Homeowners Insurance Premium

Premium hikes have been similar for homeowners in california connecticut arizona and new mexico.

Homeowners insurance premium. An item located on a property that is appealing but potentially hazardous especially to children. In special cases however they might be wholly or partially tax deductible as a business expense. By investing in a good home insurance policy you can protect your home from threats. Homeowners insurance premiums are typically not tax deductible.

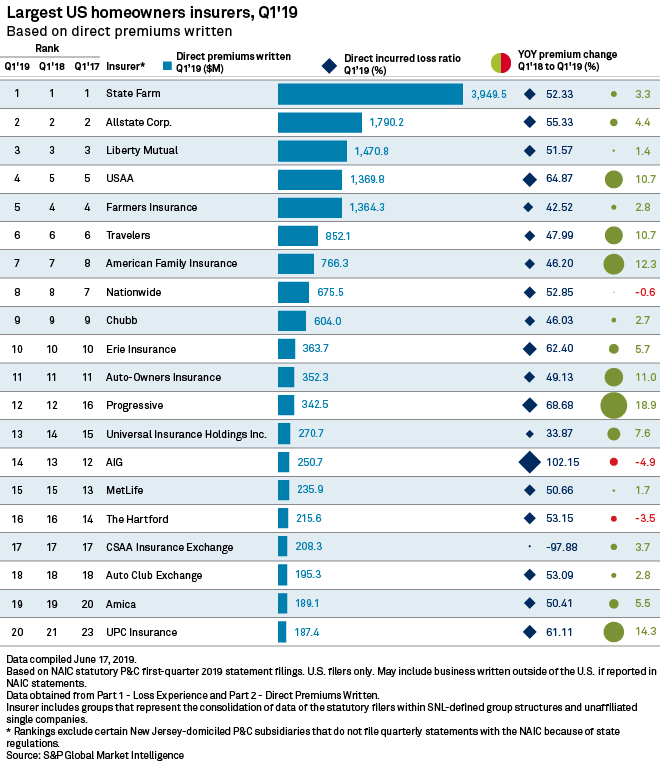

The premiums of this necessary insurance coverage like the property taxes charged by your local community are expenses that will continue as long as you own the structure. It is a sort of property insurance covering private residence. The average homeowners insurance premium in the united states is 1 211 a year according to the naic. While there are not many actions you can take to reduce your tax obligation there are ways to lower the premium you pay for homeowners insurance.

Having property insurance essentially assures you of security and certainty in an otherwise uncertain world. Attractive nuisances can lead to expensive injuries and pricey lawsuits. For instance if you are. Typically this premium is the amount paid by a person or a business for plans that provide auto home healthcare or life insurance.

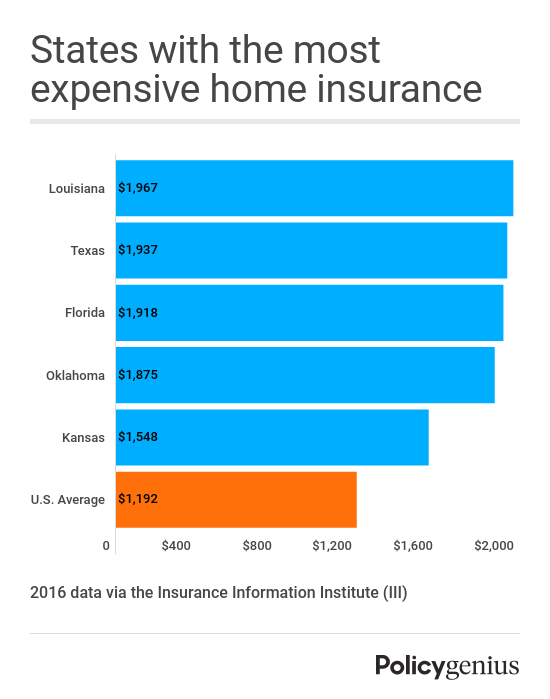

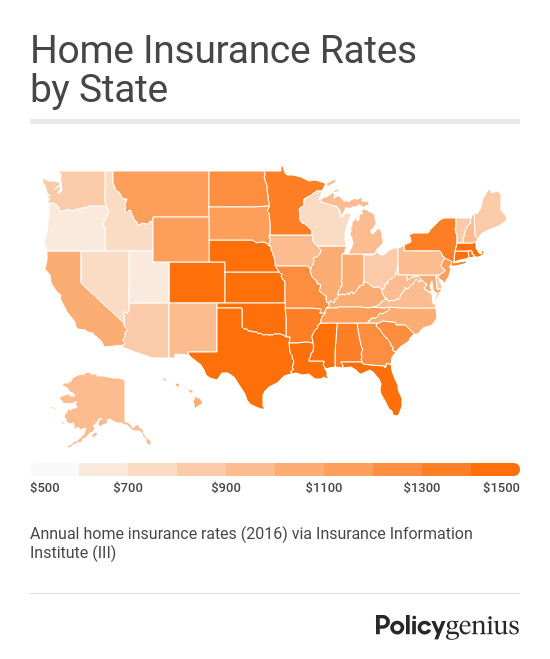

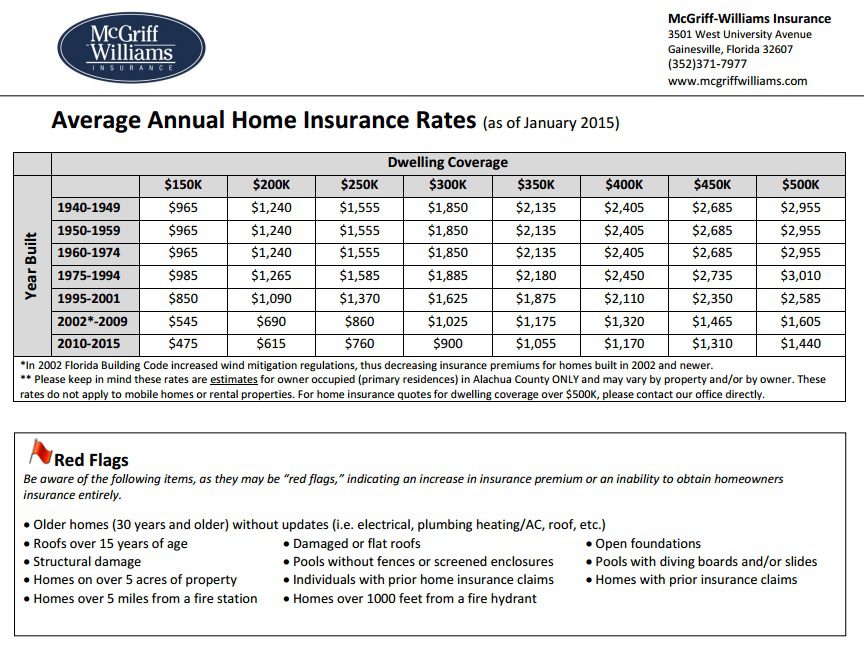

How insurance premiums work insurance premiums usually have a base calculation and then based on your personal information location and other information you will have discounts that are added to the base premium that reduces your cost. Homeowners in texas new york and massachusetts have seen minimal increases after a single insurance claim. Extreme weather is a common theme in states with high homeowners insurance premiums. The value of your home where you live and the coverage level you choose can all impact the.

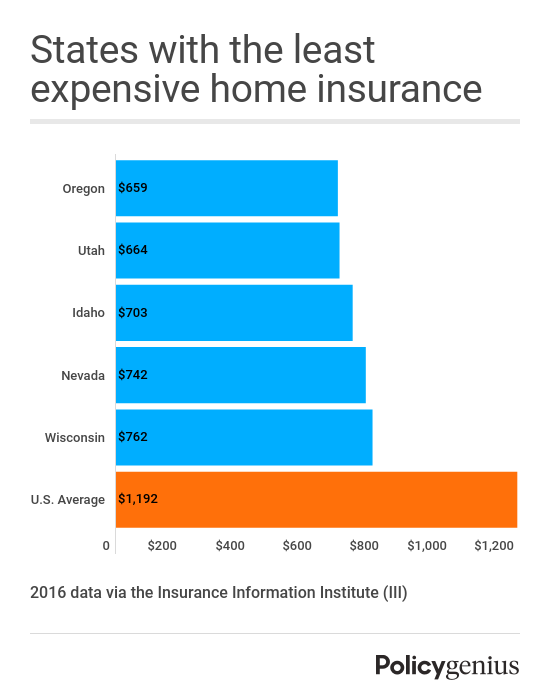

Credit history nearly all states allow insurers to consider a person s credit history when devising a home insurance premium. Insurance companies say that credit history is a good indication as to whether a person will file claims. The most expensive states for homeowners insurance. Your homeowners insurance premium is the amount you pay to keep your home insurance policy active.

Once an insurer compiles that information it is able to create a home insurance rate. There are a number of factors that impact your premium namely your level of coverage deductible amount home characteristics and credit score. Highest average premium by state.