Etn Vs Etf

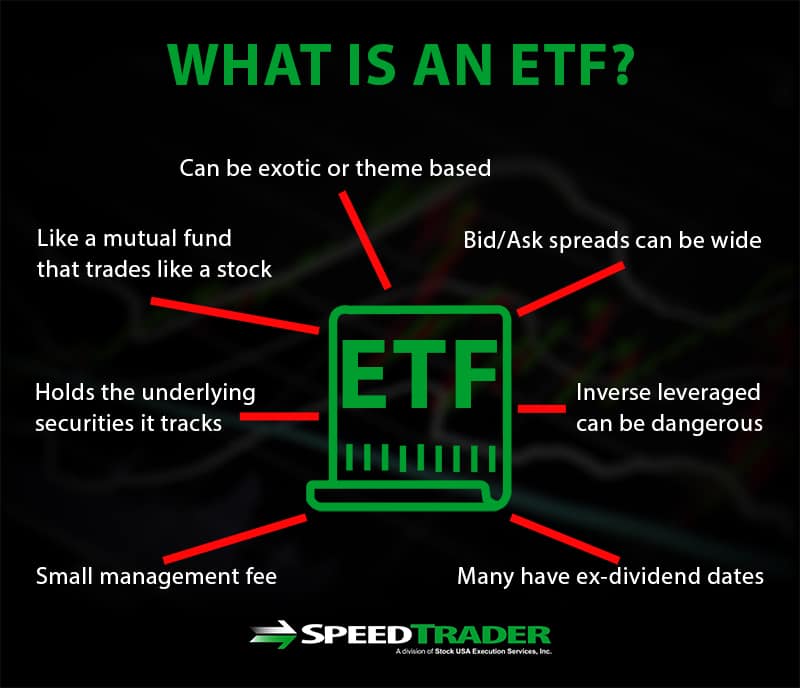

The biggest differences are between mutual funds and etf s etn s.

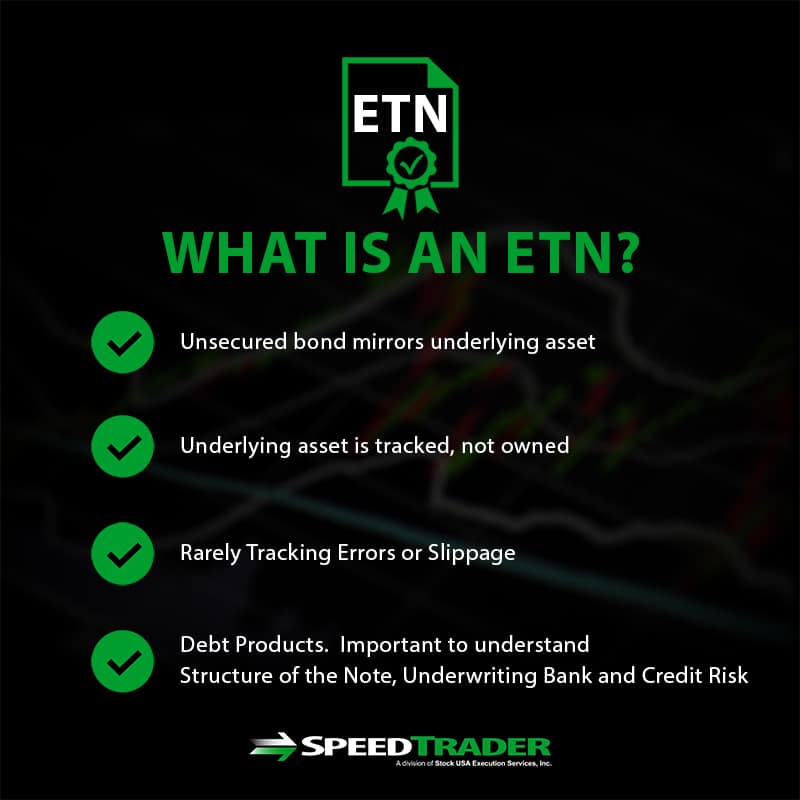

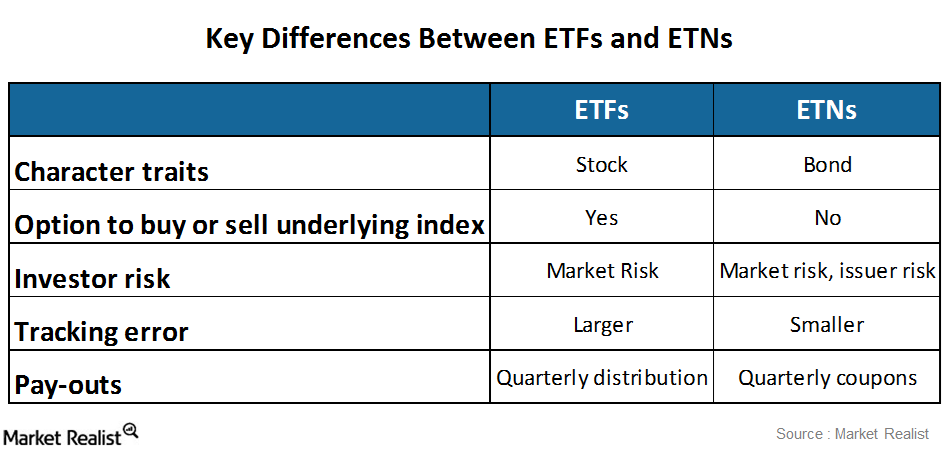

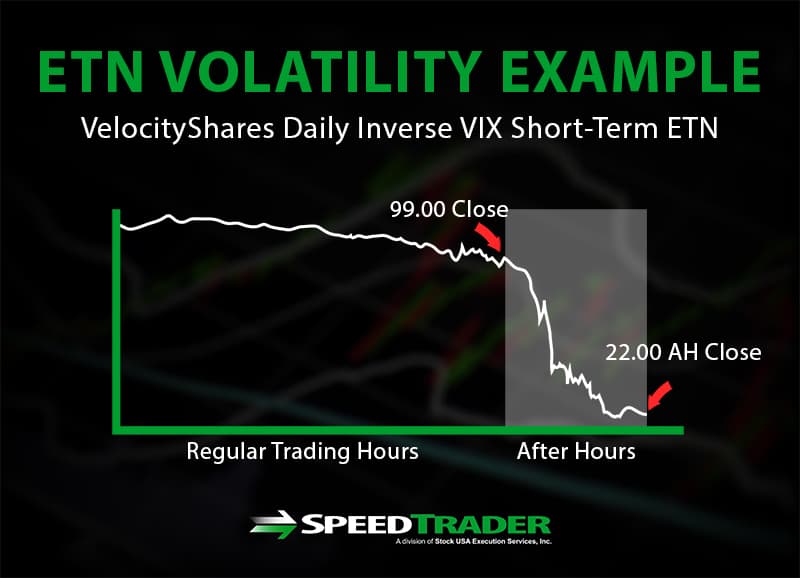

Etn vs etf. Depending on the goals of the etf those assets may be stocks bonds or derivatives like futures and options. T he most popular exchange traded product to bet on volatility the ipath s p 500 vix. Etns are more like bonds in that they are unsecured. Defining an etn vs.

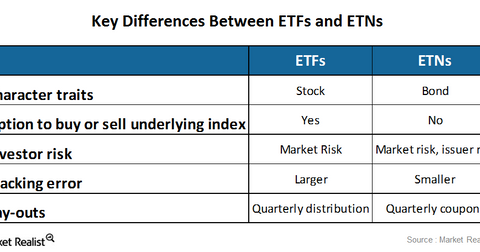

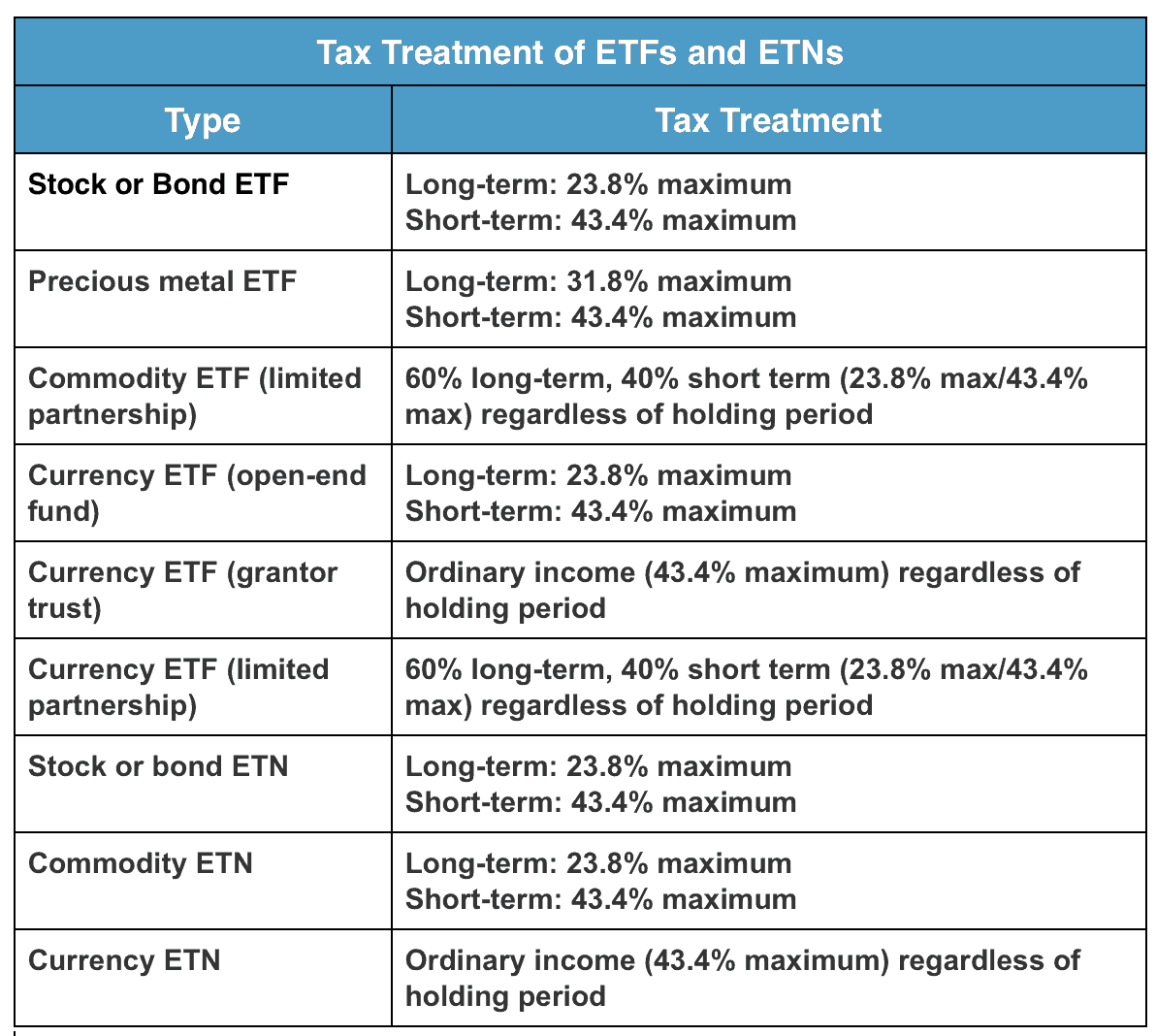

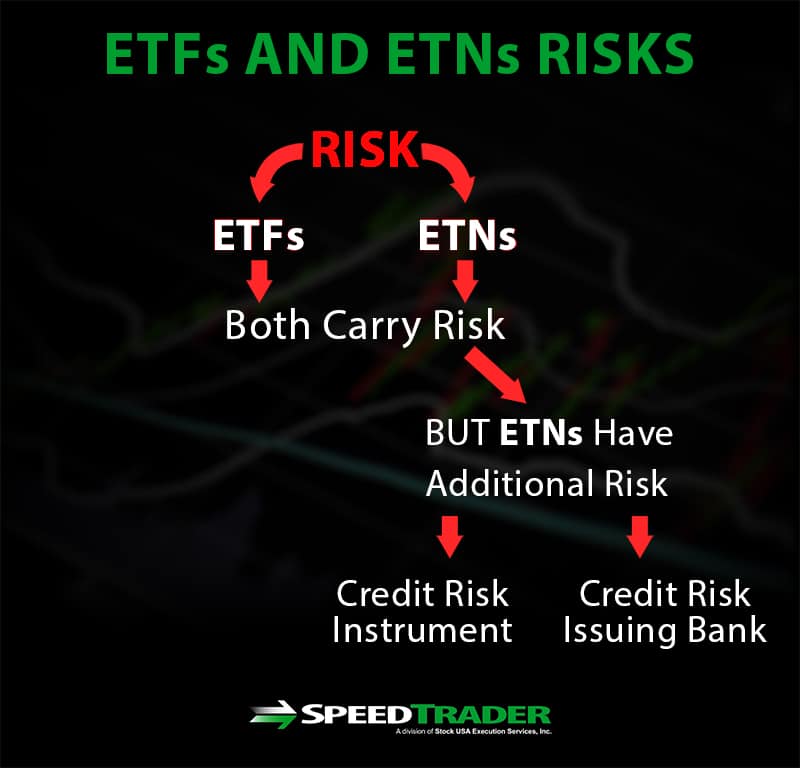

Etf and etn differences in summary. Etns are structured products that are issued as senior debt notes while etfs represent a stake in an underlying commodity. Why you need to know the difference. There are definitely some major differences in etf s and etn s.

While they trade similarly etfs and etns are very different investment products. Feb 8 2019 4 18am est. Etf report staff this article appears in our september 2019 issue of. Etns are registered as debt instruments that pay a return linked to the performance of a single security or index.

The operating structure of etns is particularly suited for specialized asset classes such as commodities and emerging markets. Mutual funds have much less in common with etf s etn s than etf s etn s do with each other.

Insight/2018/5.2018/05.17.2018_ETFs/Comparing%20Legal%20Structure%20and%20ETF%20Cost.jpg)