Llc Income Tax Form

Pa department of revenue.

Llc income tax form. For income tax purposes an llc with only one member is treated as an entity disregarded as separate from its owner unless it files form 8832 and elects to be treated as a corporation. Use estimated fee for llcs ftb 3536 file limited liability company return of income form 568 by the original return due date. Patriot s online accounting software makes it easy to track your money. Local income tax pa dced.

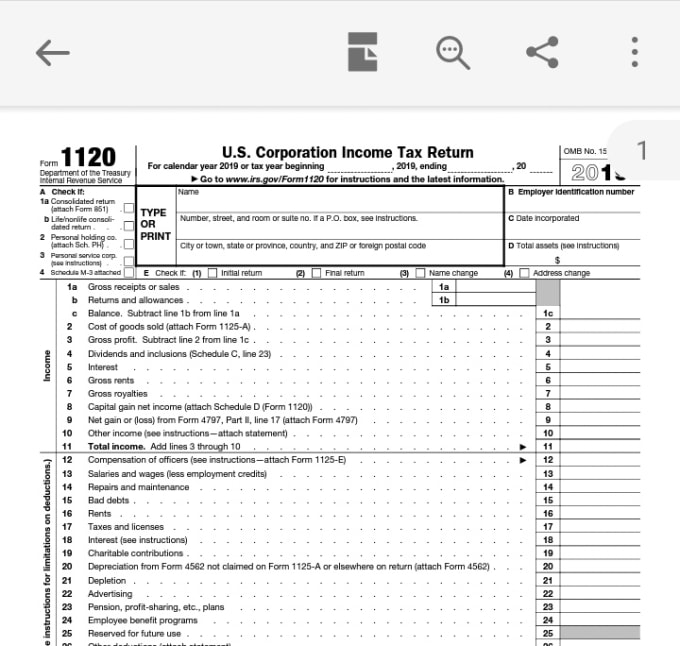

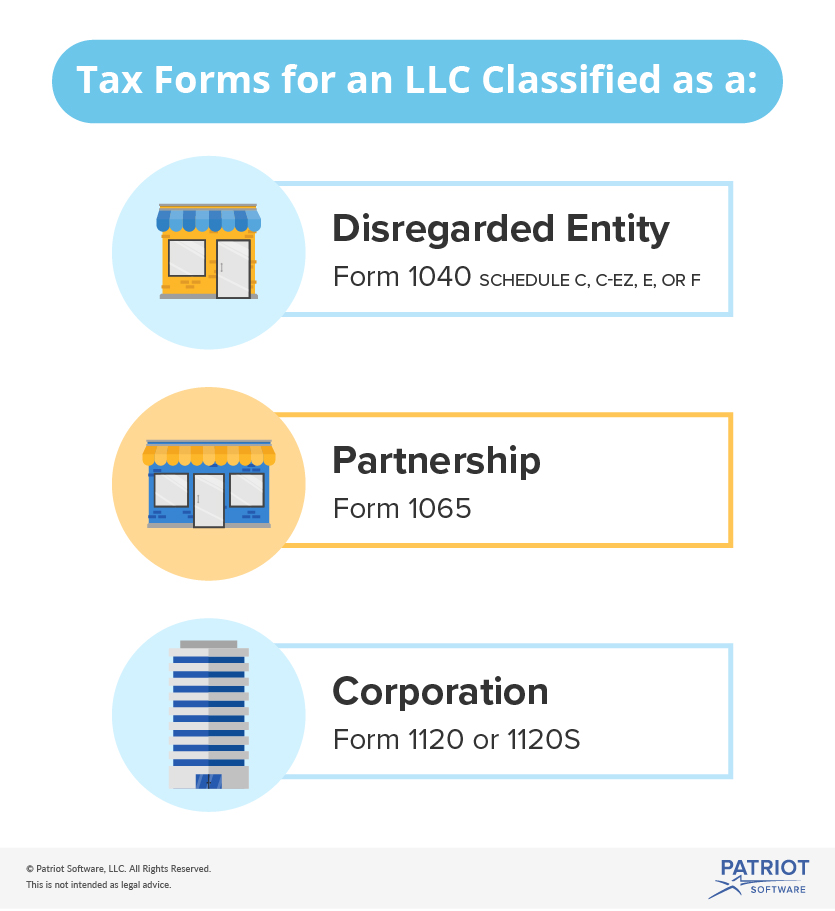

Form 1120 limited liability companies that choose a corporate designation for federal tax purposes must file an annual corporate income tax return on irs form 1120. Only member of the llc is a corporation income and expenses are reported on the corporation s return usually form 1120. How your limited liability company llc files income taxes depends on how you choose to designate your business to the internal revenue service irs. Other taxes depending on your industry where your pennsylvania llc is located how you are taxed by the irs and whether or not.

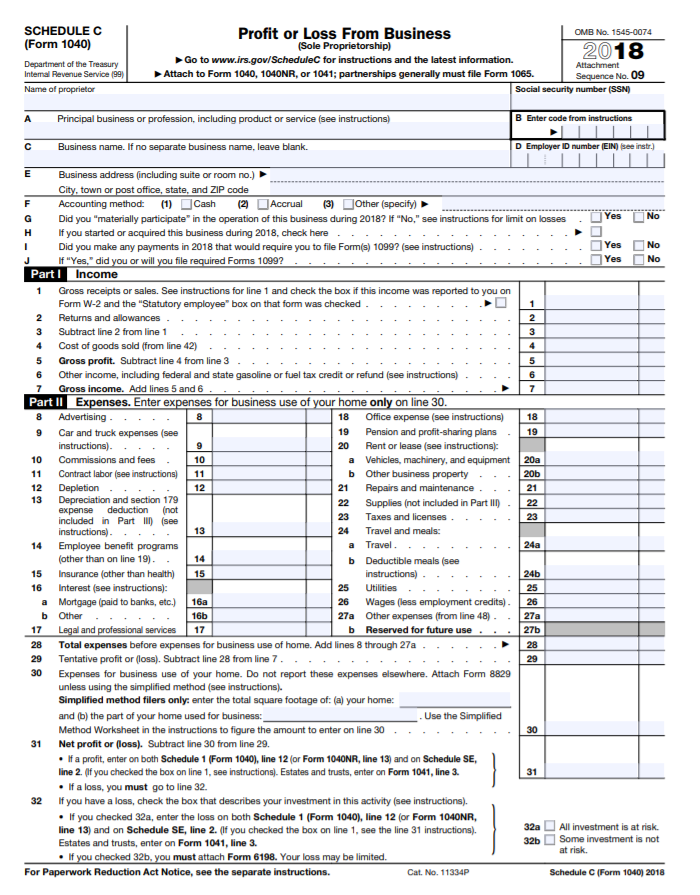

Remember the member will need to file an individual tax return and may need to complete a schedule c for self employment income. If you prefer to file as a corporation form 8832 must be submitted. Irs publication 3402 tax issues for limited liability companies provides additional information to determine the best tax reporting form to use for your llc. Sales use and hotel occupancy tax forms.

You need an ein to file taxes if you are an llc classified as a corporation. Limited liability company llc only member of llc is an individual llc income and expenses are reported on form 1040 or 1040 sr schedule c e or f. The type of tax return in which you report the llc s income and expenses depends on the tax structure you choose to apply. What kind of tax return do i file.

Because the irs does not recognize llcs as business entities llcs are taxed as sole proprietors partnerships or corporations depending on how many owners there are and what type of entity the llc elects with the irs. However for purposes of employment tax and certain excise taxes an llc with only one member is still considered a separate entity. To file tax forms for an llc you need to keep track of your business s income and expenses. Local income tax information.

How a limited liability company pays income tax depends on whether the llc has one member or several members and whether the llc elects to be treated as a different business form for tax purposes. Use limited liability company tax voucher ftb 3522 estimate and pay the llc fee by the 15th day of the 6th month after the beginning of the current tax year. If the only member of the llc is an individual the llc income and expenses are reported on form 1040 schedule c e or f. Pennsylvania employer withholding tax pa department of revenue.

Income tax return for an s corporation.

/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)