Roll 401k Into Tsp

Funds received by the tsp will not be invested until a properly completed.

Roll 401k into tsp. Direct rollover or indirect rollover. Thrift savings plan tsp 60 request for a transfer into the tsp form tsp 60 06 2020 previous editions obsolete use this form to request a transfer or to complete a rollover of tax deferred money from an eligible retirement plan into the traditional non roth balance of your thrift savings plan tsp account. Another thing to consider is reducing the number of investment accounts you have to keep track of maintain and balance. Whether to roll over tsp funds into an ira is at first glance no different than whether a non government employee should rollover their 401k or 403b.

Use form tsp 60 request for a transfer into the tsp for tax deferred amounts. If you don t already have a roth balance in your existing tsp account the transfer will create one. Keep assets in the current plan after termination if the plan allows this roll assets into a. You re allowed to roll money from a roth employer sponsored plan such as a roth 401 k that you had either prior to or after your federal career into your tsp s roth balance.

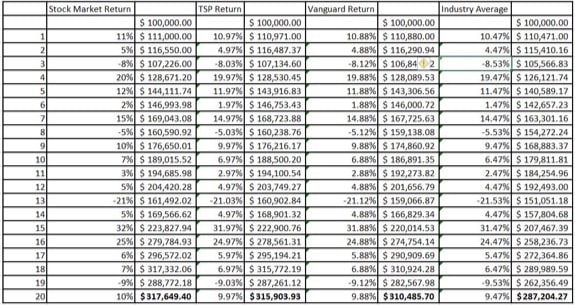

The thrift board lists three reasons why individuals should consider rolling money into their tsp accounts. Broadly speaking tsp accounts are subject to the same rollover rules and provisions that govern other tax deferred retirement plans including traditional iras and 401k plans. The tsp will accept into the roth balance of your tsp transfers from roth 401 k s roth 403 b s and roth 457 b s but you can t indirectly rollover roth funds into your tsp and can t move money from a roth ira into your tsp account. A rollover is when you receive eligible money directly from your traditional ira or plan and then you later put it into your tsp account.

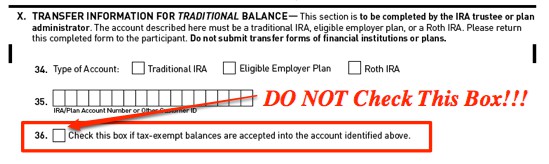

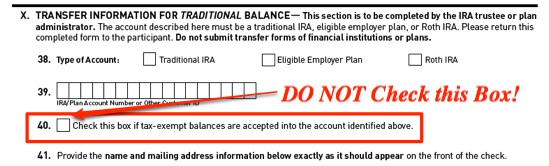

This is a good option if your new employer s 401 k plan has strong investment options and low expense ratios. Roll over traditional money into the tsp. To roll money into the thrift savings plan you would use form tsp 60 for rollovers into. To transfer roth money use form tsp 60 r request for a roth transfer into the tsp.

Upon closer examination however there is a. It also applies to rollover of 403b frs tsp 457 drop and other employer retirement plans.