Uk Spread Betting Tax

Currently in the uk there is no capital gains tax to be paid on spread bets or any types of bets as they are completely exempt of course tax law may change.

Uk spread betting tax. Spread betting is a way to take advantage of opportunities on rising or falling markets without having to buy the underlying assets. They are not taxable on the profits nor do they receive relief for their losses. Spread bets are exempt from the 0 5 per cent stamp duty applicable on uk share purchases which means that short to medium term holdings may work out cheaper than buying the underlying shares. The general assumption is that financial spread betting is tax free here in the uk at least under the current tax laws.

The inland revenue doesn t allow people to offset losses against profits either so for the time being profits or income from spread betting are not taxable. There s no stamp duty to pay with either product because you don t take ownership of the underlying assets when you trade. It s popular in the uk and ireland because profits are tax free. However this isn t always 100 the case.

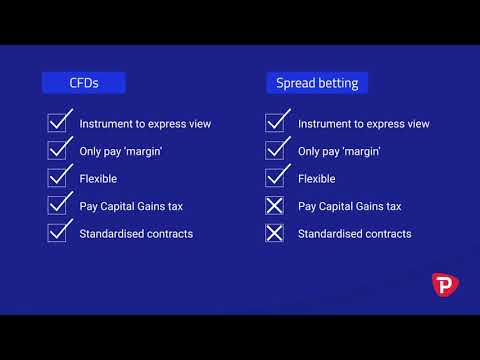

Once your main income comes through spread betting all profits will be liable for income tax. Spread betting s unique benefit is that it is exempt from both capital gains tax and stamp duty. When compared to conventional share trading and cfd trading spread betting is the only trading product to offer tax free trading in the uk and ireland. We must emphasise that spread betting is only tax free under current uk tax law which may change and that ultimately your tax treatment will depend on your individual circumstances.

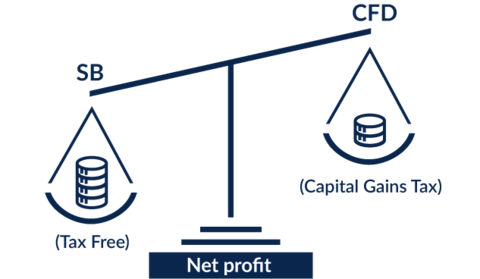

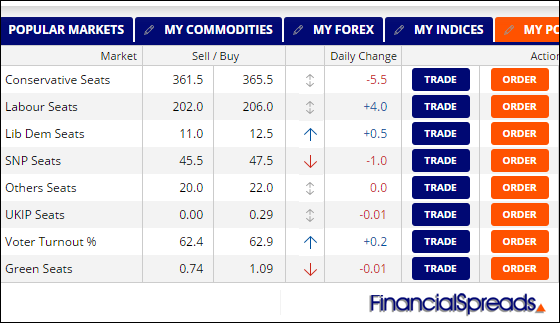

Spread betting is a tax efficient way of speculating on the price movement of thousands of global financial instruments including indices shares currency pairs commodities and treasuries. Spread bets are free from capital gains tax while profits from cfds can be offset against losses for tax purposes. Profits from spread betting are not subject to uk capital gains tax or stamp duty. Spread betting is tax free until it becomes your main income.

The crux of the issue seems to be the nature of your trades as summarised here taken from the times hmrc will try to tax betting if it forms part of another trade. Tax treatment depends on your individual circumstances and may change in the future. If spread betting is a secondary income then it is the most tax efficient way of trading if it becomes your main income cfd trading is much more tax efficient. However tax is not the only advantage spread betting has to offer read on to find out more.

Spread betting tax benefits. Make a profit from financial markets without paying any tax. For instance ig index charges libor plus 2 5 per cent on long spread betting positions held overnight.