Present Value Ordinary Annuity Formula

An ordinary annuity pays interest at the end of a particular period rather than at the beginning.

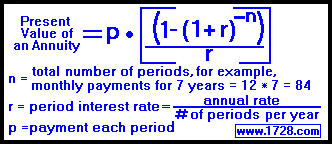

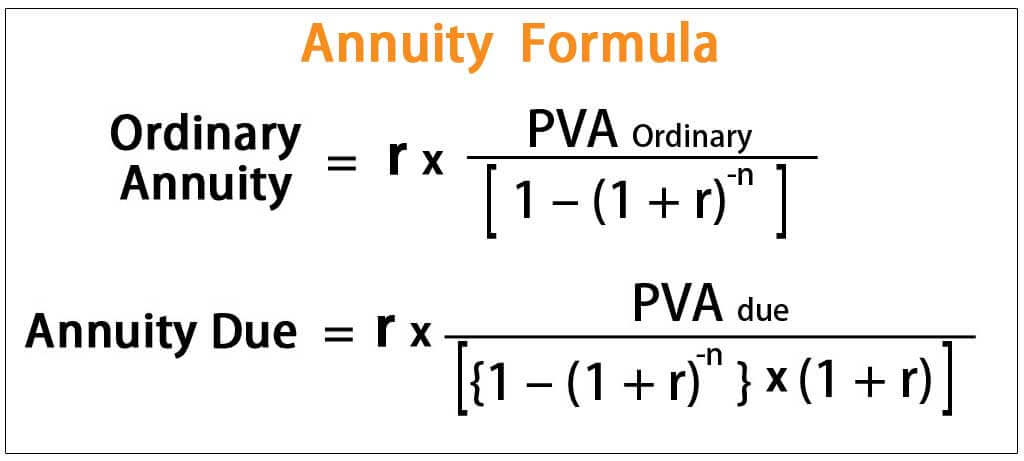

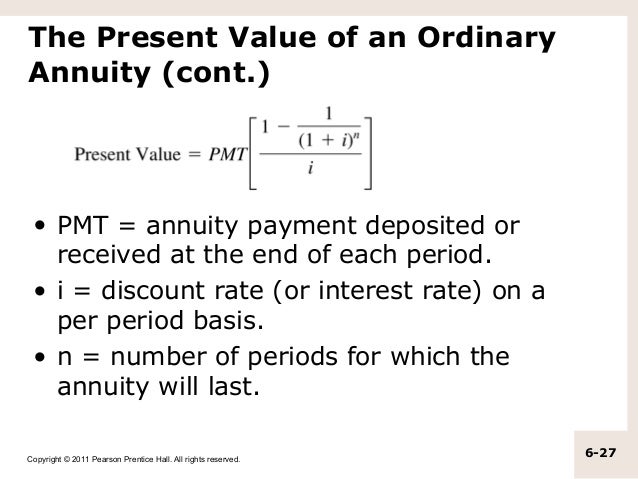

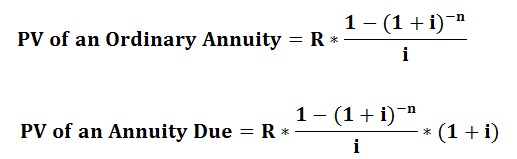

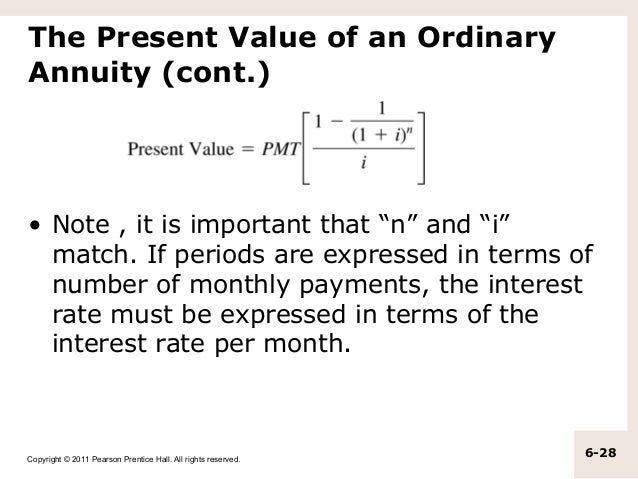

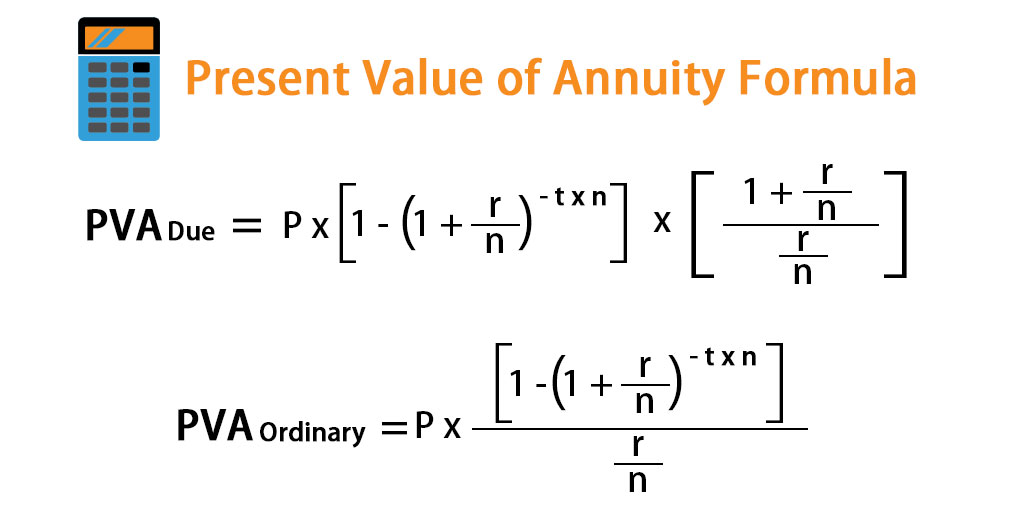

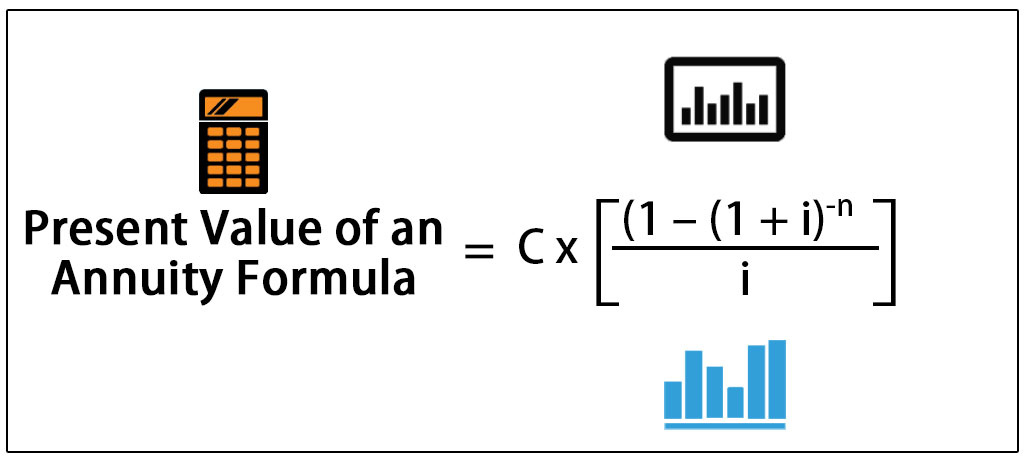

Present value ordinary annuity formula. The formulas described above make it possible and relatively easy if you don t mind the math to determine the present or future value of either an ordinary annuity or an annuity due. To get the present value of an annuity you can use the pv function. Where pmt is the periodic payment in annuity r is the annual percentage interest rate n is the number of years between time 0 and the relevant payment date and m is the number of annuity payments per year. Present value of an annuity due formula pv c times bigg dfrac 1 1 r n r bigg times 1.

The formula for calculating the present value of an ordinary. This makes the differences essential between formulas for finding the present value of an annuity and an annuity due. The present value of annuity formula determines the value of a series of future periodic payments at a given time. The formula for the present value of an ordinary annuity as opposed to an annuity due is below.

Ordinary annuity formula refers to the formula that is used in order to calculate present value of the series of equal amount of payments that are made either at the beginning or end of period over specified length of time and as per the formula present value of ordinary annuity is calculated by dividing the periodic payment by 1 minus 1 divided by 1 plus interest rate 1 r raise to the. An ordinary annuity is a series of equal payments with all payments being made at the end of each successive period. Present value of ordinary annuity 1 000 1 1 5 4 6 4 5 4 present value of ordinary annuity 20 624 therefore the present value of the cash inflow to be received by david is 20 882 and 20 624 in case the payments are received at the start or at the end of each quarter respectively. The present value calculation for an ordinary annuity is used to determine the total cost of an annuity if it were to be paid right now.

Pv c5 c6 c4 0 0 explanation an annuity is a series of equal cash flows spaced equally in time. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. Alternatively we can calculate the present value of the ordinary annuity directly using the following formula.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)