Reverse Mergers Shell Value And Regulation Risk In Chinese Equity Markets

Reverse mergers shell value and regulation risk in chinese equity markets stanford university graduate school of business research paper no.

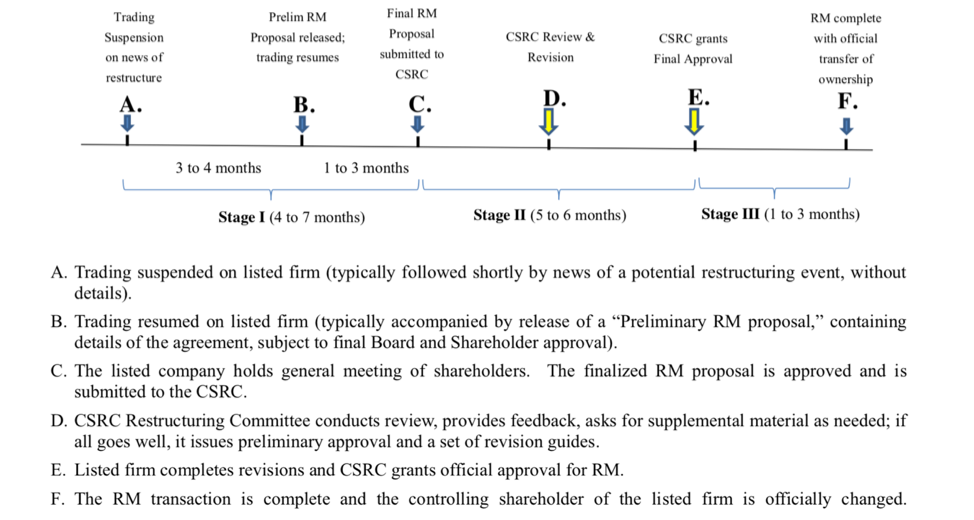

Reverse mergers shell value and regulation risk in chinese equity markets. Short selling agency and corporate investment. Reverse mergers shell value and regulation risk in chinese equity markets pdf charles m. During 2007 2015 unlisted chinese firms paid an average of 3 to 4 billion rmb for each listed shell an amount exceeding 2 3 of the median market capitalization of a listed firm. Its object is to render useless and worthless dormant shell companies that might otherwise be hijacked used in reverse mergers and ultimately pumped and dumped.

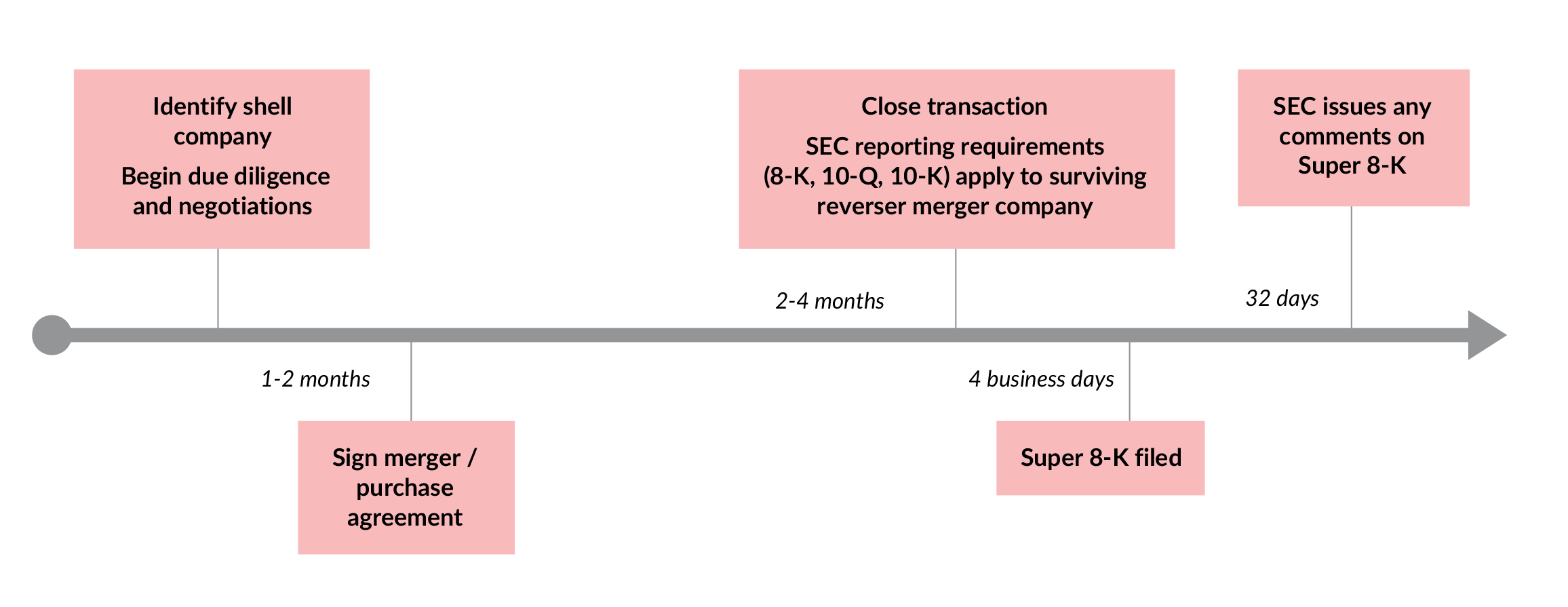

Reverse mergers can be excellent opportunities for companies and investors but there are still risks. Lee yuanyu qu tao shen september 9 2017 working paper no. Why does short sale volume predict stock returns. Shell expel is one of the securities and exchange commission s most successful enforcement initiatives to combat the use of shell companies for reverse mergers.

19 sep 2017 last revised. Lee yuanyu qu tao shen september 9 2017 mutual funds and short sellers. The high price paid for shell companies also raises the specter that chinese ipo regulations may be preventing healthy firms from accessing public equity markets. Reverse mergers shell value and regulation risk in chinese equity markets by charles m.

Tao shen s 7 research works with 5 citations and 215 reads including. Using a comprehensive sample of reverse merger rm transactions we examine the effects of china s ipo regulations on the prices and returns of its publicly listed stocks. Find out the pros and cons of reverse initial public offerings ipos. Managing risks challenges and regulatory uncertainty journal of risk and financial management 10 3390 jrfm12030126 12 3 126 2019.

In this study we follow lee et al s 2017 lead in treating the large price paid for shells in rm transactions as a shadow price for the cost of accessing chinese equity markets.