Factoring Of Receivables With Recourse

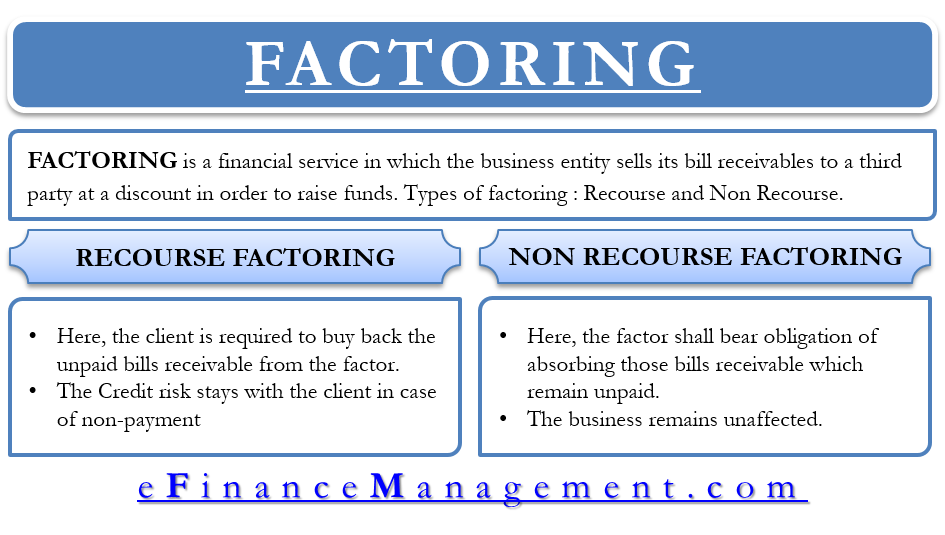

Non recourse factoring means the factoring company assumes most of the risk of non payment by your customers.

Factoring of receivables with recourse. Accounts receivable factoring can be without recourse or with recourse. Recourse in factoring meaning. In transfer with recourse the factor can demand money back from the company that transferred receivables if it cannot collect from customers. Non recourse does not necessarily protect your company from all risk though.

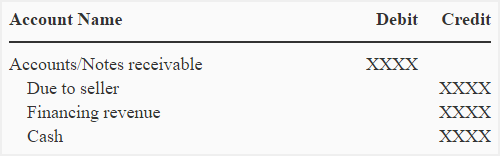

Factoring without a recourse agreement means that the seller of receivables is not responsible for any losses of factor that exceed the retained amount. Recourse is a type of factoring which happens when an entity has to sell the invoices to the client factor with a condition that the entity will purchase back any invoices that remains uncollected this means that in recourse the factor client is not taking any risk of the uncollected invoices. Under factoring with a recourse agreement the seller of receivables is responsible for paying to the factor any bad debts in full. Recourse factoring and non recourse factoring.

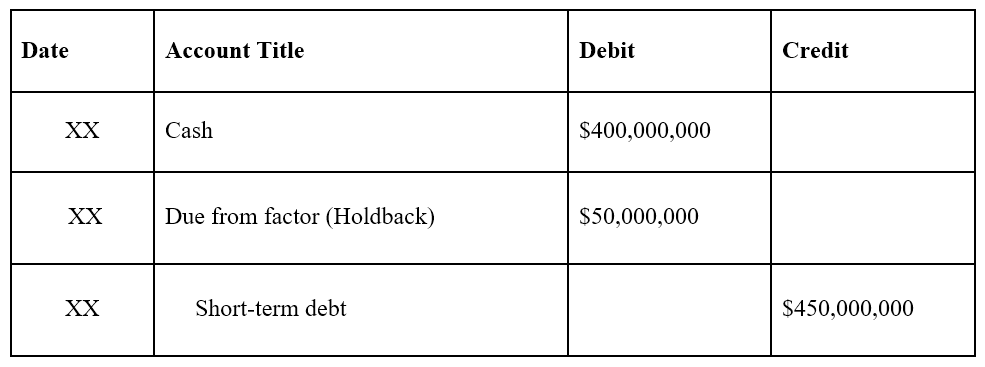

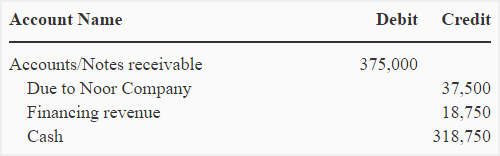

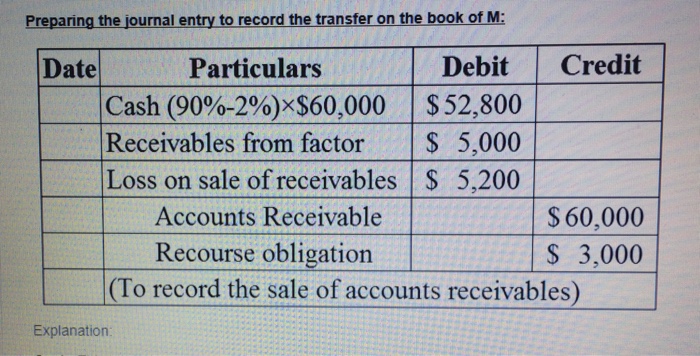

With recourse journal entries when the invoices are factored with recourse the business will bear the loss if the customer does not pay the factor. When a business. The net effect of factoring the receivables of 5 000 without recourse is that the business has received cash of 4 850 and paid a fee to the factor of 150. As the recovery is guaranteed by the seller a recourse liability is determined and recorded by him.

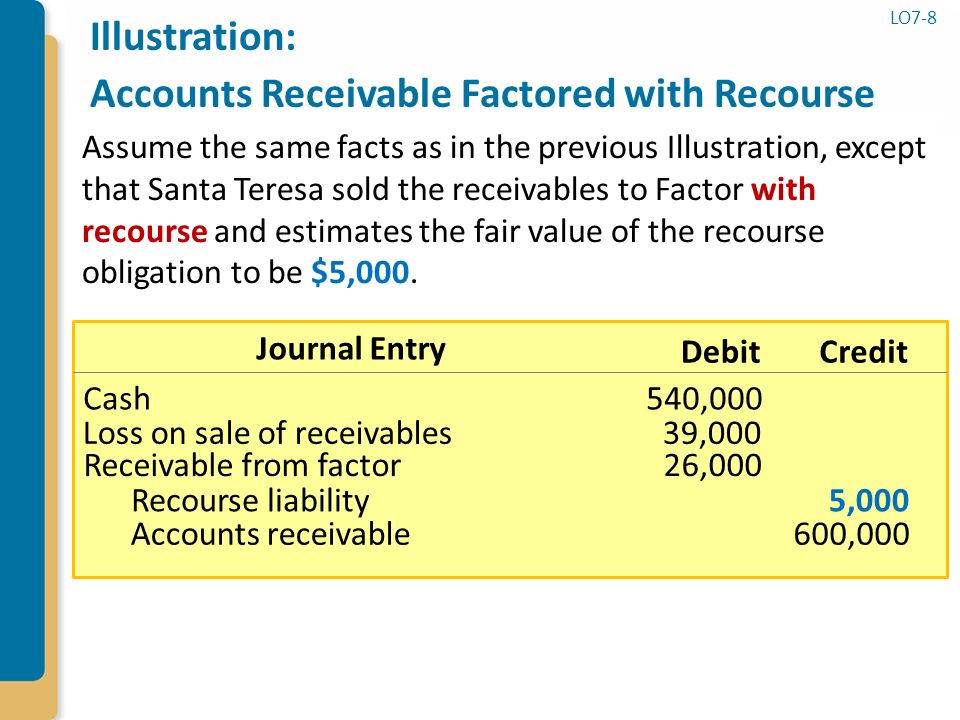

In a factoring with recourse transaction the seller guarantees the collection of accounts receivable i e if a receivable fails to pay to the factor the seller will pay.