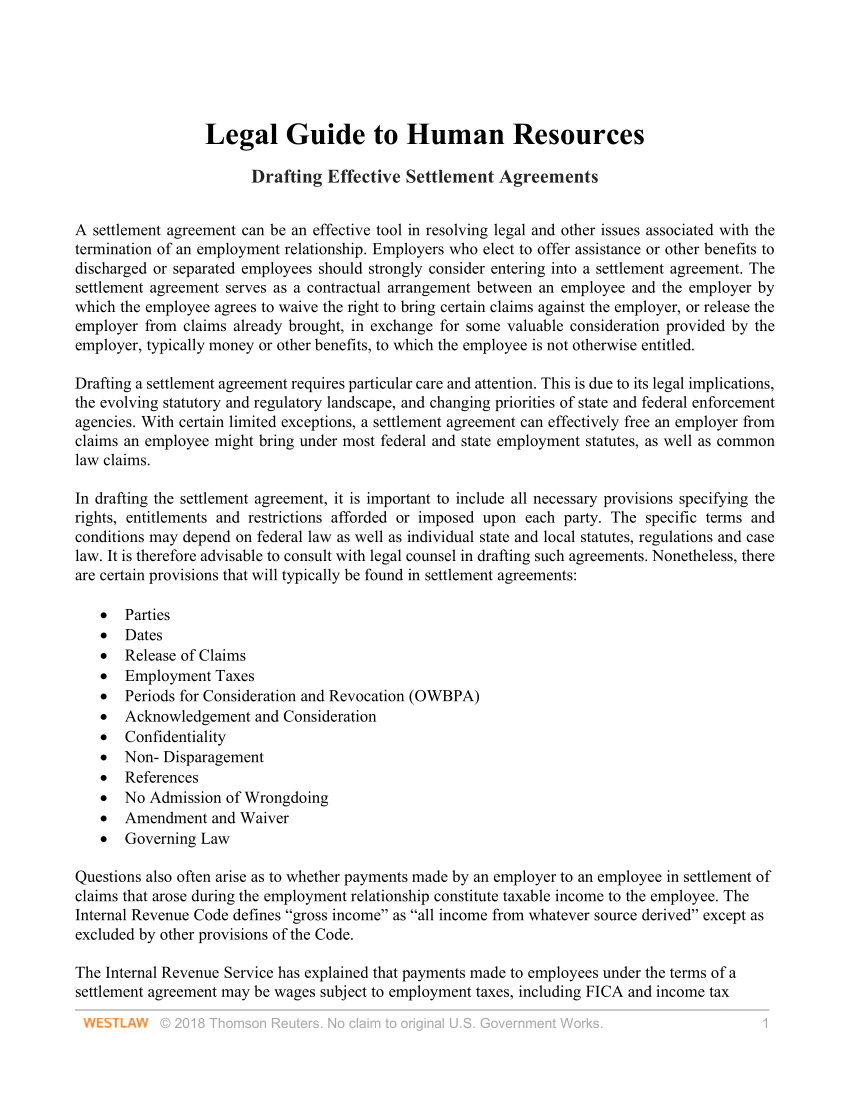

Settlement Payments Taxable Income

United states department of the treasury internal revenue service irs.

Settlement payments taxable income. Court awards and damages. If you get laid off at work and sue seeking wages you ll be taxed as wages and probably some pay. The tax treatment of a settlement or award payment will be determined by the origin of the claim doctrine. But any interest gained from a life insurance payout or any money you withdraw from a cash value life insurance policy while the insured person is still alive is counted as income and taxed as such.

However the irs requires you claim the entire 200 000. And since the tax reform law of 2017 you can no longer claim the 80 000 as an itemized deduction for legal fees source. Publication 4345 united states department of the treasury internal revenue service irs. Taxes depend on the origin of the claim taxes are based on the origin of your claim.

Last reviewed or updated 18 january 2019. Under this doctrine if a settlement or award payment represents damages for lost profits it is generally taxable as ordinary income. Taxable and nontaxable income. Insurance payments that are designed to replace or supplement income may also be subject to taxes.

Important note about health insurance coverage. Character of settlement and award payments. The bottom line is that the irs taxes most money you win in a lawsuit as income. Publication 525 taxable and nontaxable income visit our website at www irs gov or call toll free at 1 800 829 1040.