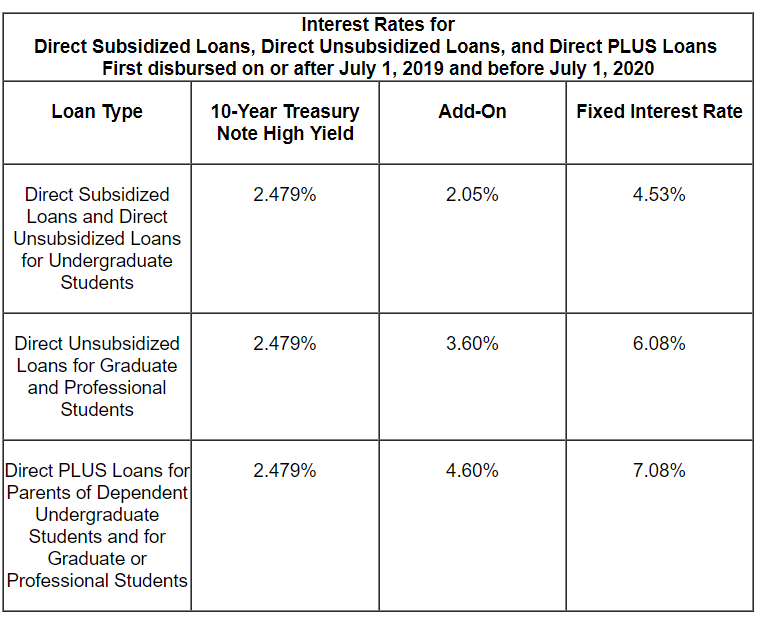

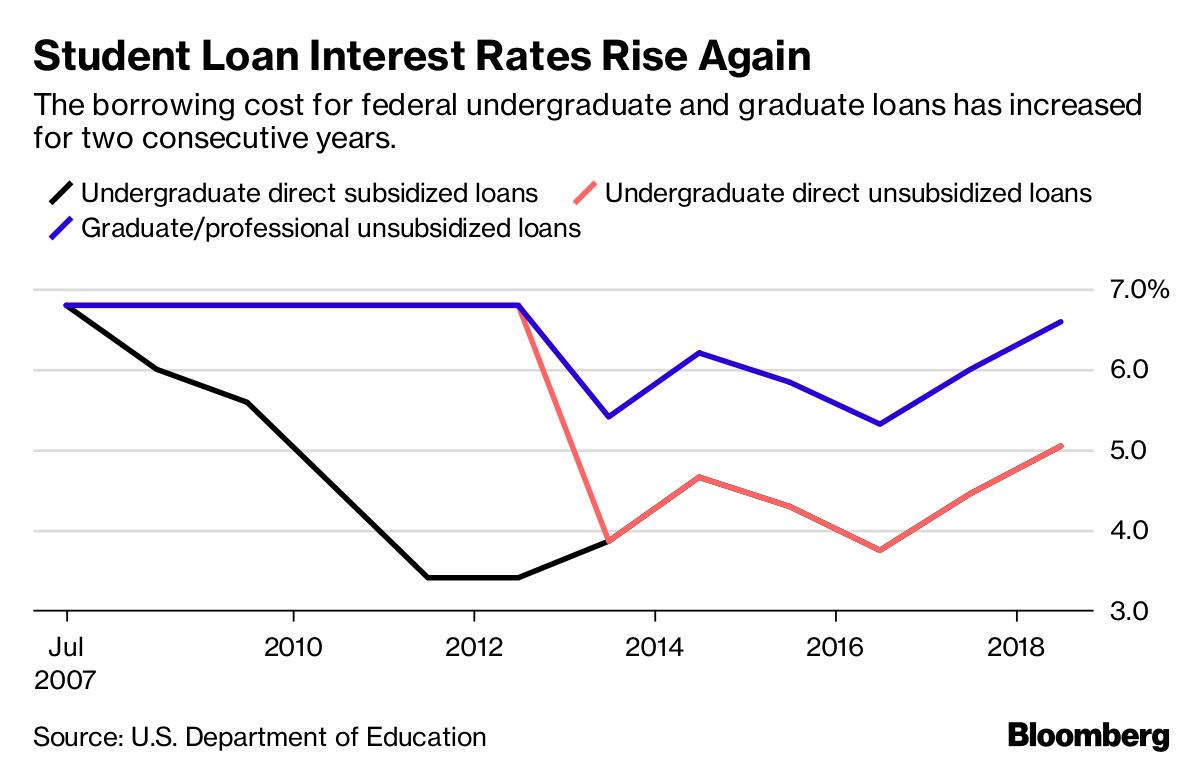

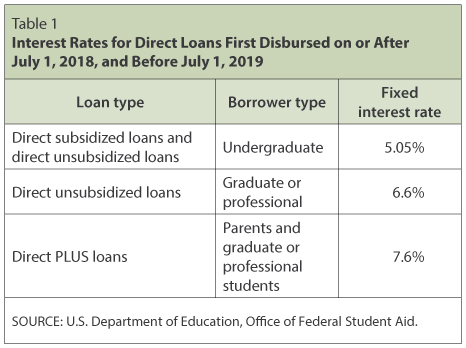

The apr on unsubsidized loans for graduate and professional students is 6 08. All direct subsidized and unsubsidized loans disbursed between july 1 2014 and june 30 2015 carry a fixed interest rate of 4 66 for undergraduates. The direct unsubsidized loan and the grad plus loan. Ford federal direct student loan program federal direct loans for the processing of the federal direct subsidized and unsubsidized loans.

Direct unsubsidized loans for undergraduate students. To be eligible you must complete the free application for federal student aid fafsa. Compared to undergraduate loans there are increased borrowing limits but there is no longer an interest subsidy. Undergraduate students remain eligible for new direct subsidized loans.

Direct subsidized loans for undergraduate students. The direct subsidized loan is no longer available to graduate students. But while demonstrated financial need currently determines how much of the loan burden is subsidized. Interest rates for direct loans first disbursed on or between july 1 2019 and june 30 2020 these will be fixed rate loans direct subsidized loans for undergraduate.

The rate for a direct unsubsidized loan disbursed between july 1 2014 and june 30 2015 is fixed at 6 21. Federal loans are available for students attending graduate or professional school.