Insurance Company Assets And Liabilities

Because assets are better than liabilities companies want to have more assets and fewer liabilities on their balance sheets.

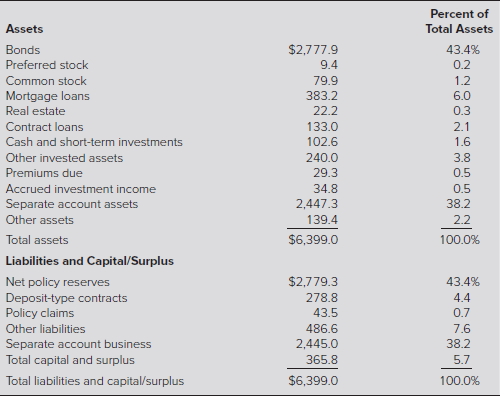

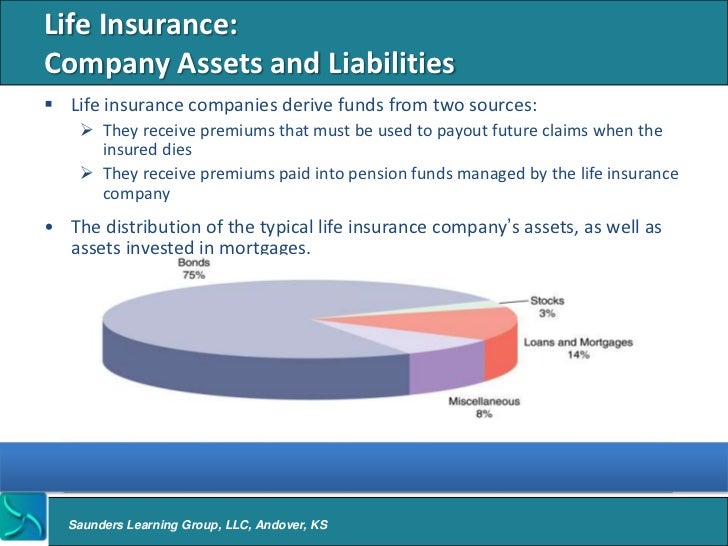

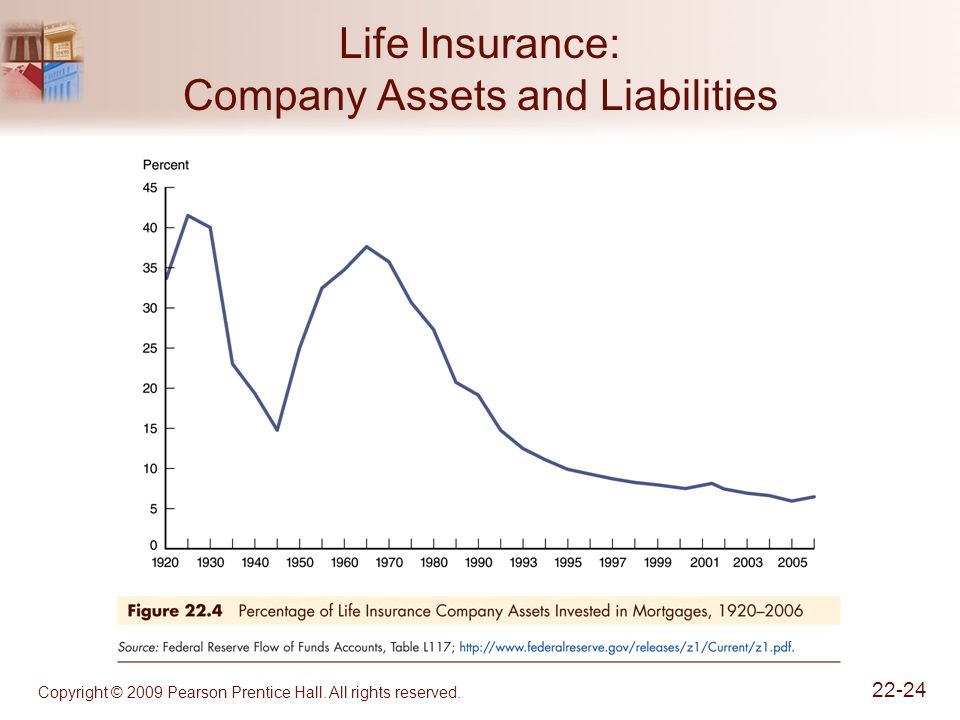

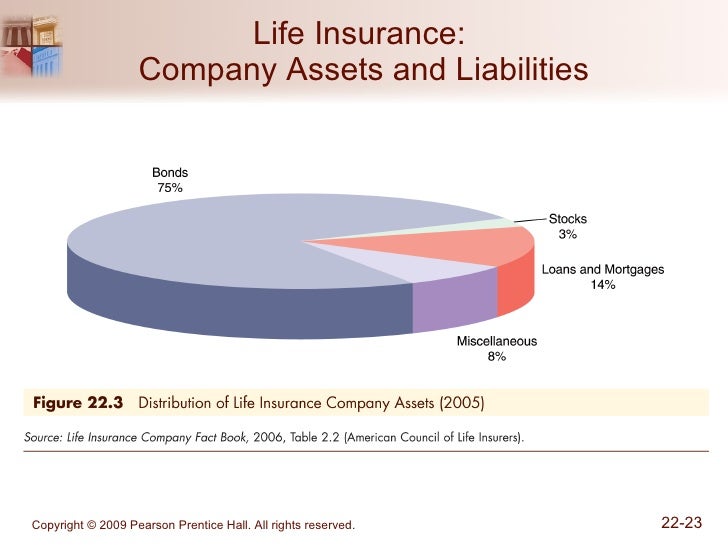

Insurance company assets and liabilities. Im unsure which should be used. Ortec finance is a leading asset liability management alm and own risk and solvency assessment orsa provider for insurance companies. Asset and liability management is conducted from a long term perspective that manages risks arising from the accounting of assets vs. Let s say that a company has taken a loan from the bank to acquire new assets.

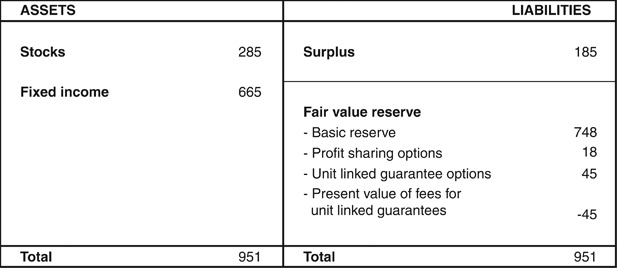

Ignoring other assets and liabilities which we ve netted out. Liabilities include items like monthly lease payments on real estate bills owed to keep the lights turned on and the water running corporate credit card debt bonds issued to investors and other outflows. Firstly i often find values for both total current assets and other current assets. Broadly speaking liabilities are debts and obligations owed by the company.

Secondly again regarding finding the current assets and current liabilities i m told on gurofocus that there for banks and insurance companies. The opposite of assets. There s a strange relationship of leverage with liabilities. If a company uses liabilities to own assets the company is said to be leveraged.

The sine qua non of insurance operation is to service the capital. Our flexible modeling framework covers a comprehensive range of assets liabilities and risk management strategies. That s why it s said that a good proportion of debt and equity ratio is good for business. As an independent specialist ortec finance provides you with a complete and consistent risk management simulation software solution for modelling insurance liabilities asset classes investment policies and economic scenarios.

Asset liability management is the process of managing the use of assets and cash flows to reduce the firm s risk of loss from not paying a liability on time. Well managed assets and liabilities. Insurance companies are magical creatures that. The moody s analytics insurance alm solution enables insurers to build better investment solutions where the measurement and management of risk depends on client specific cash flows and liabilities.

/Clipboard01-5c7005ccc9e77c0001ddce7a.jpg)