Roll 401k Into 403b

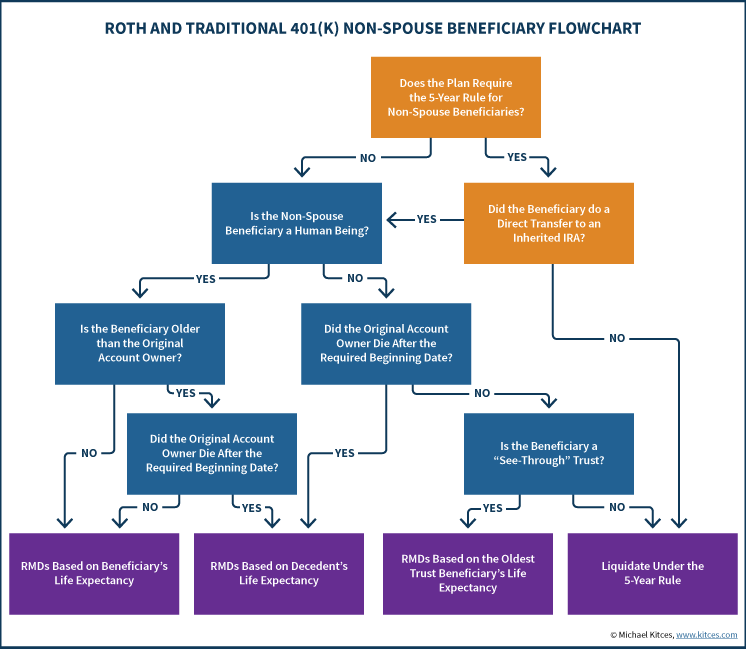

A rollover from a roth 401 k or 403 b should end up in a roth ira.

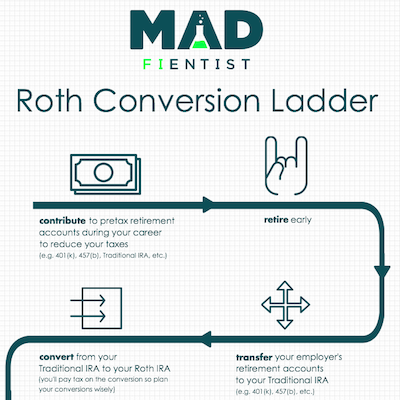

Roll 401k into 403b. For most people rolling over a 401 k or the 403 b cousin for those in the public or nonprofit sector into an ira is the best choice. With a rollover the money is paid to you first and then you have up to 60 days to redeposit the money into the 403b plan. Roll your 401 k 403 b to your new employer. The lesser known cousins to corporate 401 k plans 403 b plans are only available to certain nonprofit organizations such as schools or certain religious organizations fundamentally a 403 b operates much like a 401 k plan including the provision allowing rollovers.

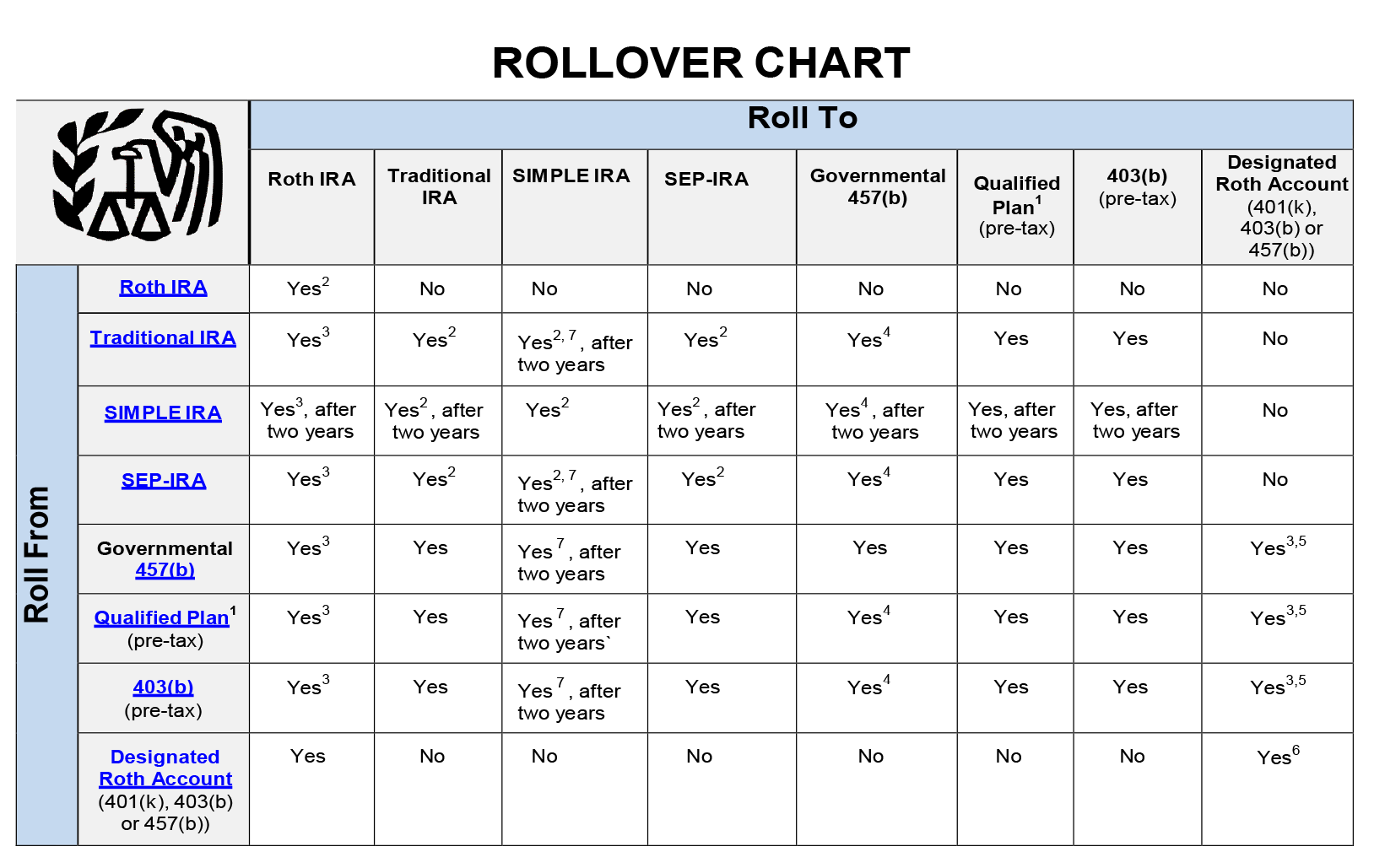

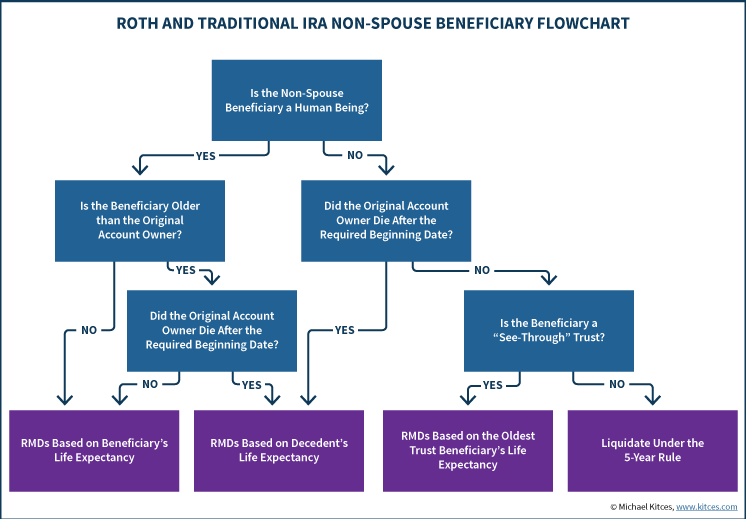

Before going into these options it s important to note that a 401 k 403 b or an ira is an account. Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k. If you have a 401k 403b 457 or some other retirement plan with a previous employer you should strongly consider the benefits of transferring your retirement assets into a rollover ira. A 403 b is an employer sponsored retirement account that offers employees various tax benefits.

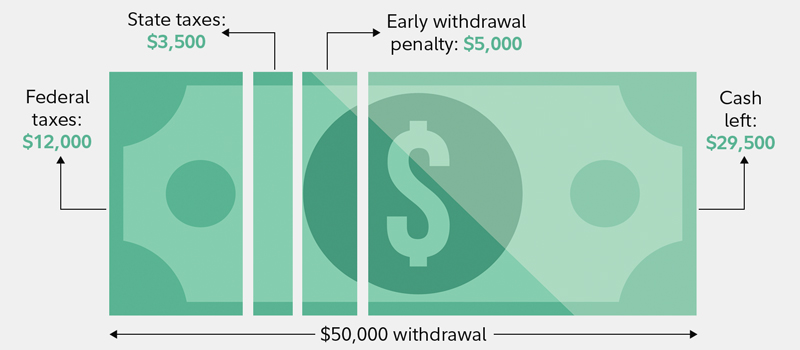

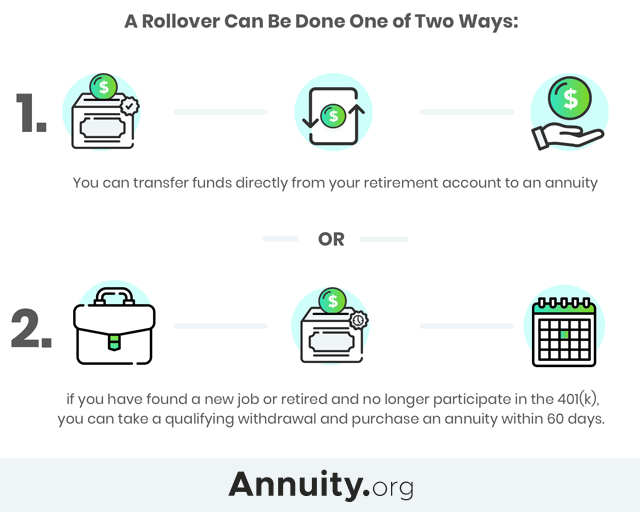

The irs says you can roll a 403 b plan into a 401 k plan if you work for an employer that offers a 401 k. If you withdraw from a traditional 401 k or 403 b as a non rollover before age 59 you will face a 10 penalty for an early withdrawal. You can move money from your 401k plan to your 403b plan either through a rollover or through a direct transfer. The rollover ira is a tax advantaged ira account designed to receive retirement funds rolled over from an ex employer s retirement plan 401k rollover 403b rollover 457 rollover.

You can also roll a 403 b plan into a solo or independent 401 k plan if you are self. With a direct transfer the money moves automatically from your 401k plan to your 403b plan. If you rollover from a traditional plan into a roth ira you will have to pay income taxes on the money. Below are seven reasons why.

In addition you could not roll over the money from the sep ira that you rolled the money into for 12 months. You could also transfer money from an ira into a 401 k sometimes called a reverse rollover but in most cases it s not a good idea.

/104494896-5bfc3c6f46e0fb00511e018a.jpg)