Personal Brokerage Account Vs 401k

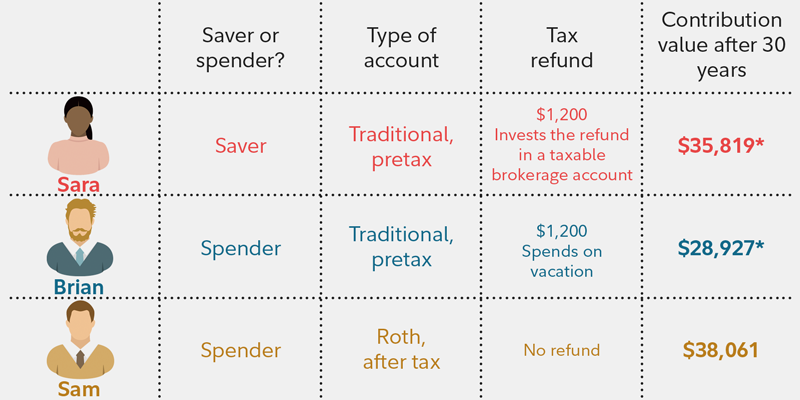

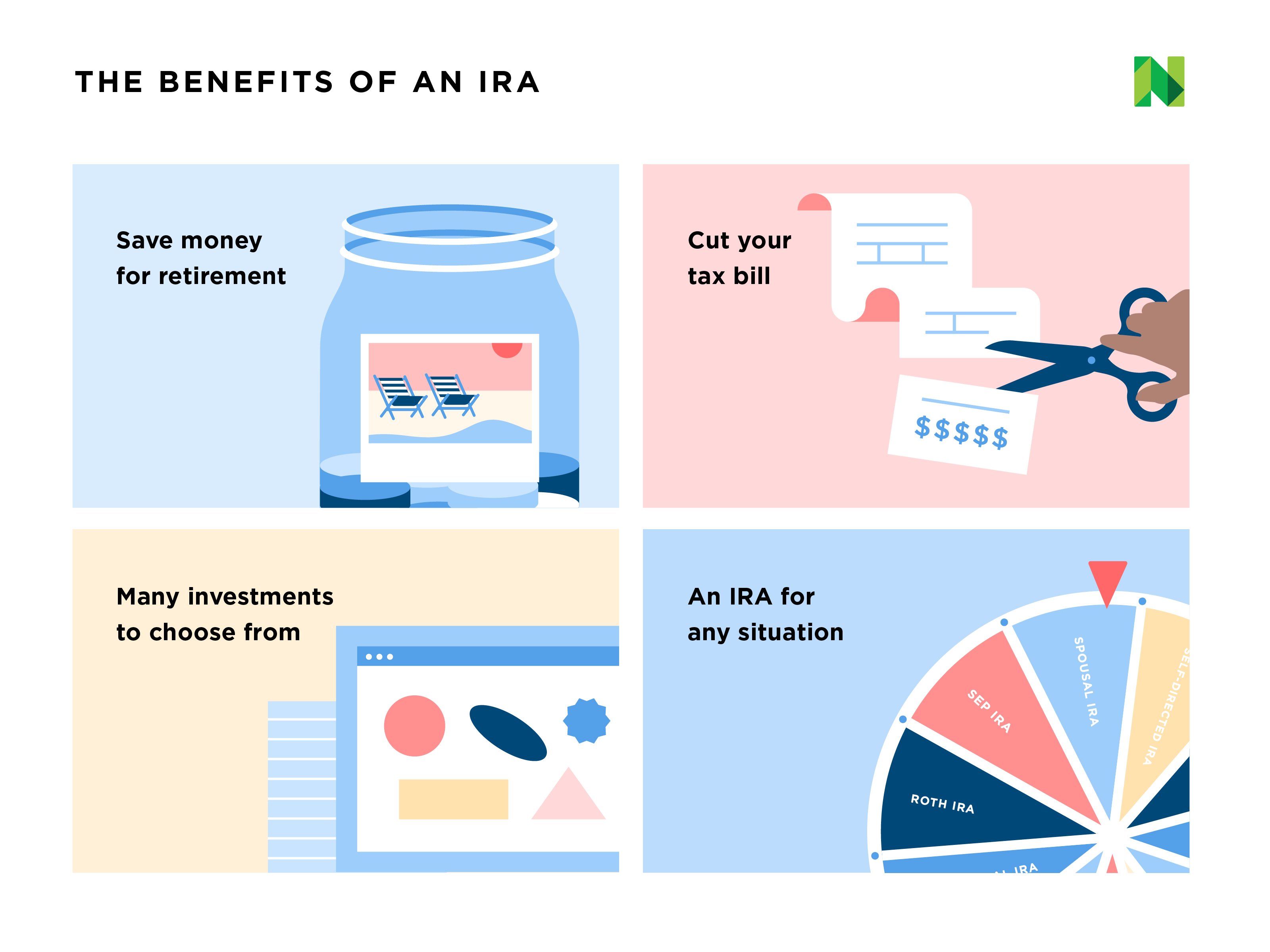

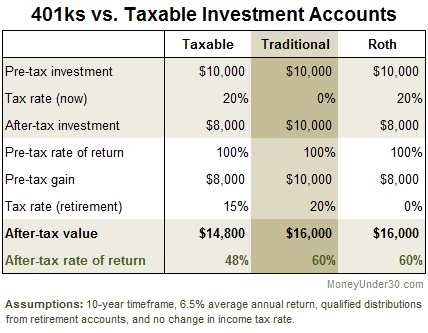

A brokerage account compared to an ira has differences with when you can choose to liquidate your investments and pay capital gains taxes and there are differences between a brokerage account vs ira in terms of contribution limits and withdrawal rules.

Personal brokerage account vs 401k. Most 401 k s are offered through employers while anyone can open an ira with any brokerage so people don t have to depend on their company to offer one. Equity trades exchange traded funds etfs and options 0 65 per contract fee in a fidelity retail account only for fidelity brokerage services llc retail clients. An ira or individual retirement account is a retirement based account that helps you. With a 3 employer match would earn about 66 000 more than a brokerage account.

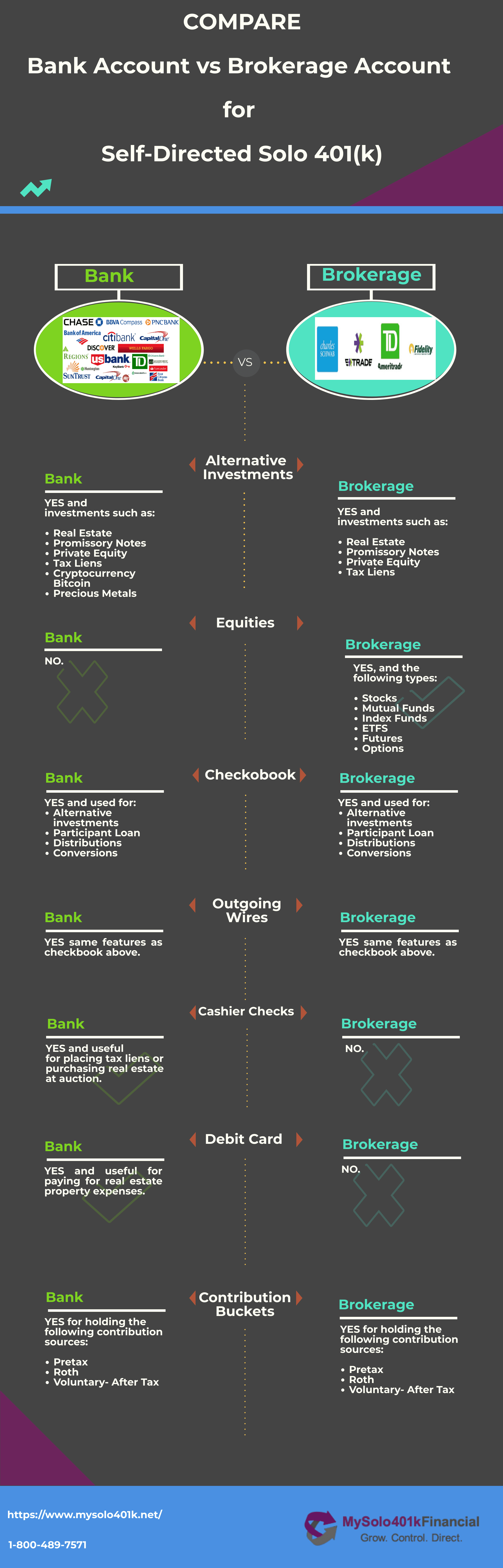

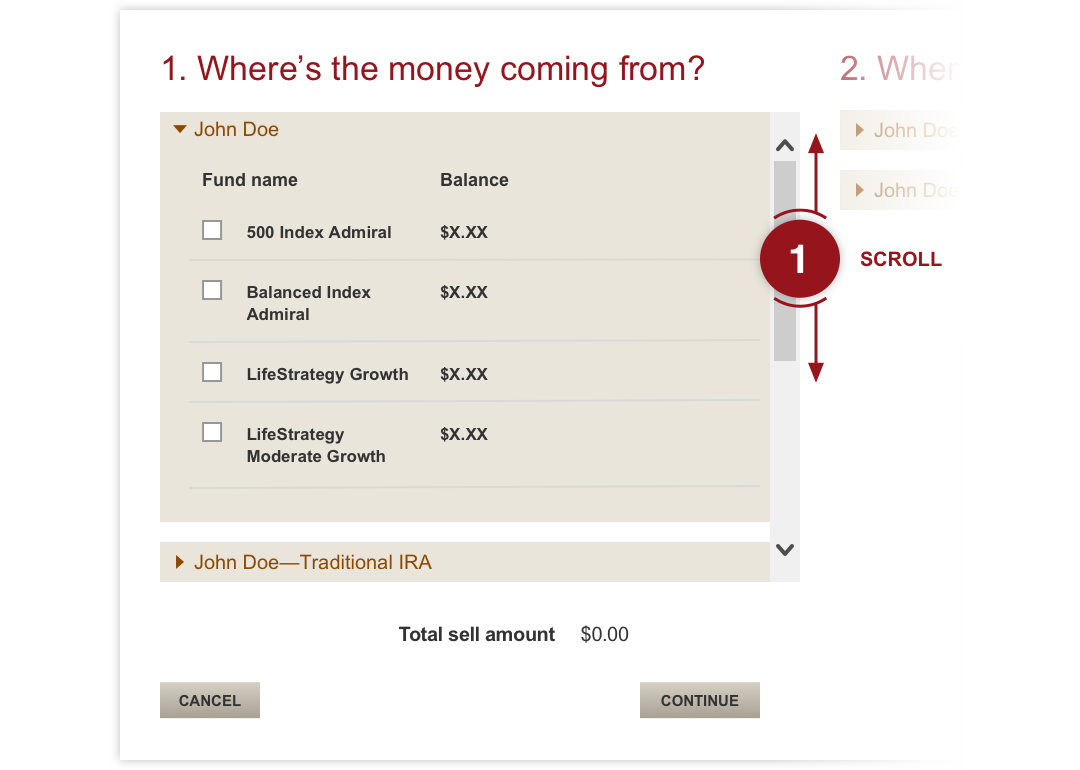

Employers who offer brokerage accounts in their 401 k s must pick a specific firm to use such as e trade or charles schwab and list this account along with the other investment choices in the plan. Now i can just log into personal capital to see how my stock accounts are doing and how my net worth is progressing. Taxable brokerage accounts and iras have various taxation rules and unique benefits. The primary difference between an ira or a brokerage account is the purpose for which you are opening one.

Capital gains taxes kick in when you sell investments at a profit. 0 00 commission applies to online u s. Some investors may be able to take advantage of multiple account types. Morningstar s director of personal.

The amount a 401 k balance would exceed an individual stock picker s balance. For example if you pay a total of 5 000 to buy a stock and sell your shares for 7 000 you have 2 000 in capital gains. For example if your employer offers a 401 k with a match it s wise to contribute just enough to that plan to maximize the match.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

/what-is-a-brokerage-account-356076_FINAL-5e0c3872c0684007b1d5595593c0c9d0.png)

:strip_icc()/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)