Insurance Lines Of Business List

Irmi offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere.

Insurance lines of business list. For example if a fire forces you to close your doors for two months this insurance would reimburse you for salaries taxes rents and net profits that would have been earned during the two month period. Personal lines insurance covers individuals against loss resulting from death injury or loss of property. A line of business is the set of products and services managed by a department or team. It is a term that can apply to any industry but is particularly common in banking and insurance.

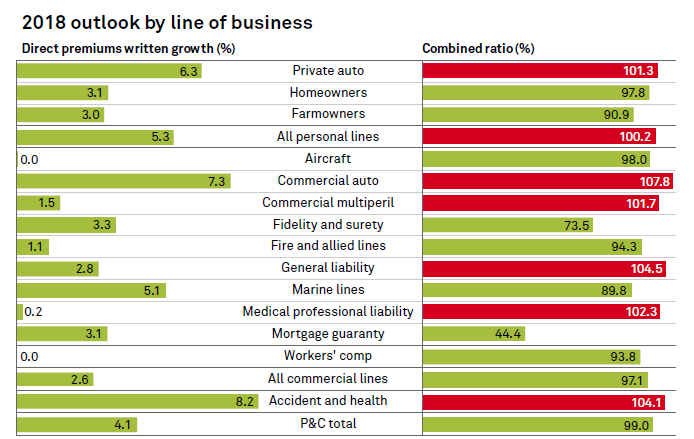

The list below contains a sample of some of the insurance products that can be transacted with this license. Looking for information on line of business. Losses stemming from the destruction of the world trade center and other buildings by terrorists on september 11 2001 totaled about 32 5 billion including commercial liability and group life insurance claims not adjusted for inflation or 35 9 billion. Property casualty insurance industry and includes the many kinds of insurance products designed for businesses.

In addition to the risk of natural disasters the insurance industry faces the threat of terrorist attacks. Commercial lines accounts for about half of the u s. Where life health disability and long term care insurance insure people and not things these lines of insurance are called personal lines property and casualty covers the risk of loss or damage to things or liability that may arise from an accident or negligence. Click to go to the 1 insurance dictionary on the web.

Business owner s policy bop covers small and medium sized businesses. Generally the property broker agent license allows authority to transact insurance coverage on the direct or consequential loss or damage to property of every kind. Personal insurance lines make it possible to do things such as driving a car and owning. Business interruption insurance business interruption insurance covers lost income and expenses resulting from property damage or loss.

The structure of many organizations distributes responsibility for similar products to different teams. 34 aggregate write ins for other lines of business casualty glass as 21 12 070 6 casualty leakage and fire extinguishing equipment as 21 12 070 8 casualty livestock as 21 12 070 12 casualty.

/25567315133_73d8a98efb_o-575fe82e2f4549e9a56005245c1baed0.jpg)