Types Of Bankers Acceptance

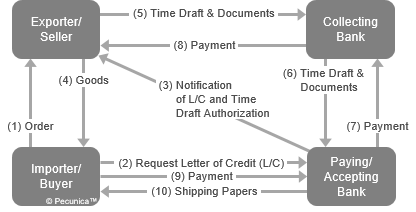

A banker s acceptance is often used in importing and exporting with the importer s bank.

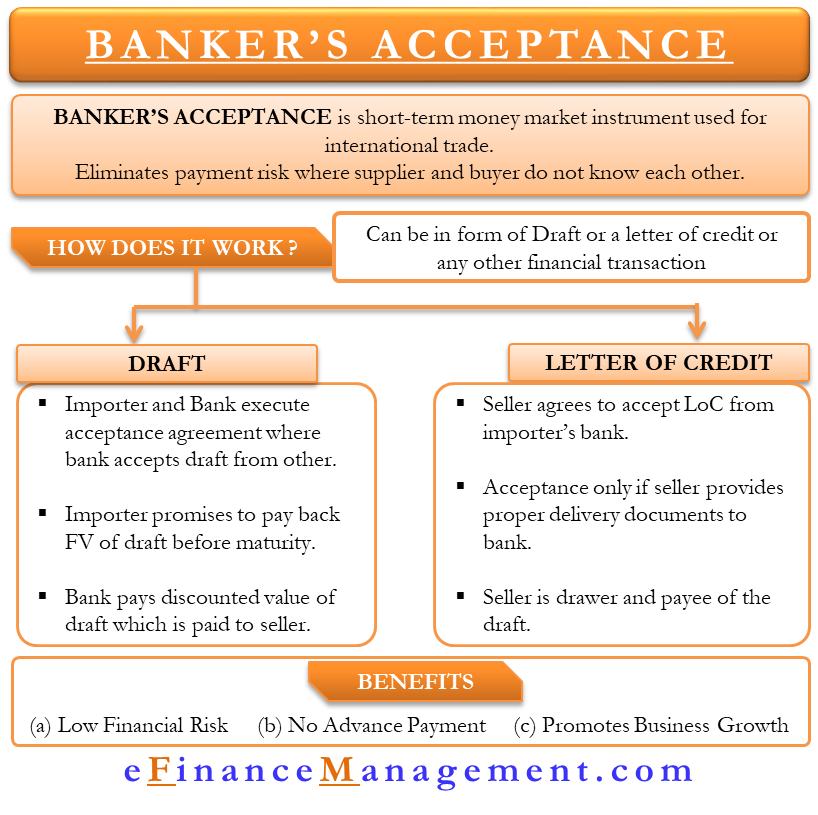

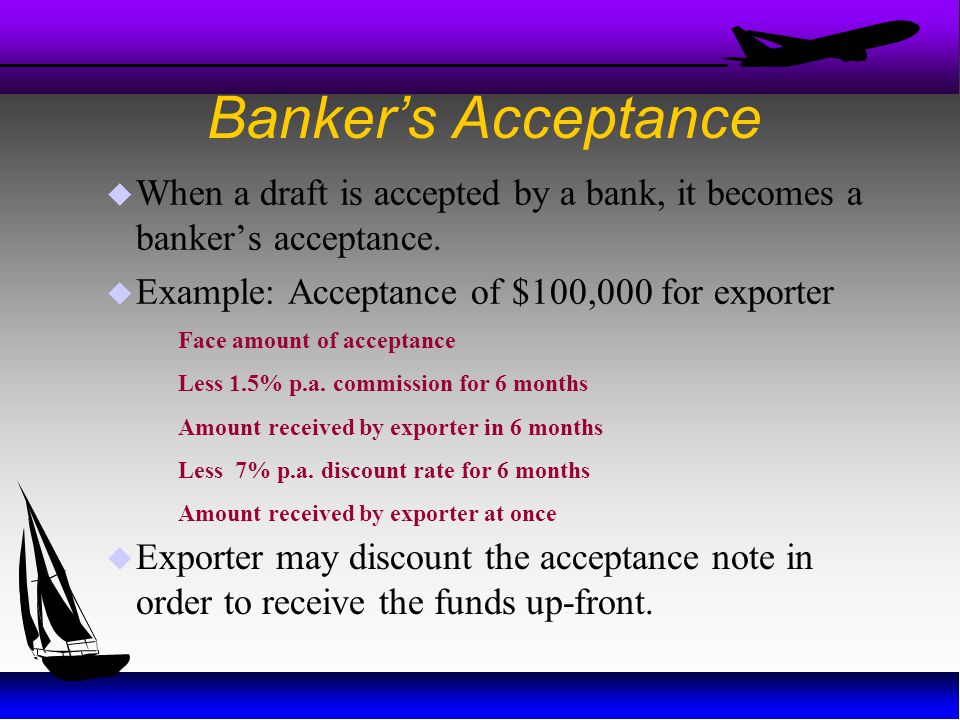

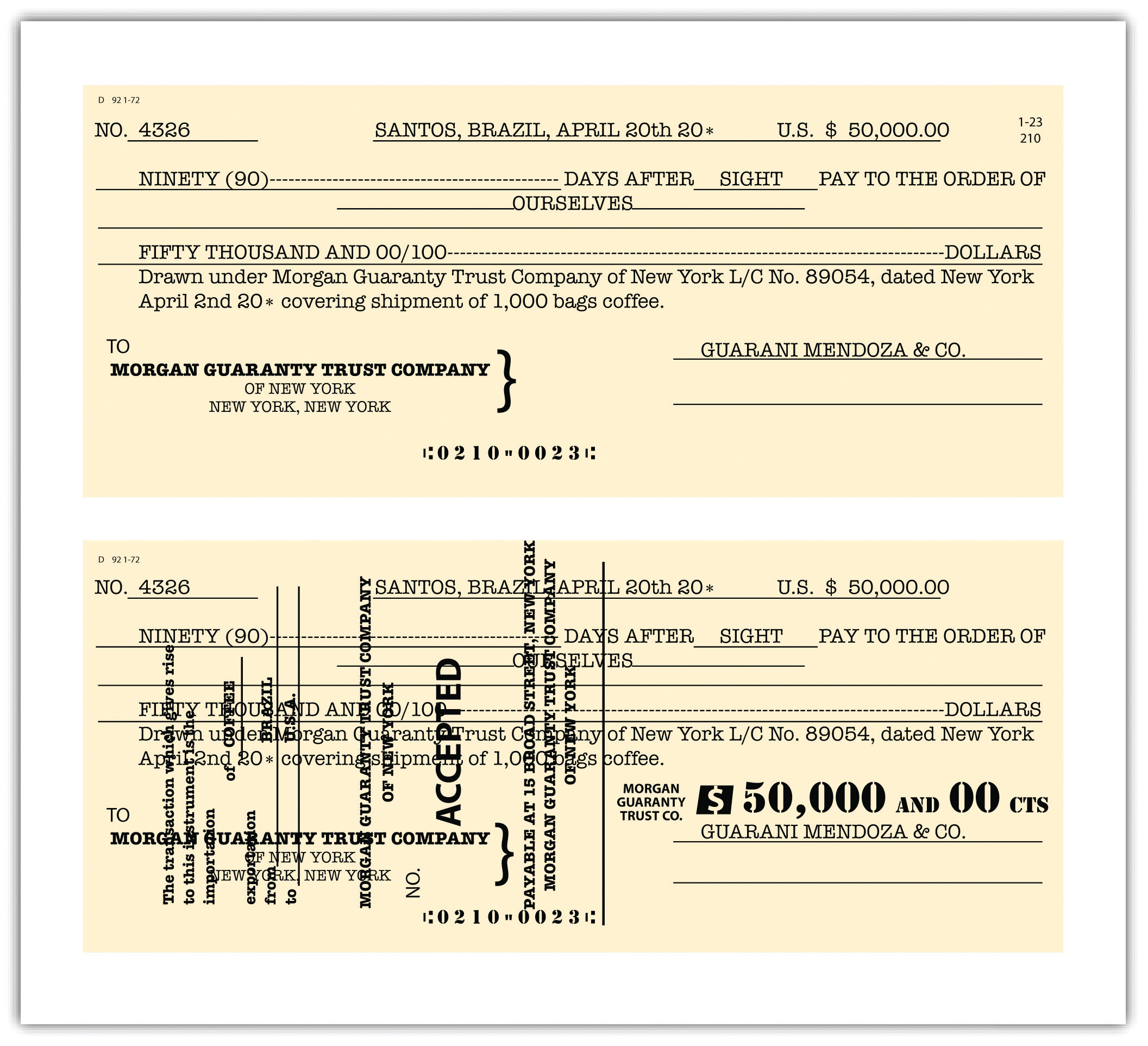

Types of bankers acceptance. A banker s acceptance is a legally binding obligation by the accepting bank to pay the stated amount at the maturity date of the time draft. A banker s acceptance requires the bank to pay the holder a set amount of money on a set date. A bankers acceptance ba aka bill of exchange is a commercial bank draft requiring the bank to pay the holder of the instrument a specified amount on a specified date which is typically 90 days from the date of issue but can range from 1 to 180 days the bankers acceptance is issued at a discount and paid in. Money bonds bonds types money market instruments bankers acceptances.

The drawee assumes responsibility as the acceptor and for payment at maturity. Acceptance contractual agreement instigated when the drawee of a time draft accepts the draft by writing the word accepted thereon. It can have maturity dates ranging from 30 to 180 days. Letter of credit and banker s acceptance.

A banker s acceptance is an instrument representing a promised future payment by a bank the payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit. That is a bank. A banker s acceptance is a short term debt instrument that helps to facilitate trade transactions between two parties when they do not have an established credit relationship. They are most commonly issued 90 days before the date of maturity but can mature at any later date.