How Much Of Your Income Should You Invest In Stocks

Together with other steps that should help ensure you have enough income to maintain your current lifestyle in retirement.

How much of your income should you invest in stocks. Including utility stocks in your portfolio is a good way to get income and ease volatility. Therefore if you have to choose between those two stocks as an income investor you should choose smith co. How much should i risk with my investments. One of the most commonly cited rules of thumb in the world of finances is that you should save at.

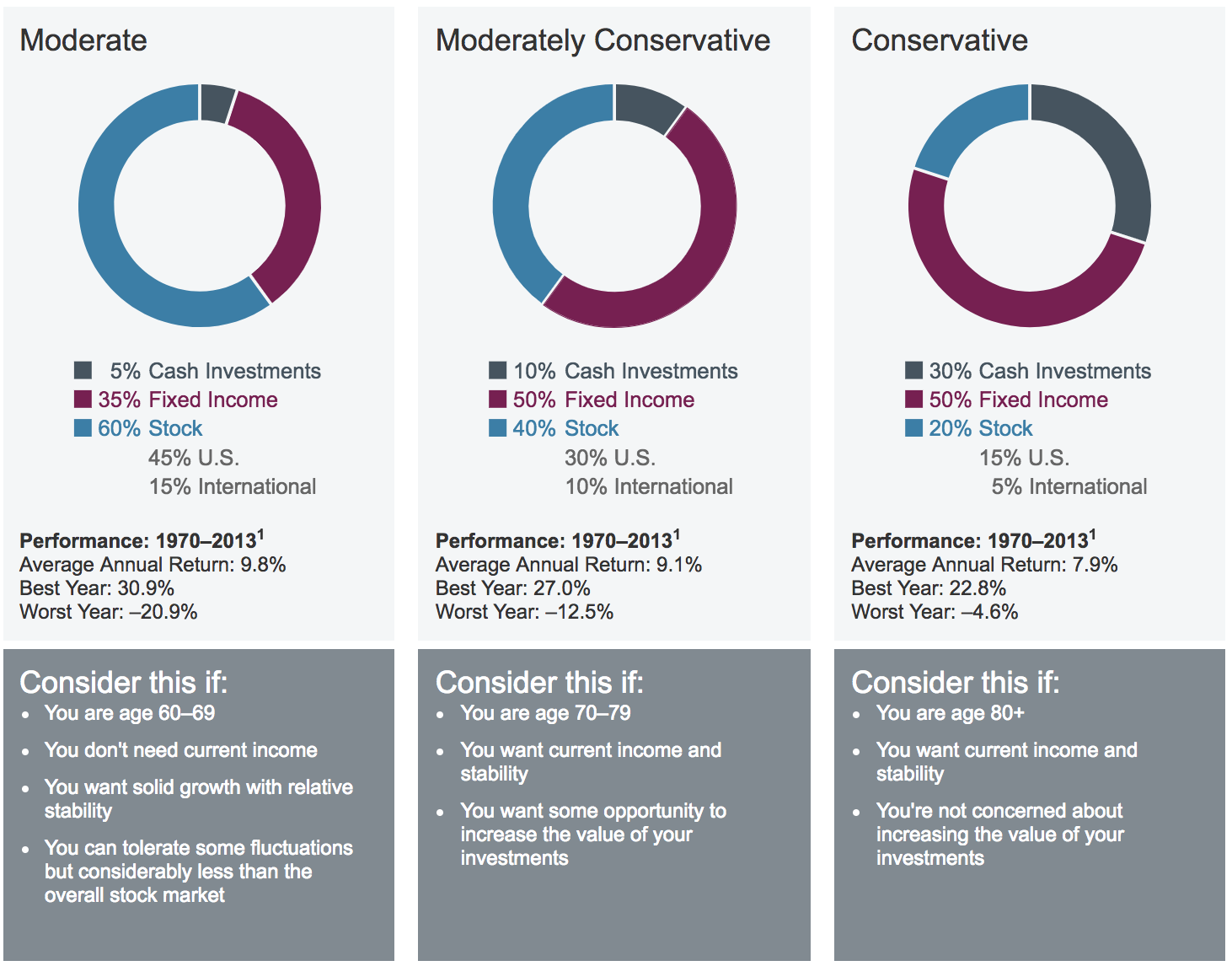

Our rule of thumb. If you want to target a long term rate of return of 8 or more allocate 80 of your portfolio to stocks and 20 to cash and bonds. Your investment goals should also be based on how much you can afford to invest. With this approach expect that at some point you could experience a single calendar quarter where your portfolio drops 20 in value and perhaps even an entire year where your portfolio drops by as much as 40.

Now as you need more income you tap into your principal by liquidating investments today yield on the 10 year treasury is well below 1. 7 ways to invest for income every portfolio should focus on income using some of these techniques. With 400 000 invested and an average yield of 4 you d be looking at 16 000 annually or about 1 333 per month a rather meaningful addition to your social security income. Here are some guidelines that can help you decide how much of your income to invest.

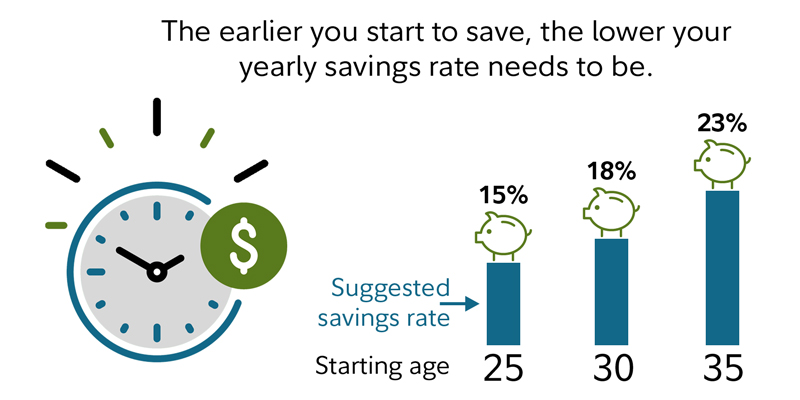

Once you re comfortable investing 10 of your income challenge yourself to invest 13 then 15 20 and so on. How did we come up with 15. The 10 rule of thumb. Of course if you truly want to maximize your income and don t really need your investment to appreciate significantly you should probably choose brown co s bond because it offers a yield of 6 percent.

Stock indexes such as the s p 500 or dow jones industrial average are a representation of the performance of a large group of stocks but often not an entire stock exchange and are often used. That s assuming you save for retirement from age 25 to age 67. Aim to save at least 15 of your pre tax income 1 each year. The more you invest now the faster you ll reach your financial goals.

Yield from s p 500 index funds is typically shy of 2. The answer depends on your situation and what you are trying to accomplish in the future.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)

/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)