Fha Loan Assumption Requirements

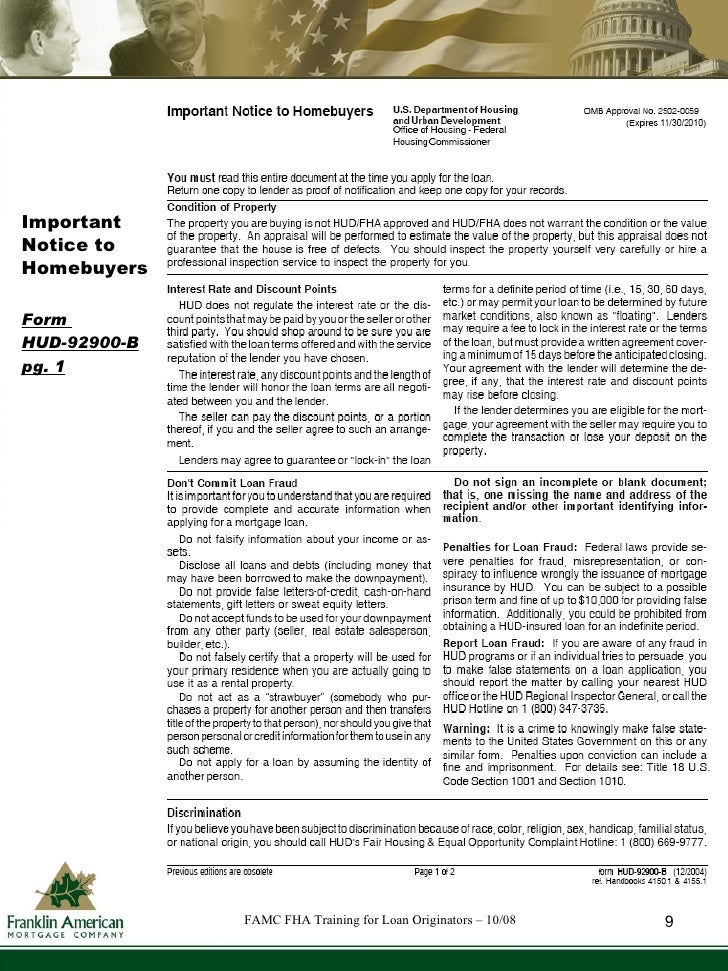

Restrictions on fha loan assumptions aren t terribly complicated but if you are interested in assuming an fha loan there are some things to keep in mind starting with a requirement that the lender participates in the process.

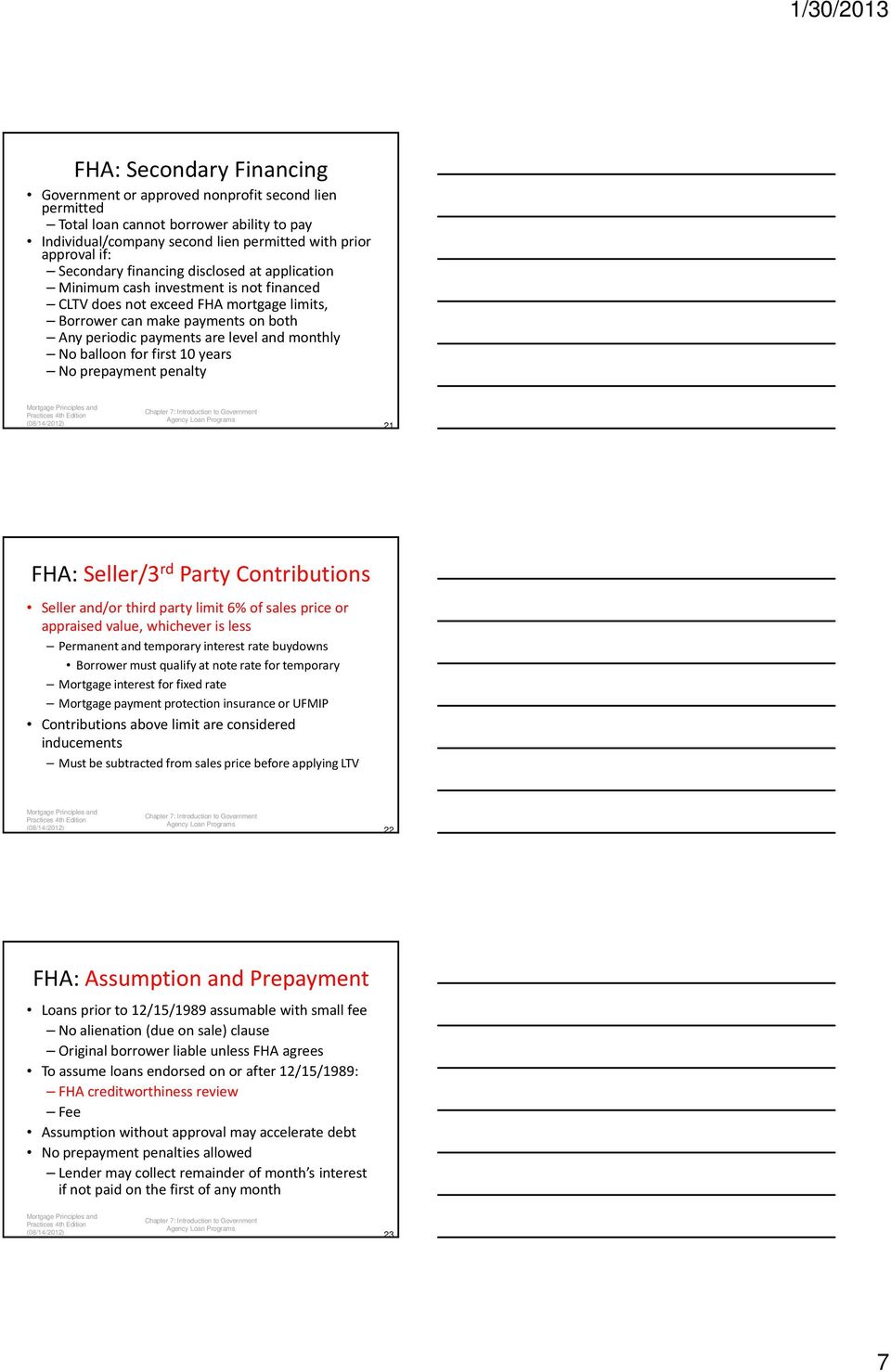

Fha loan assumption requirements. If the loan originated before dec. A loan assumption credit check is done in the same way as the procedure for any fha loan application. To qualify for an fha mortgage assumption you must make the home your primary residence or hud must formally approve its use as a secondary residence. Loan requirements follow the same fha guidelines for new loans and refinances.

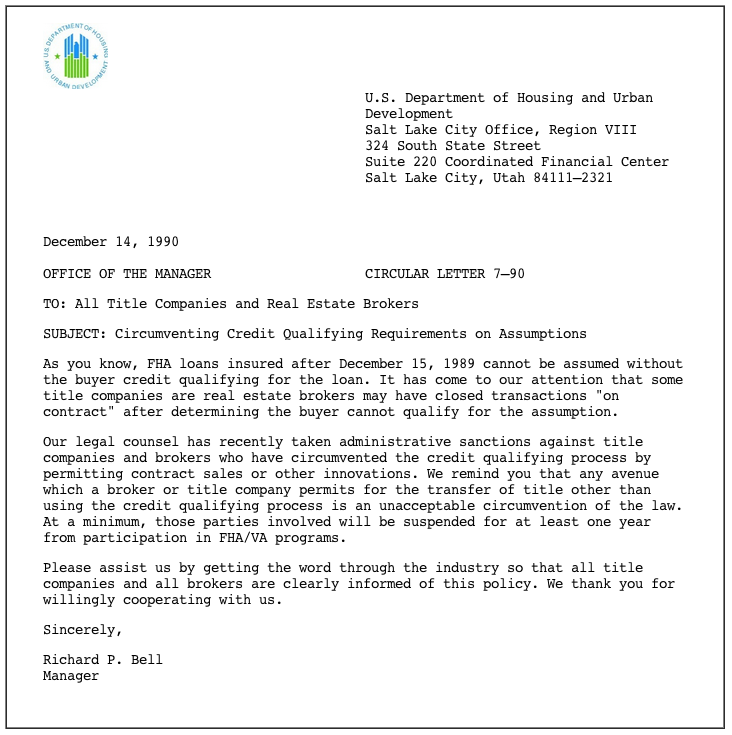

The loans that most often qualify for assumption are va and fha loans which are backed by the federal government. Loan to value reduction requirements for assumptions certain mortgages depending on when originated may require a reduction to the outstanding principal balance when assumed by investors or as secondary residences. For fha loans issued after december 1 1986 the lender s participation is required. Department of housing and urban development hud which oversees the program.

However there are three different sets of loan assumption rules for fha home loans depending on when the loan was taken out. Fha home loans permit the home owner to have the mortgage assumed by another person who would become the owner of the property and financially responsible for the mortgage. Loan assumptions can t offer more lenient credit check policies or more stringent ones. The rule applies to loans originated on or after dec.

The new fha rules governing loan assumption requires the borrower to qualify much in the same way he or she would qualify for any other fha home loan. 4155 1 7 3 b investors assuming mortgages when assuming a mortgage not subject to the hud reform act of 1989 an. Fha home loans were long ago considered freely assumable with no real participation required of the lender. Later the fha loan rules changed to require lender participation and approval of an fha loan assumption.

Fha lenders are required to review the creditworthiness of the prospective borrower who wishes to assume an existing fha loan. There are no restrictions on assuming a loan meaning there s no need for the lender to review the creditworthiness of a buyer taking over a mortgage. An fha loan assumption requires a credit check to insure the borrower is qualified. All fha loans are assumable according to the u s.

There is an exception granted by hud for investors to assume such mortgages but only in cases where the original mortgage closed on or before december 15 1989. Furthermore the original borrower will have to work with the lender in order to complete the loan assumption.

/loan-to-value-ratio-315629_FINAL_v2-6fd1a550be4f4cd19dd4eea140143f44.png)

/shutterstock_492133468-5bfc3d8cc9e77c005184408a.jpg)