Irs Tax Settlement Help

There are many tax settlement options offered by the irs and by most states ranging from paying back taxes in full over time to negotiating with the irs to pay far less than the amount owed.

Irs tax settlement help. If you hire a tax professional to help you file an offer be sure to check his or her qualifications. If you need tax settlement assistance we can help resolve your tax problems with the best settlement method available for your individual situation. The irs will return any newly filed offer in compromise oic application if you have not filed all required tax returns and have not made any required estimated payments. Make sure you are eligible.

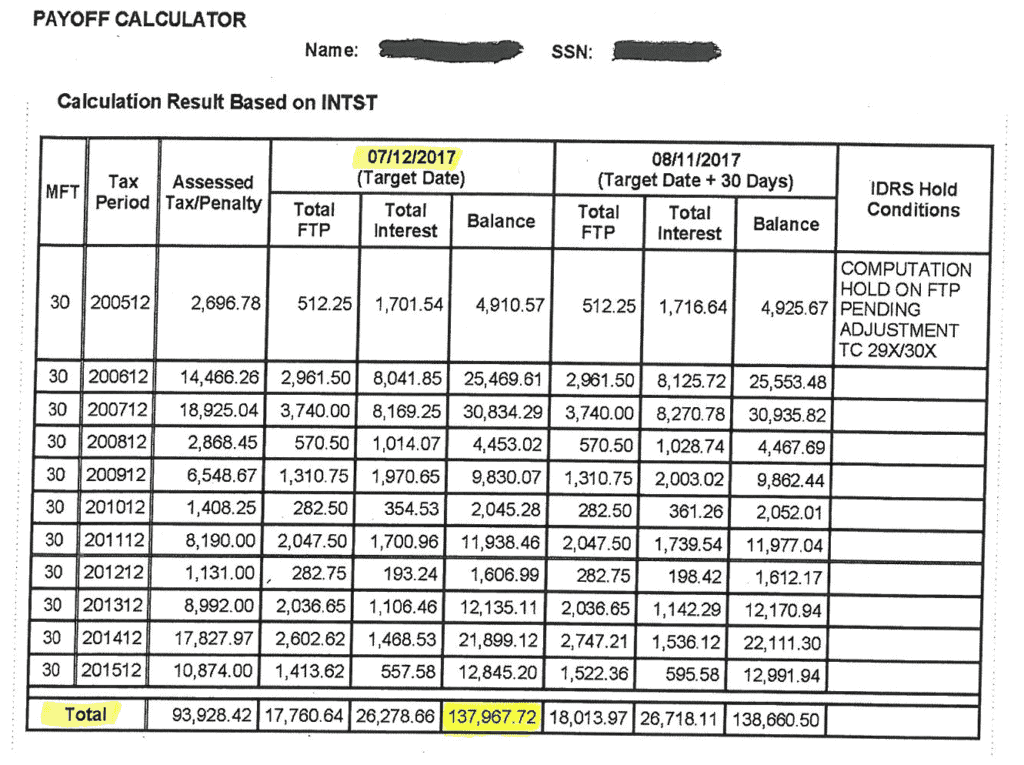

Our fee for irs tax settlements audit help and basic tax help is typically 500 to 750 as an initial retainer. A tax settlement is an arrangement which is acceptable to the irs or state taxing authorities that allows a taxpayer to retire an outstanding tax debt for less than the original amount owed. A tax settlement is when you pay less than you owe and the irs erases the rest of your tax amount owed. Taxation authorities sometimes allow this type of tax settlement when extenuating circumstances exist that would prevent the taxpayer from honoring the full debt.

There are many different types of tax settlements. The irs encourages unrepresented taxpayers with active tax court cases to contact the assigned chief counsel attorney or paralegal about participating in a virtual settlement days event. The offer in compromise program is not for everyone. If you don t have enough money to pay in full or make payments the irs may let you settle.

Yes if you re not current with your tax return filing we can provide you with advice to help get you started during your free consultation but we won t be able to move forward until you are current don t worry as we also offer tax preparation services to get your tax filings current. Having said that some tax help and audit help can be accomplished with just a phone call or letter. If a taxpayer s case is currently under consideration by the irs independent office of appeals the taxpayer should contact the assigned appeals officer to discuss case resolution. It helps to consult with a licensed tax professional.

The irs also reverses penalties for qualifying taxpayers. If you are looking for tax debt settlement either for irs or state taxes call to have a tax professional analyze your financial situation. The irs has 10 years from the date of an assessment usually close to the filing date to collect all taxes penalties and interest from you. An expert tax attorney tax cpa or tax resolution specialist can help resolve your back taxes and irs problems by just by advising and strategizing with you to wait out the 10 year expiration date.

The majority of tax settlement companies charge their clients an initial fee that can easily run anywhere between 3 000 to 6 000 depending on the size of the tax bill and proposed settlement. They can help you figure out which option is best for your situation.

:max_bytes(150000):strip_icc()/GettyImages-174879501-6ea54fc3862e4354b06db5dcffb76dc9.jpg)