Punishment For Tax Evasion Australia

Th e main offences for prosecuting tax fraud also known as tax evasion are contained in sections 134 1 1 134 2 1 and 135 4 3 of the criminal code act the act all of which carry maximum penalties of 10 years in prison.

Punishment for tax evasion australia. Obtaining property by deception. High call volumes may result in long wait times. A yet to be published review of the tax office by one of its directors warns financial penalties for tax evaders are so low that some people could be better off taking the risk of being caught. Tax crime is abusing the tax and super systems for financial benefit.

Tax evasion penalties can range from a good behaviour bond to long term imprisonment so it s important to take any charges or allegations of tax evasion seriously. Tax evasion is a serious criminal offence and can come with harsh consequences. What is the law and penalties for tax evasion fraud. Always speak to a criminal defence lawyer who is experienced in taxation law and has a proven track record of getting good outcomes for clients who.

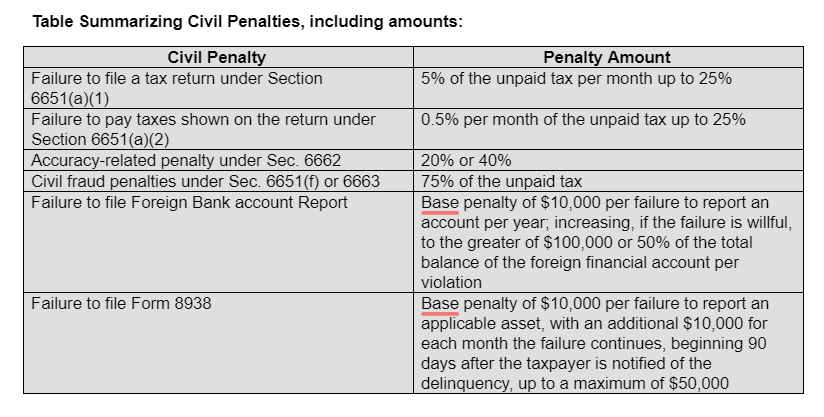

By jimmy singh on 26 06 2019 it is reported that a 27 year old woman has made false statements in her income tax returns claiming refunds over a three years period benefiting over 45 000 from the australian taxation office ato. Using complex offshore secrecy arrangements. There are serious consequences for tax crime. Penalties are calculated according to a statutory formula or in multiples of a penalty unit.

Before calling us visit covid 19 tax time essentials or find answers to our top call centre questions. Falsely claiming refunds and benefits. Deliberate fraud or false statements on the other hand can lead to charges of tax evasion. The main offences for prosecuting tax evasion are contained in sections 134 1 1 134 2 1 135 2 1 and 135 4 3 and 4 of the act.

Punishment under australian law can be severe for tax fraud. See this australian tax office fact sheet on what is tax evasion.