Tax Recovery Meaning

The process of becoming.

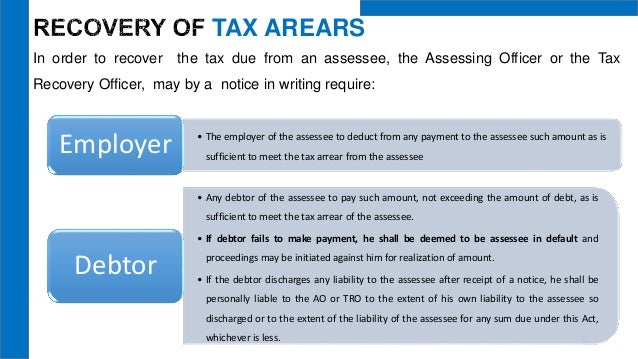

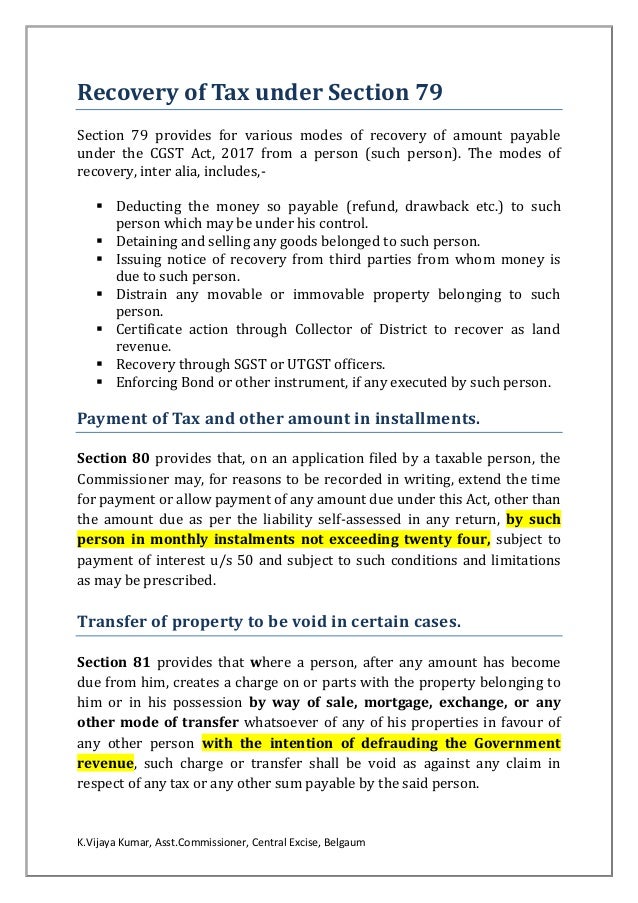

Tax recovery meaning. The eu has developed the world s strongest framework for international tax recovery assistance. As the input tax claims are only provisionally allowed at the end of each prescribed accounting period you are still required to perform a longer period adjustment by performing the same test in respect of the input tax. When to initiate proceedings for recovery of tax under gst. As per the provisions of recovery of tax in gst if the amount payable by a taxable person.

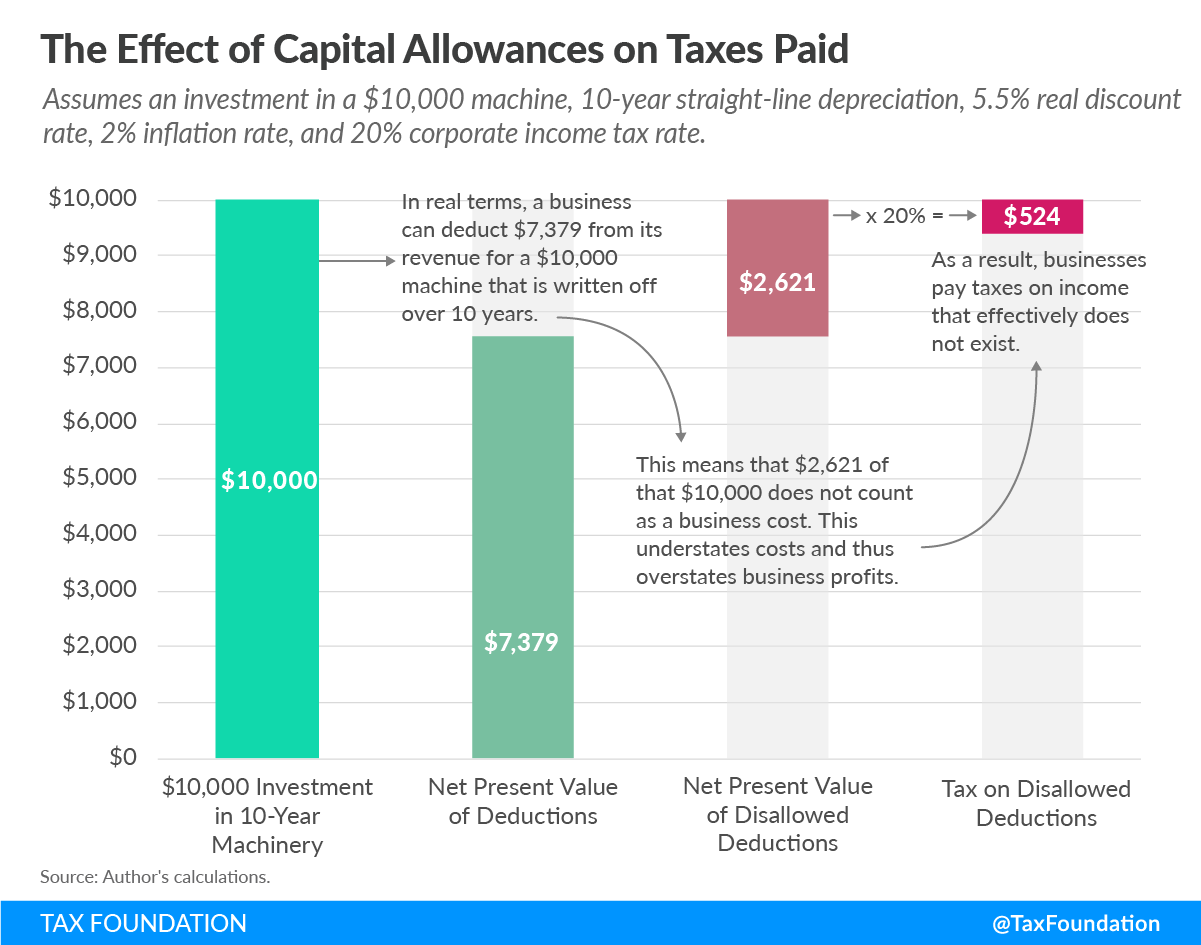

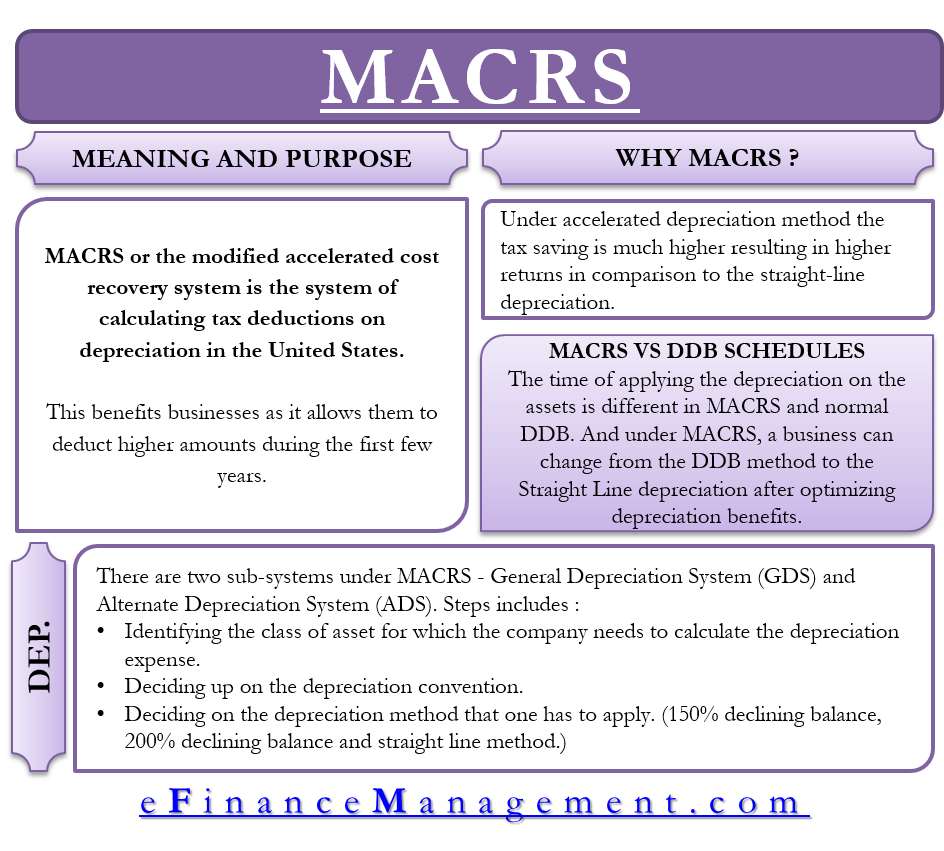

The recovery period of an asset is the length of time over which the internal revenue service requires you to depreciate it. Travelers often pay tax recovery charges instead of taxes when booking a hotel room in the us through a major online travel agency like expedia orbitz priceline and travelocity what are these mysterious charges. For example in most european countries tax is fully recoverable on all purchases except for businesses that only sell nontaxable supplies such as financial. A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes.

When the de minimis rule is satisfied you may claim all input tax incurred excluding disallowed input tax under regulations 26 and 27 of the gst general regulations. Say you book a night s stay at a hotel through a major online travel agency and you pay 100 plus tax recovery charges and service fees. There are usually many regulations surrounding the details of tax recovery. From the taxpayer s point of view this may mean a refund of tax.

These periods theoretically track the actual useful life of an asset so for instance an office building has a much longer life than a computer. Organising tax recovery assistance within the eu. From the tax authorities point of. However if the due tax amount still remains unpaid then the department is authorised to start recovery of tax meaning proceedings can be started officially.

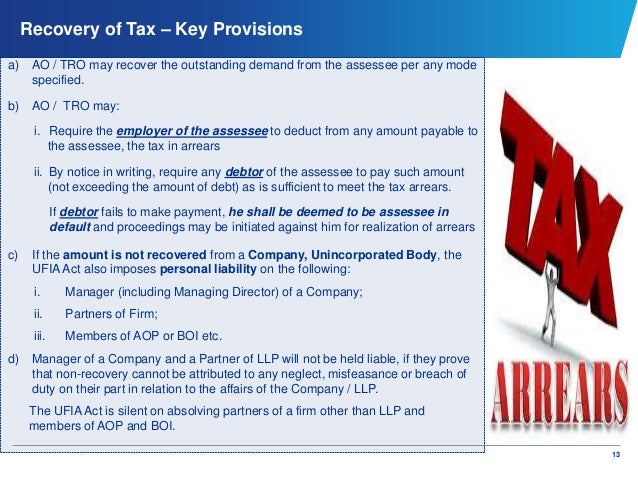

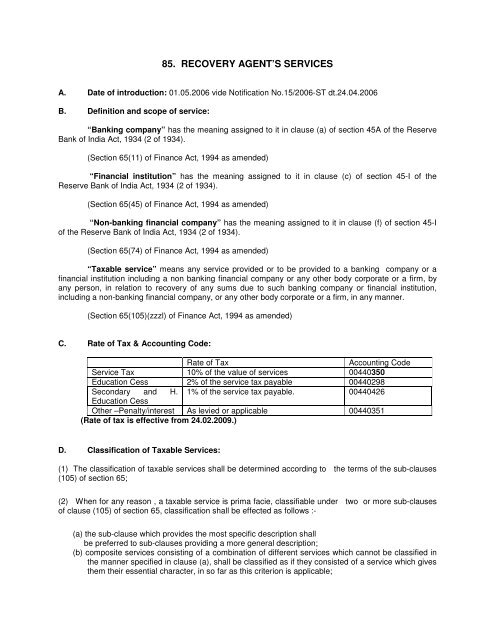

Modes of recovery of tax section 122 section 122 provides that in case assessee fails to pay any sum imposed by way of interest fine penalty or any other sum payable under the provisions of this act the same shall be recoverable in the manner specified in the act for the recovery of arrears of tax. It is the opposite of a deferred tax liability which represents income taxes owed. What is recovery of tax. The process of becoming well again after an illness or injury.

What does recovery period mean for taxes.

:max_bytes(150000):strip_icc()/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_U-Shaped_Recovery_May_2020-01-5cbef049426c4f708f8e24ac48fa3320.jpg)