Factoring Credit Facility

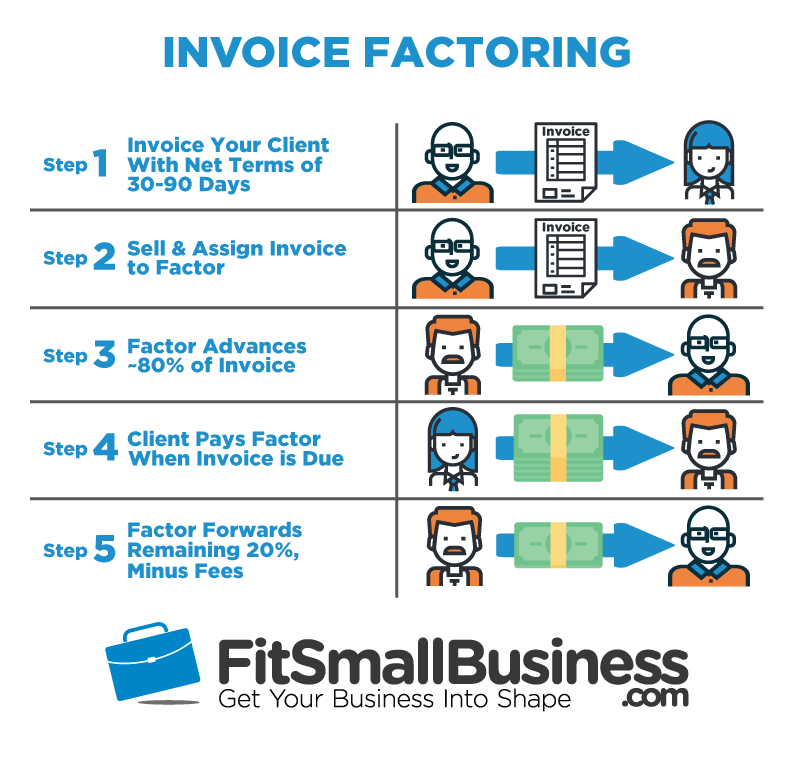

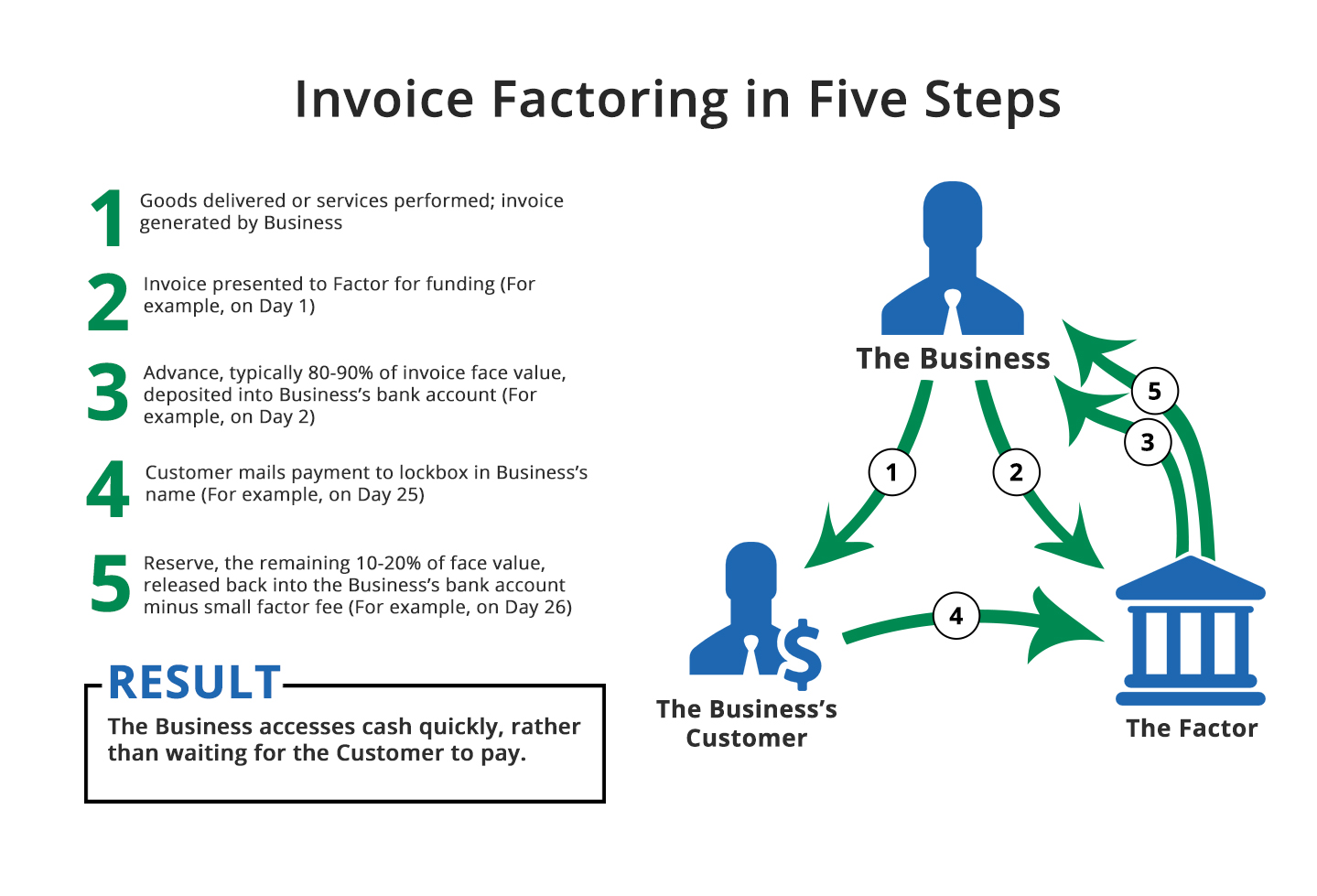

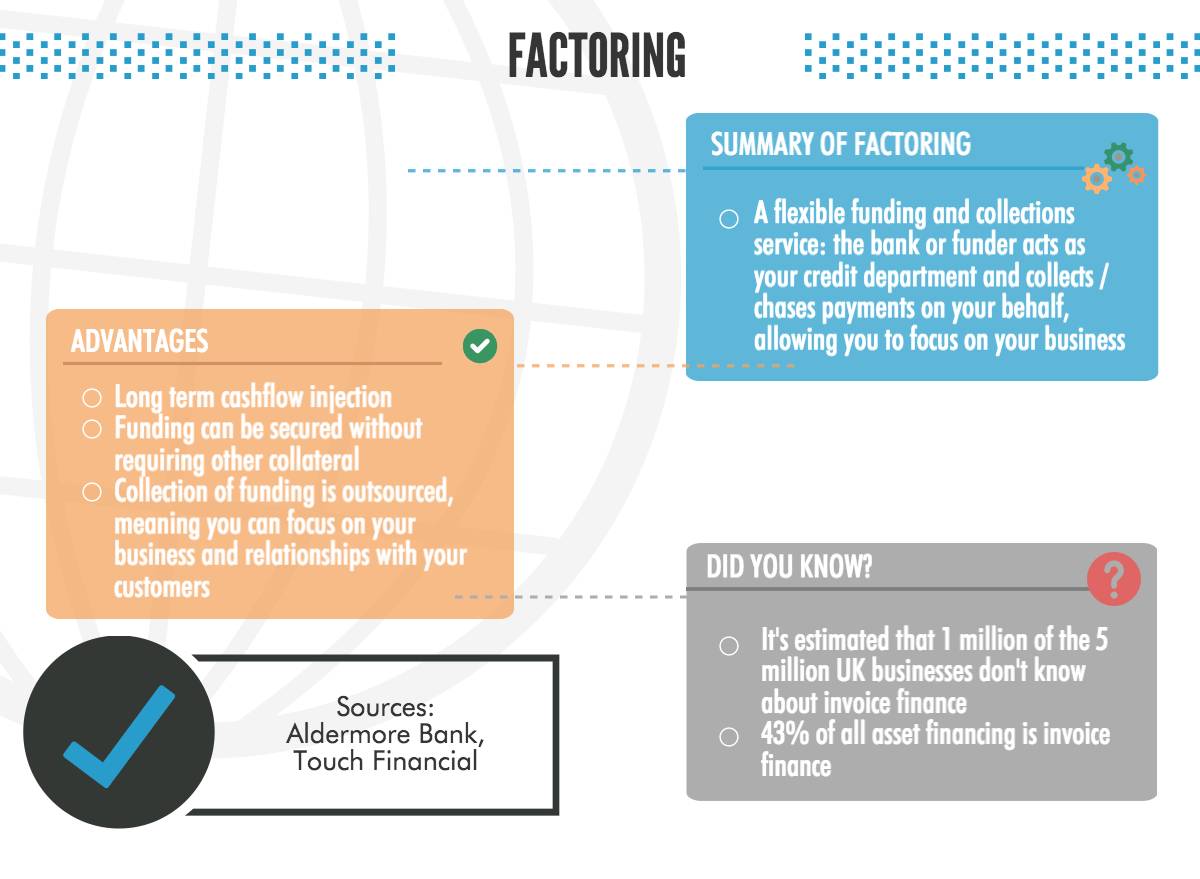

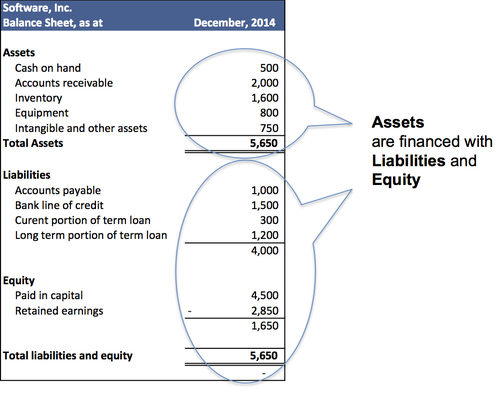

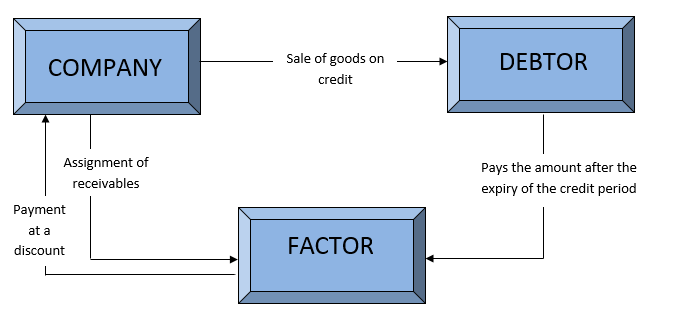

Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances.

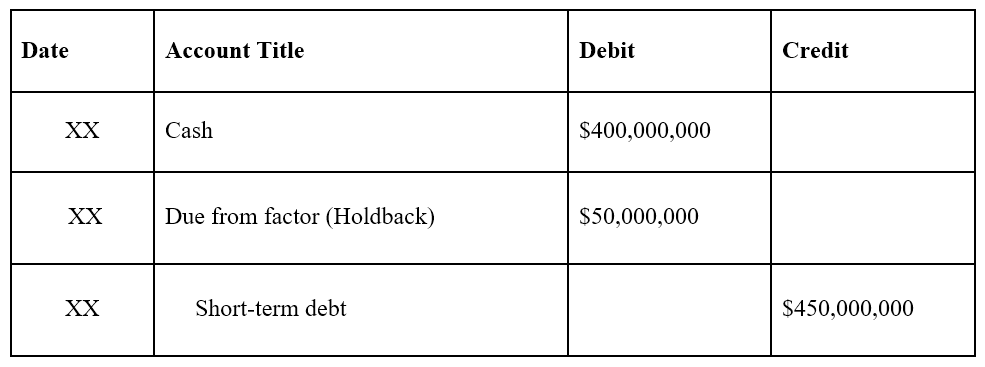

Factoring credit facility. There is a varied array of different types and names given to the different types of factoring facilities so. Credit facility sizes vary. A factoring line of credit is a line of credit facility with an accounts receivable factoring company that is based on outstanding invoices that will increase and decrease with your outstanding accounts receivable. In a factoring line and in an asset based loan your funding limit is determined by the amount and quality of your accounts receivables.

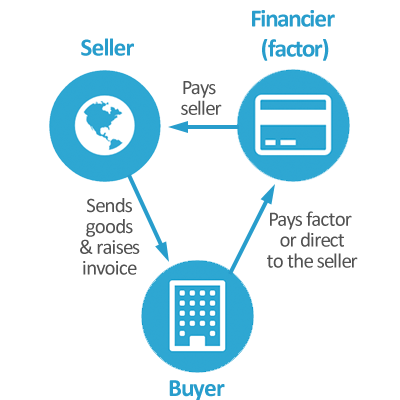

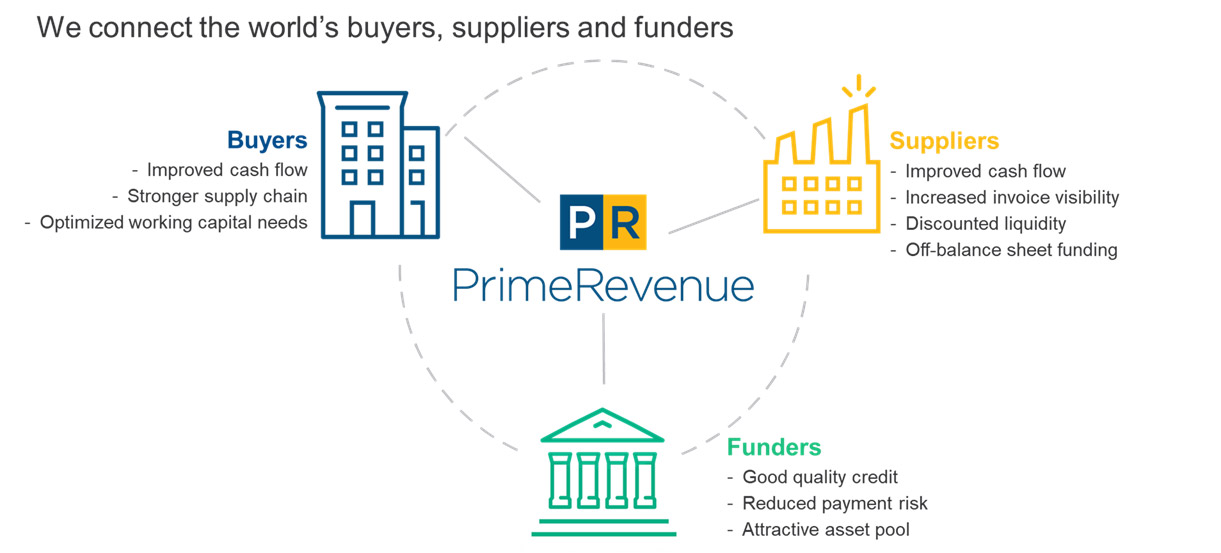

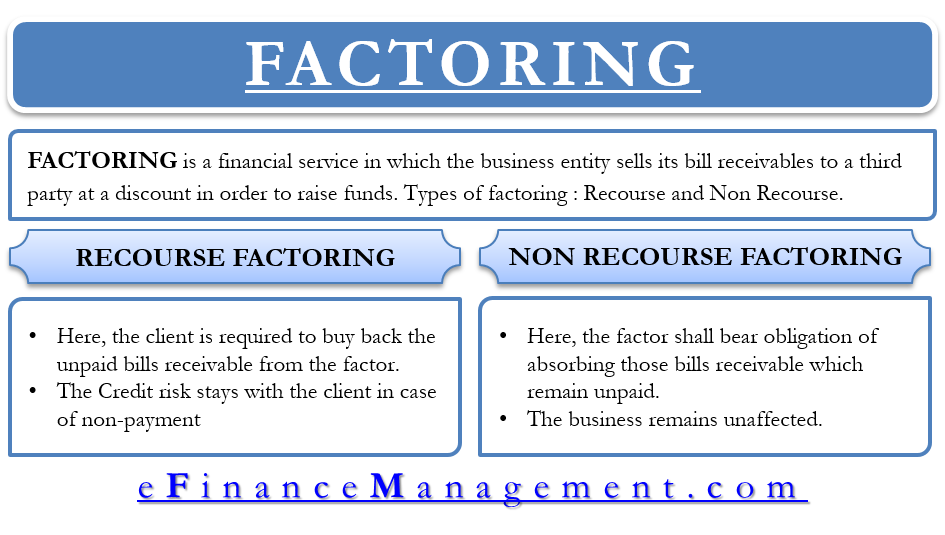

Large facilities extend up to 10 million or more. Factoring receivables factoring or debtor financing is when a company buys a debt or invoice from another company factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. This means if the business s customers default or go into insolvency the funds tied up in unpaid invoices can be recovered.

A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Many factoring facilities include credit insurance these are called non recourse facilities. The facility provides availability on the manufacturer s inventory accounts receivables merchant accounts and e commerce rela. In general a line of credit is a facility that allows you to draw funds up to a certain amount known as the credit limit.

Some factoring companies specialize in credit facilities below 25 000 while normal facilities are in the range of 1 to 3 million. Revolving credit may take the form of credit cards or lines of credit revolving lines of credit can be taken out by corporations or individuals. It may be offered as a facility. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

Republic business credit provided a 3 million direct to consumer inventory loan facility to a private equity owned apparel accessory manufacturer based on the west coast. The factor will set credit limits for each customer and as long as the client trades within these limits it will be covered against any bad debt.