Fafsa Bank Account Balance

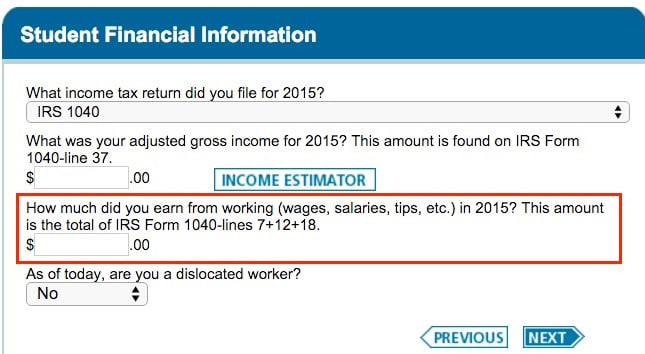

The fafsa mostly focuses on what you re making what your parents are making if they re a.

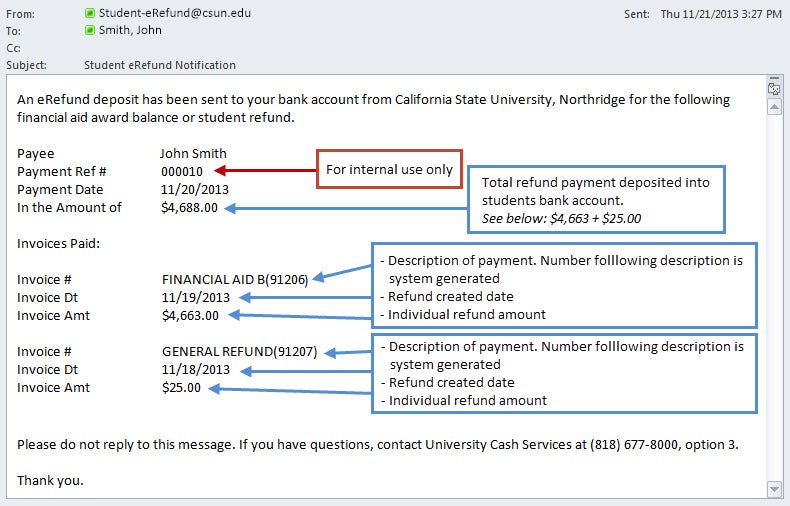

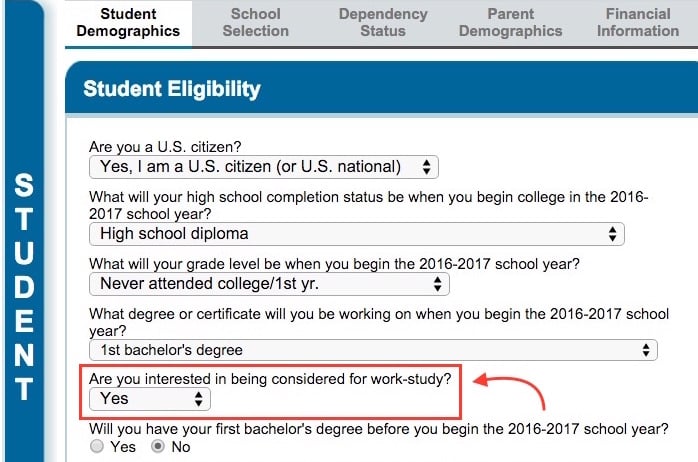

Fafsa bank account balance. Although balances may change on a daily basis you ll only need to report the balance on the date you complete your application there is no need to update your fafsa to report changes in account balances. The fafsa will specifically ask as of today what is the cash balance of checking savings accounts for the student. If the accounts are co mingled then the amount actually belonging to the student should be reported as student assets and the amount belonging to the parent as parent assets. The titling of the custodial 529 plan account is similar to that of the original utma account.

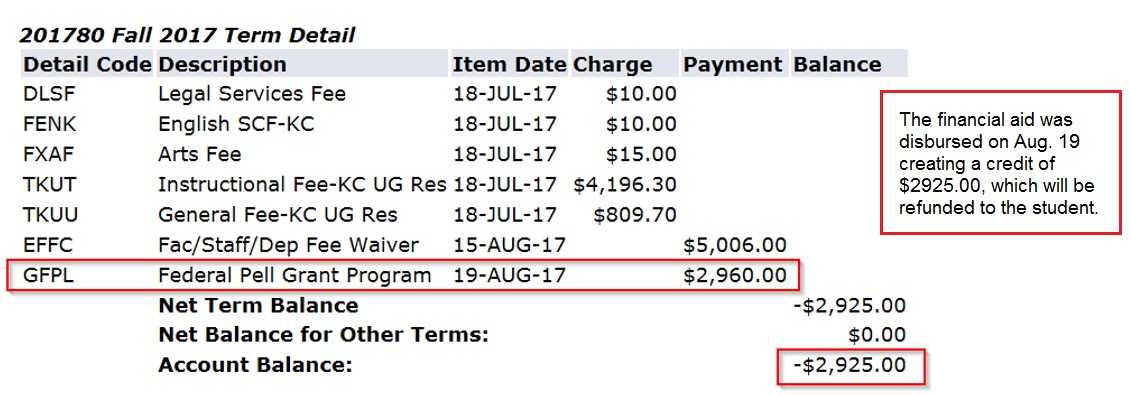

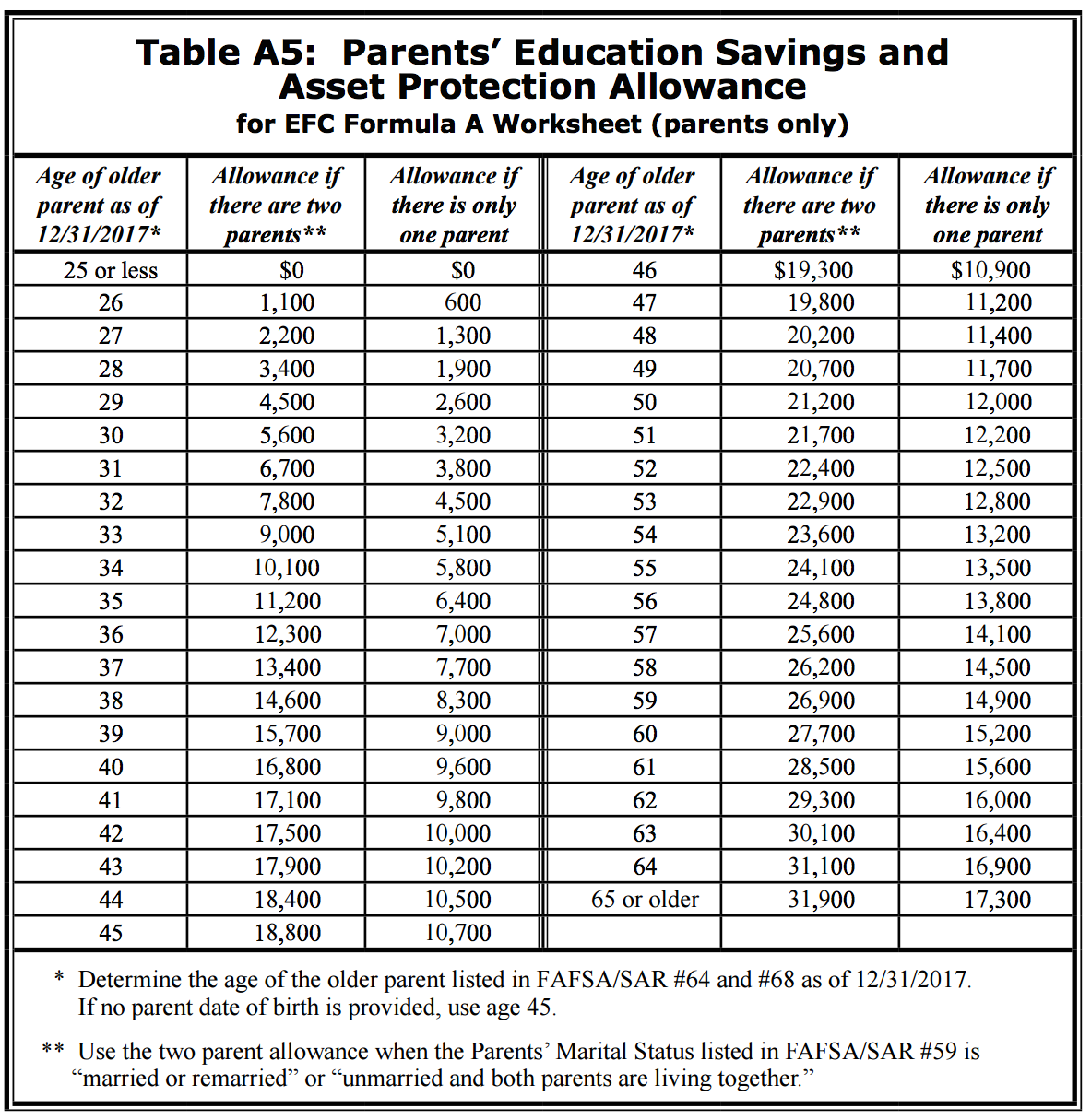

Enter the total of all accounts as the total current balance. Fafsa counts 20 of a student s assets and only 5 6 of parents assets towards your efc. One of the things the fafsa requires on question 90 of the application is the total current balance of cash savings and checking accounts that your parents own. This doesn t just mean the total in your bank accounts but also any cash or cash assets on hand regardless of whether they re in a bank account in a safe at home or in a safe deposit box earmarked for your inheritance.

The fafsa itself can not and as far as i remember there is no question about your current bank balance. The fafsa will require disclosure of financial information including bank account balances by the student applicant and also from the student s parents if the student is classified as a dependent student. Because the question is phrased as of today it leaves room for interpretation. The fafsa asks for the amount of your assets on the day you file and the amount used in the calculation is based off of this amount not the amount of savings you might have when school starts.

You ll also need to report the balance of your bank accounts and cash on hand when you fill out your fafsa. There are separate questions for student income assets and parent income asset. So if you do fafsa 9th oct it is the balance on 9th oct. Your best bet is to gift it to your parents this will lower your efc by over 2400.

If you do leave it in your name spend all your money your first year before spending any of your parents money. Such classification is automatic unless the student meets the criteria of being an independent student. If all money were pulled from checking and savings the day before the fafsa were filed then the answer would be zero. If the total is negative enter zero as the total current balance.