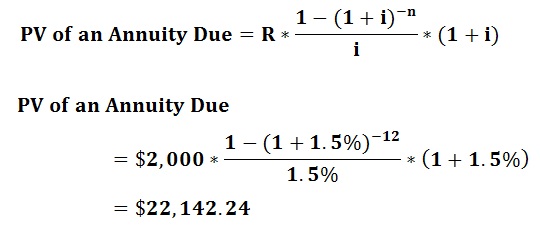

Present Worth Annuity Formula

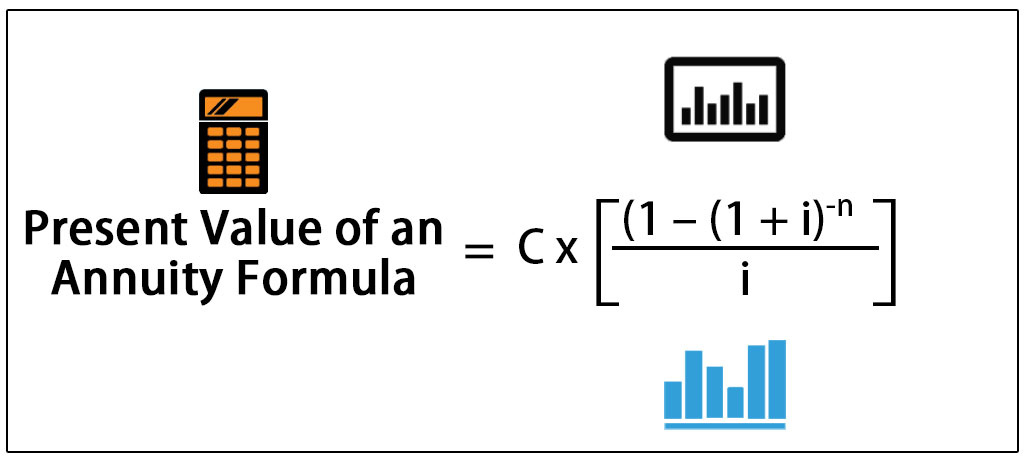

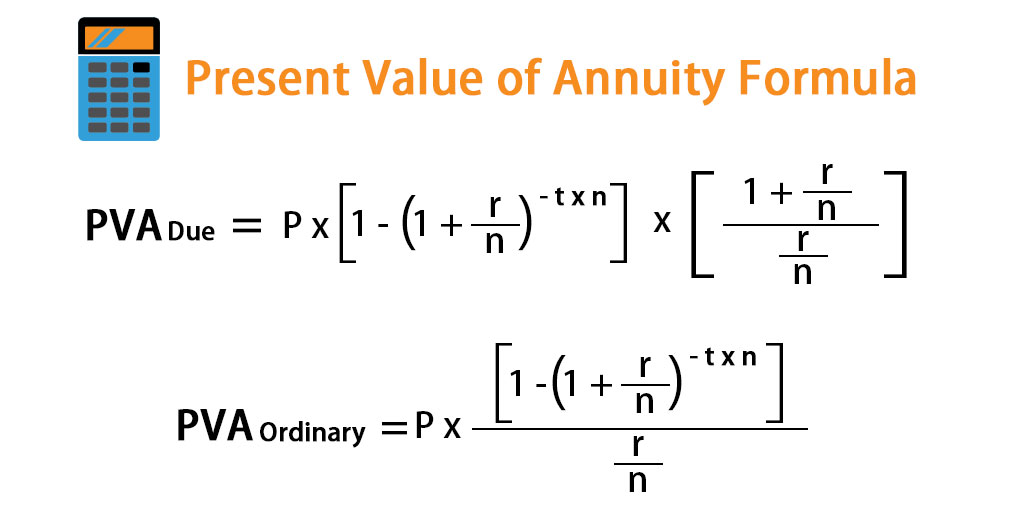

The present value of an annuity formula is a tool to help plan an investment amount based on the desired cash flow later.

Present worth annuity formula. To get the present value of an annuity you can use the pv function. Using the present value formula above we can see that the annuity payments are worth about 400 000 today assuming an average interest rate of 6 percent. Pv c5 c6 c4 0 0 explanation an annuity is a series of equal cash flows spaced equally in time. In the example shown the formula in c9 is.

Johnson is better off taking the lump sum amount today and investing in himself. So the calculation of the pv present value of an annuity formula can be done as follows present value of the annuity will be 1 250 x 1 1 2 5 60 0 025 present value of an annuity 38 635 82. The formulas described above make it possible and relatively easy if you don t mind the math to determine the present or future value of either an ordinary annuity or an annuity due. Here if we change the discount rate then present value changes drastically.

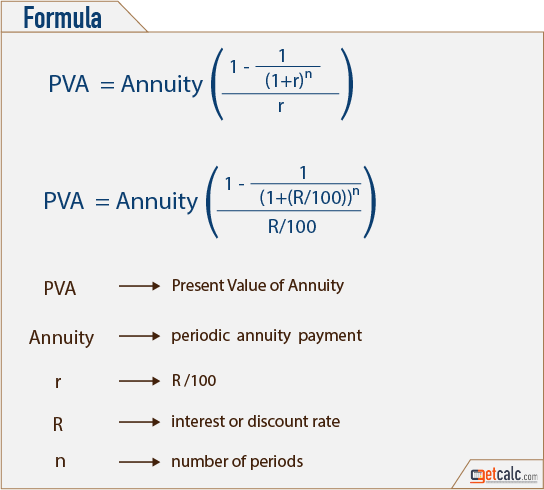

Use the following data for the calculation of the present value of an annuity. The formula for the present value of an ordinary annuity as opposed to an annuity due is below. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)