Factoring Loans Receivable

Then the factor is paid by your customer.

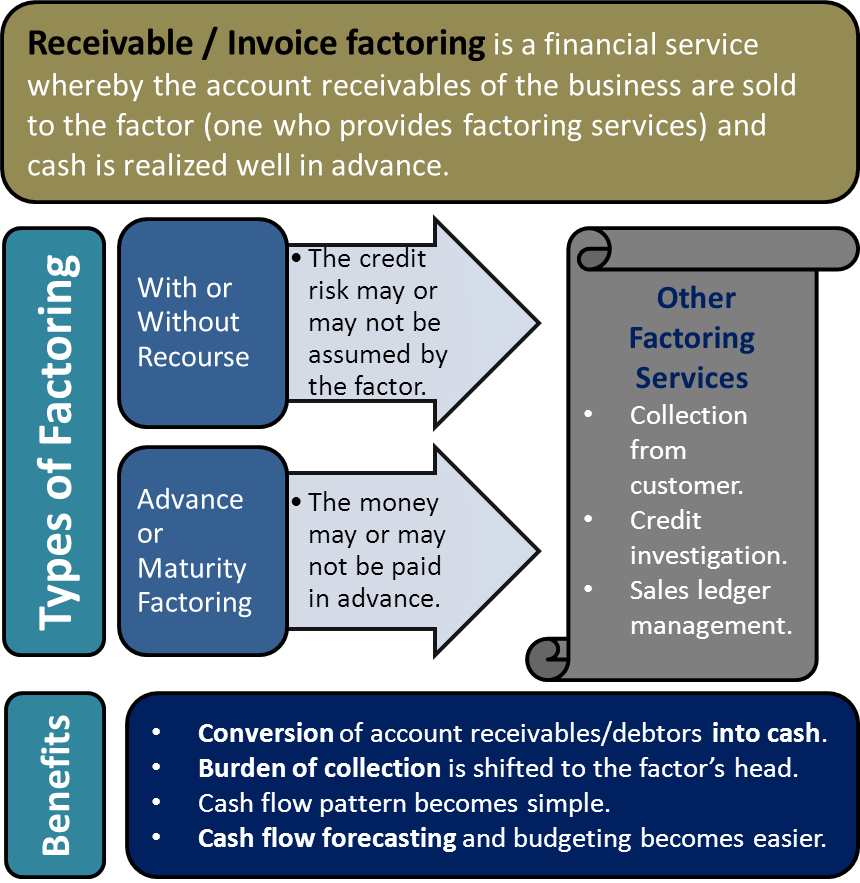

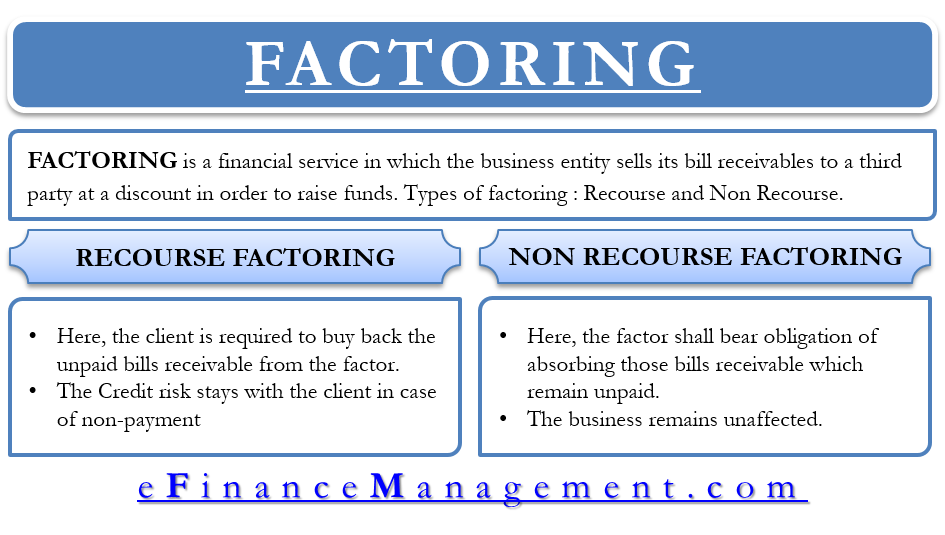

Factoring loans receivable. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. The factor collects payment on the receivables from the company s. Factoring and accounts receivable are two forms of financing based on receivables offering business owners and entrepreneurs an alternative to traditional bank loans if you need cash now you should consider these financing options.

Factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Understanding how accounts receivable factoring works.

Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital. Instead the receivables merely act as collateral for a loan. Like accounts receivable factoring invoice financing allows you to access financing based on the value of your receivables. The receivables factoring company pays the business owner you up to 97 of the value immediately.

Factoring is the sale of accounts receivable of a company to a financing company at discount. Factoring helps a business convert its receivables immediately into cash instead of waiting for due dates of payment by customers. Factoring is a financial transaction in which a company sells its receivables to a financial company called a factor. Receivables financing is a specific type of asset based loan or abl.

However instead of using stock equipment or other capital as collateral you use your accounts receivable. One main difference between receivables financing and invoice factoring is that with receivables financing you still retain ownership of the asset. Factoring vs accounts receivable financing. Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices.

The financing company which buys the receivables is called a factor. But with the latter product you aren t selling your receivables to the business lender.