Settlement Payments Tax Free

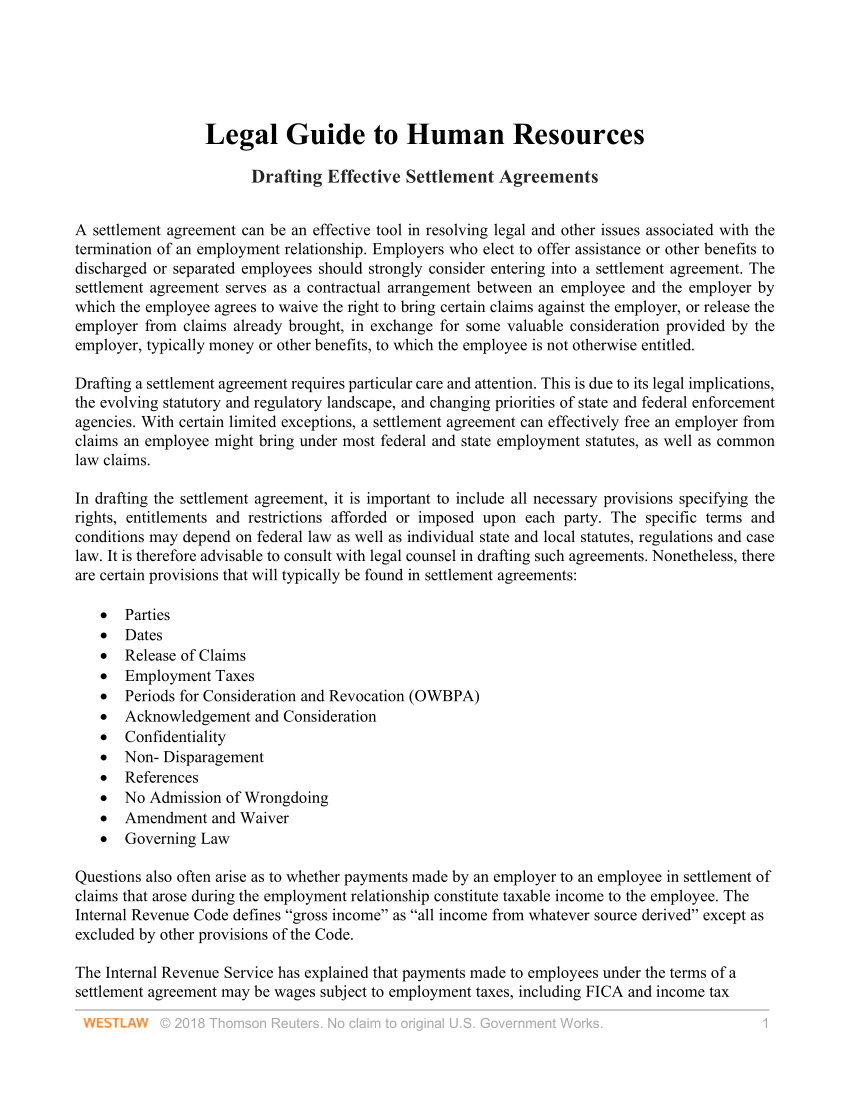

Generally speaking employers can pay the first 30 000 compensation for the settlement agreement tax free but this will not apply to all payments.

Settlement payments tax free. Information on estimated taxes can be found in irs. With the right advice you can reduce your tax liability and maximise the settlement payment you receive. The 30 00 tax free limit could apply to more than one settlement agreement. Taxable sums are usually contractually owed sums such as your usual salary holiday pay notice pay bonus and commission payments.

Tax free means you do not pay tax on any interest you earn on the money in the account. Whether or not payments made under a settlement agreement are taxable depends on to what the particular payment relates. You might receive a tax free settlement or judgment but pre judgment or post judgment interest is always taxable and can produce attorney fee problems. Usually settlement agreements are used when the employment is coming to an end and so the basic rule that the first 30 000 can be paid tax free will apply.

Tax on settlement agreements differ according to a range of considerations. We will advise you on this and if appropriate will negotiate to ensure that the payments are made in a tax efficient manner. As of 6 th april 2018 this was no longer possible and a payment in lieu of notice is taxable regardless of whether there is a contractual right to do so or not. What is a tax free savings account.

That can make it attractive to settle. Some payments can be paid free of tax under settlement agreements. How settlement agreement payments are treated for tax purposes will depend on what kind of payment they are. You can get help with your tax return from an accountant a free tax clinic or a community agency.

Previously you could offer an employee a discretionary termination payment of up to 30 000 tax free. Publication 505 tax withholding and estimated tax and in form 1040 es estimated tax for individuals. Generally speaking employers can pay the first 30 000 compensation for the settlement agreement tax free but this will not apply to all payments. It s worth noting that the tax free limit of 30 000 is an aggregate of all such payments in respect of.

The 30 000 tax free limit can apply to more than one settlement agreement depending on the circumstances. Tax on settlement agreement differs according to a range of considerations. In some situations a payment in lieu of notice used to be paid tax free in this amount. A tax free savings account is a type of bank account.

It s very important to get the taxable position on payments made under settlement agreements right whether a redundancy situation arises. Some settlement recipients may need to make estimated tax payments if they expect their tax to be 1 000 or more after subtracting credits withholding. How settlement agreement payments are treated for tax purposes will depend on the basis on which they are paid.

.png)