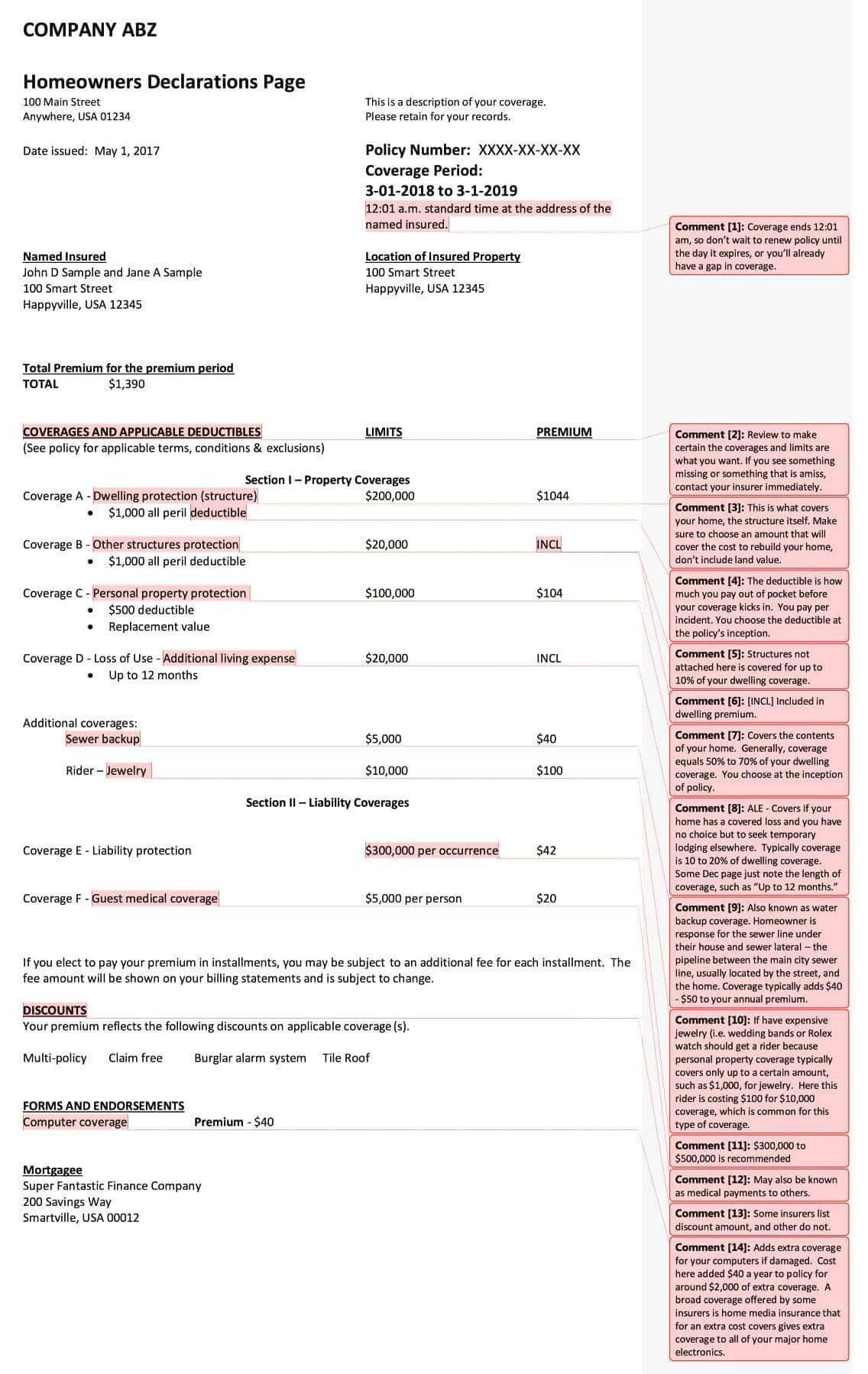

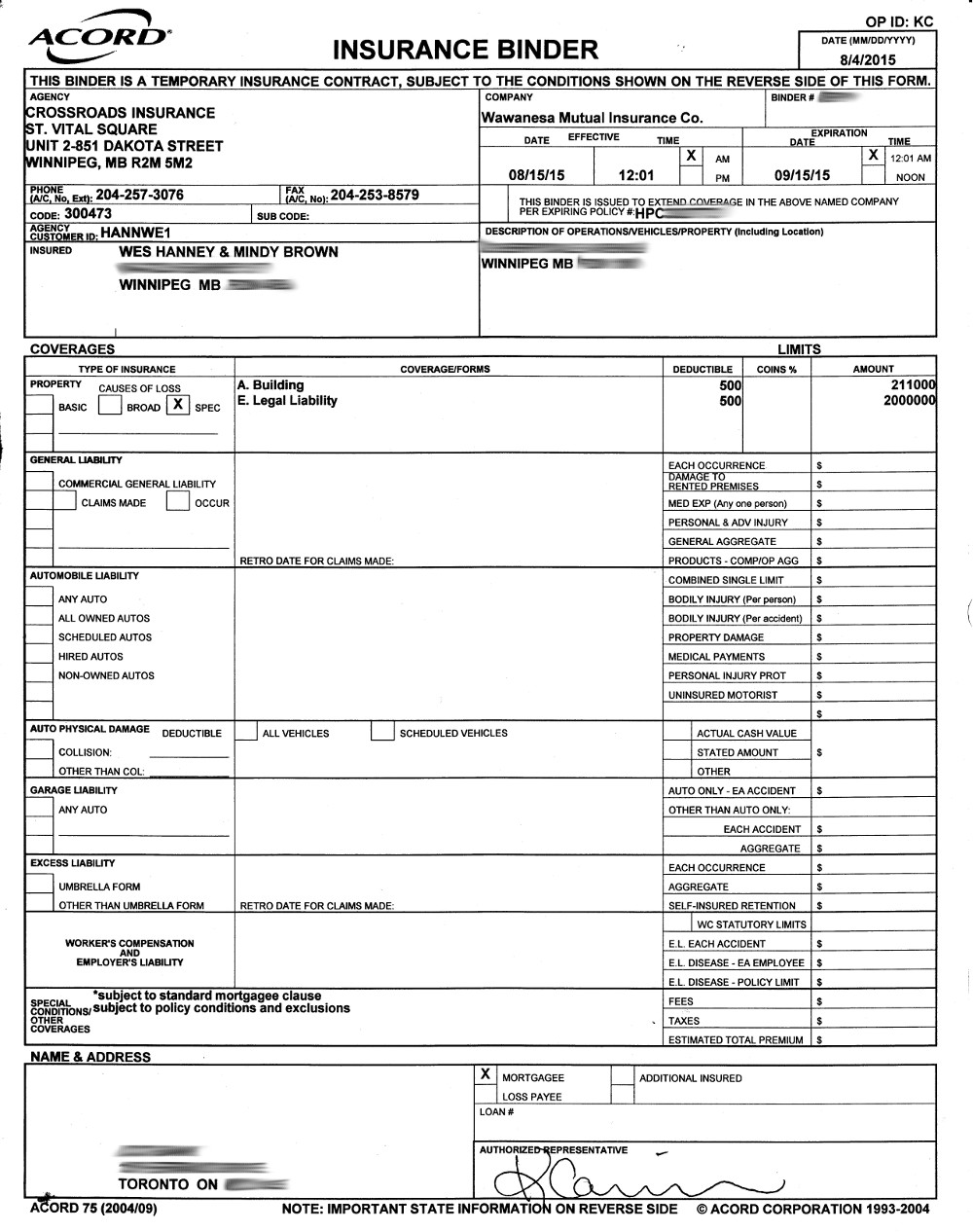

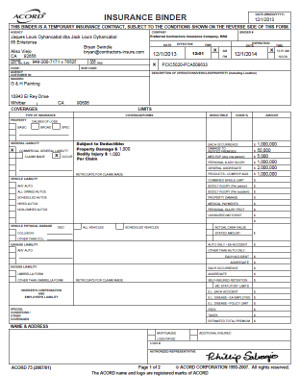

Homeowners Insurance Binder

It s typically replaced within 30 to 90 days.

Homeowners insurance binder. The binder may be issued by the agent or the company. Plus standard policies cover injuries that occur on your property and lawsuits against you such as someone suing you because they were hurt at your home. Two of the most common examples of insurance binder use are in cases of purchasing a home or a car. Within thirty 30 days of receipt of this binder you should request an insurance policy or certificate if applicable from your agent and or insurance company.

An insurance binder is a temporary insurance policy. In other words it is a temporary proof of insurance that will cover or bind coverage until the formal policy is issued. Should a tree fall through your roof or a fire break out in the kitchen insurance for your home helps cover the cost to repair or rebuild. Homeowners insurance is designed to protect you from the things that can damage your home personal property or hurt you financially.

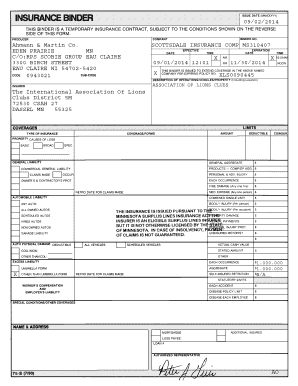

The insurance binder should indicate the deductible for each section of insurance on the car or for the home or property. If there is a relevant insurance endorsement that is an important aspect of the coverage you purchased the insurance binder may also include mention of these coverages. An insurance binder is a one page document showing the insurance company s written confirmation to insure your newly purchased house. They will usually ask for an insurance binder before you can purchase the property.

It covers wind hail damage fires lightning theft and more. The type of coverage and limit for each coverage should also be mentioned. Applicable in the virgin islands with respect to binders issued to renters of residential premises home owners condo unit owners and mobile home. Having dead bolt locks a burglar alarm smoke detectors and other home safety features will all help you stay safe and lower the cost of your home insurance policy.

Homeowners insurance protects one of life s biggest investments. Similarly a lender may require an auto insurance binder to approve an auto loan on a new car. It includes general information about your business and your policy including policy limits and other coverage information. It is commonly a requirement for financial companies when a person takes out a mortgage.

From insurance binder to cover note. For example when closing on a house a homeowners or home insurance binder helps finalize your mortgage by providing temporary evidence of insurance. Typically a home insurance binder. For auto insurance the insurer must give 5 days prior notice unless the binder is replaced by a policy or another binder in the same company.

A binder is issued when a homeowner needs evidence of having an insurance policy coverage.

/GettyImages-1053743626-21039c92e4b44b828f71db2c1d27a9a2.jpg)