Tax Relief Commuting

12 march 2017 at 6 37pm edited 30 november 1 at 1 00am in employment jobseeking training.

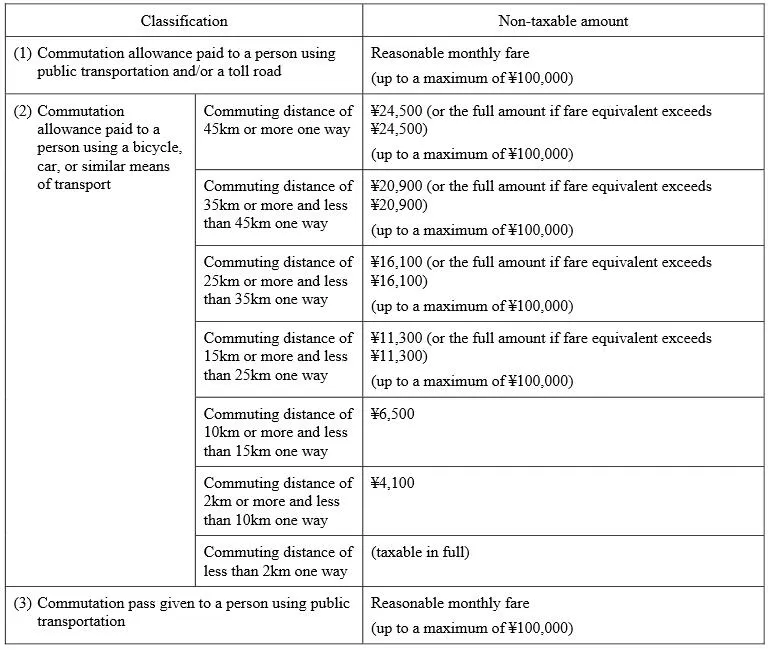

Tax relief commuting. Tax relief for commuting to work costs. In particular there is generally no tax relief available for the costs of ordinary commuting that is travel between an employee s home and a permanent workplace more on this below. An employee cannot have tax relief for the cost of a journey which is ordinary commuting or private travel. Example if you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12.

Tax relief for commuting post by mullet sat apr 17 2010 11 19 am interestingly hmrc have said that if my accomodation costs are necessary because of the length of the commute they may be deductable. Commuting to work tax deduction. You need to enter your employment expenses claim under the employment section in your income tax return. Hmrc plans to restrict tax relief for temporary workers commuting costs.

The following paragraphs explain what these terms mean. 12 march 2017 at 6 37pm edited 30 november 1 at 1 00am in employment jobseeking training. If you are not a taxpayer you cannot get tax relief. Worker cannot claim tax relief on commuting expenses.

You have to keep complete and proper records of all expenses incurred for 5 years. You ll get tax relief based on what you ve spent and the rate at which you pay tax. It is crucial to understand that the rules on what travel expenses qualify for tax relief are quite strict. Made possible with a home office.

For example expenses incurred in 2019 for ya 2020 must be kept and retained until 31 dec 2024. A man who had a series of temporary contracts working at different company sites has lost his appeal for tax relief on his travel expenses on the. 9 january 15 by. However s338 and s339 itepa 2003 allow deductions for travel and subsistence expenses incurred in travel to a location that is not a permanent workplace.

Tax relief for travel and subsistence as a matter of general law the cost of commuting between home and the workplace is not a deductible expense against employment income. 17 replies 2 3k views lmcox forumite. In this event you can deduct the cost of any trips you make from your home office to another business location.