Present Value Of Annuity Formula

Sometimes the present value formula includes the future value fv.

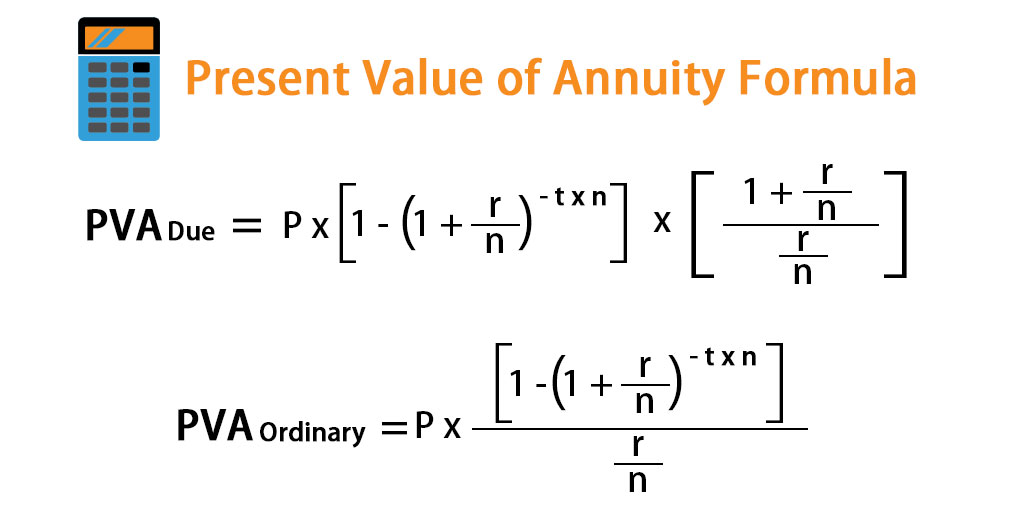

Present value of annuity formula. John is currently working in an mnc where he is paid 10 000 annually in his compensation there is a 25 portion which is will be paid an annuity by the company. An ordinary annuity pays interest at the end of a particular period rather than at the beginning. The result is the same and the same variables apply. The three constant variables are the cash flow at the first period rate of return and number of periods.

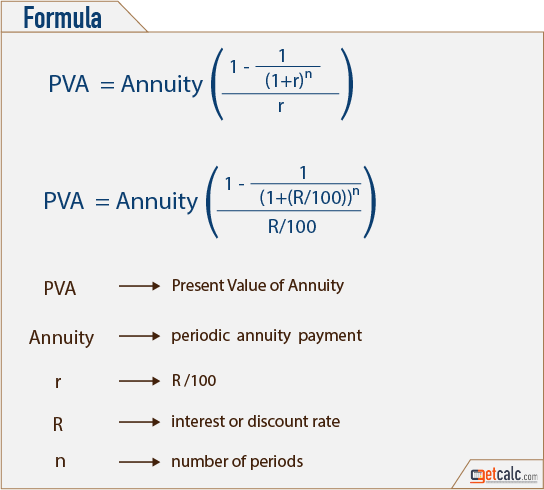

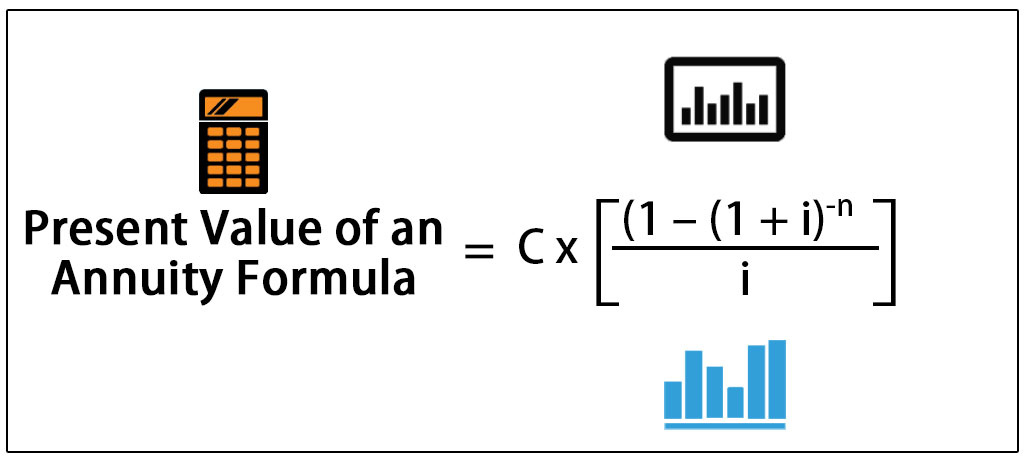

Present value of the annuity will be 1 000 x 1 1 5 25 0 05 present value of an annuity 14 093 94. The present value of annuity formula determines the value of a series of future periodic payments at a given time. The present value of annuity formula. The formula for the present value of an ordinary annuity as opposed to an annuity due is below.

There is a formula to determine the present value of an annuity. The formulas described above make it possible and relatively easy if you don t mind the math to determine the present or future value of either an ordinary annuity or an annuity due. P the present value of annuity. Using the present value formula above we can see that the annuity payments are worth about 400 000 today assuming an average interest rate of 6 percent.

Johnson is better off taking the lump sum amount today and investing in himself. Here if we change the discount rate then present value changes drastically. The future value of an annuity is a difficult equation to master if you are not an accountant.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)