Uk Stock Trading Tax

Long term investments those.

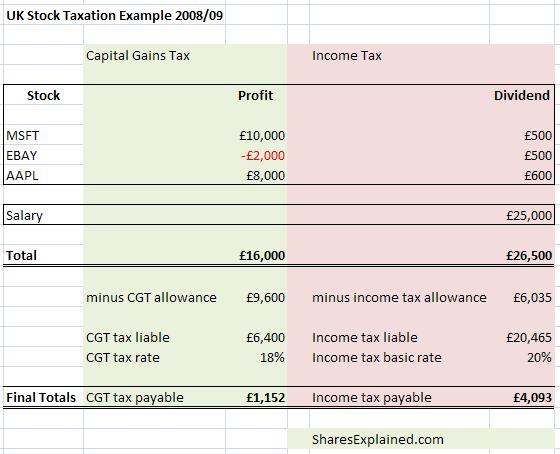

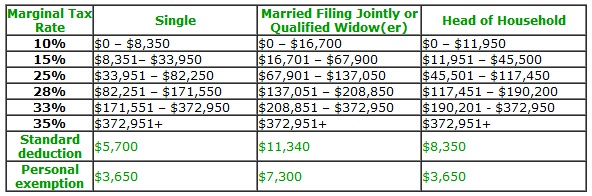

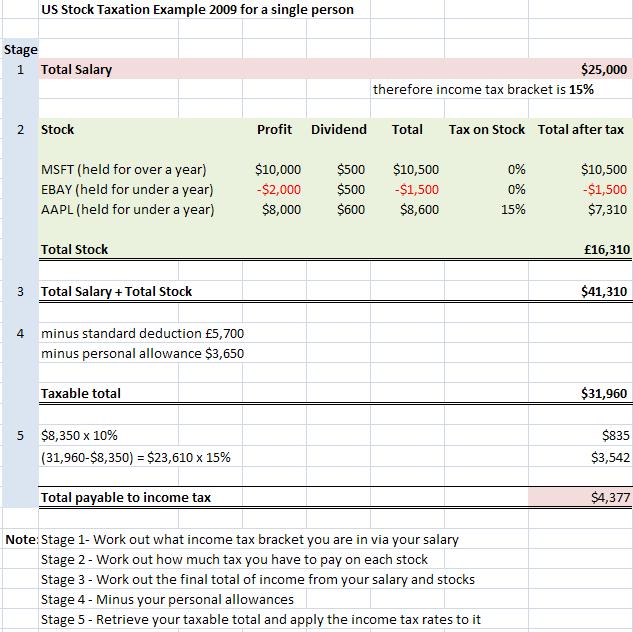

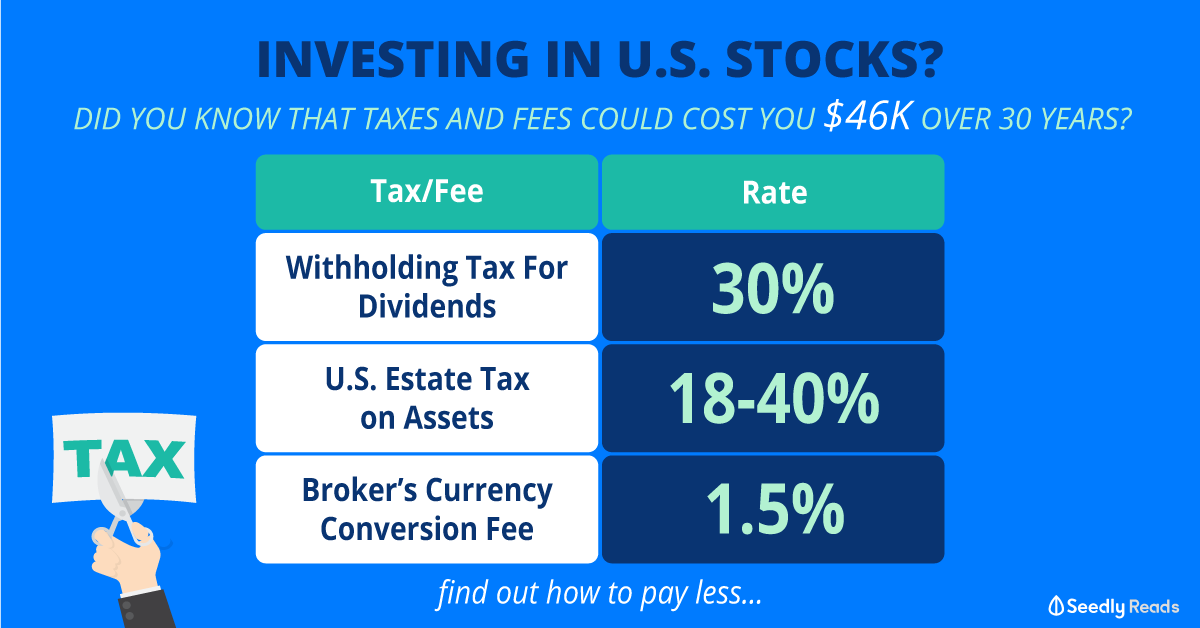

Uk stock trading tax. Profits from trading cfds however are taxable. The current tax rates are 0 15 or 20 depending on your individual tax bracket. This page breaks down how tax brackets are calculated regional differences rules to be aware of as well as offering some invaluable tips on how to. For those entirely new to financial markets the basic distinction in tax structure is between long and short term investments.

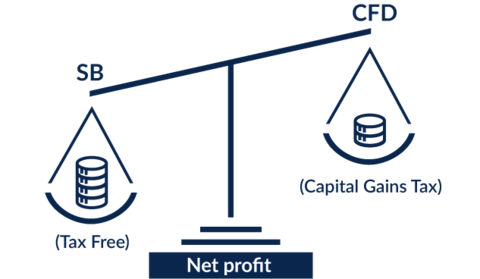

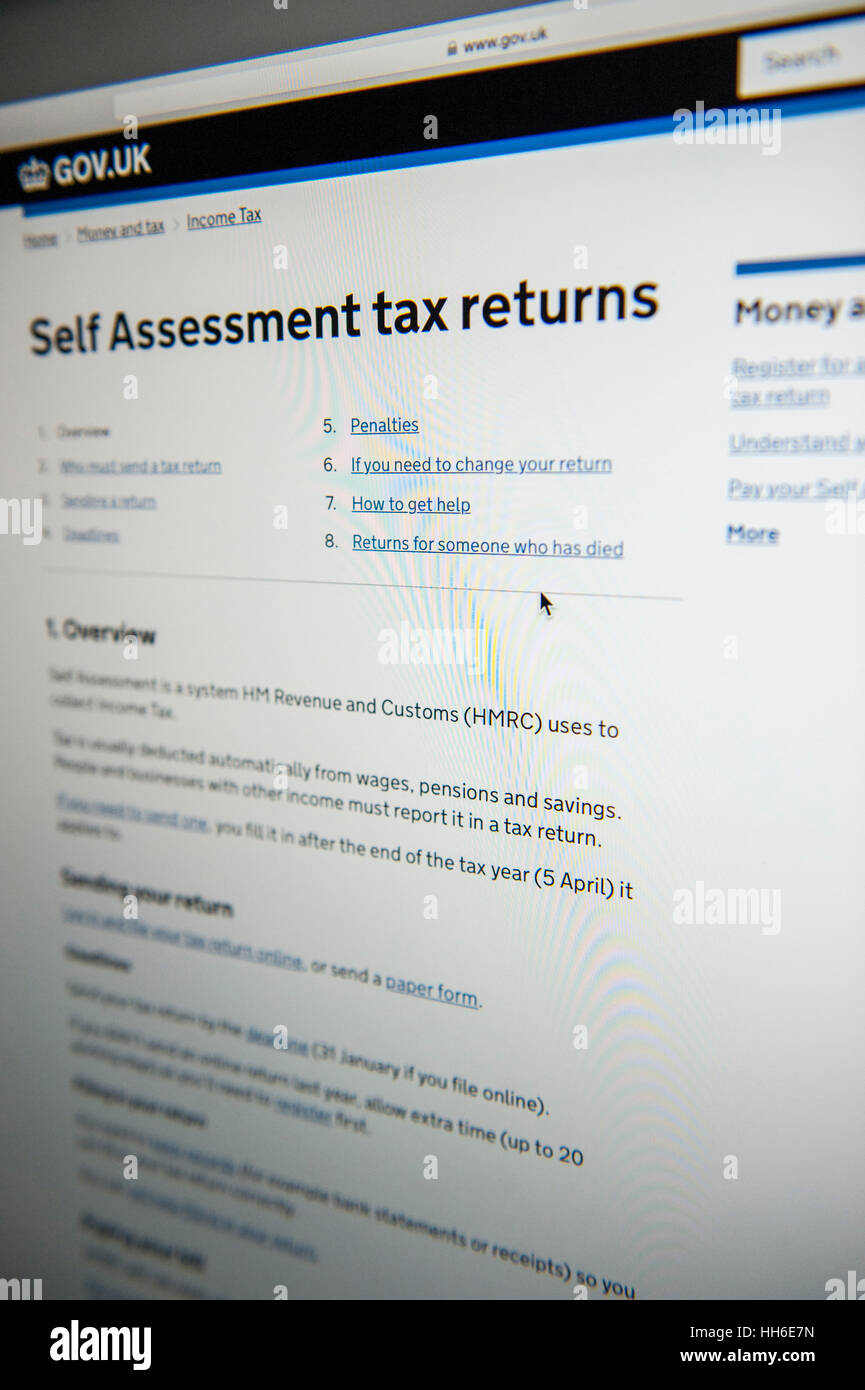

Tax reporting means deciphering the multitude of murky rules and obligations. Shares using a stock transfer form you ll pay stamp duty if the transaction is over 1 000 you ll have to pay tax at 1 5 if you transfer shares into some depositary receipt schemes or. Whether you are day trading cfds bitcoin stocks futures or forex there is a distinct lack of clarity as to how taxes on losses and profits should be applied. At the time of this writing spread betting profits are generally not taxable in the uk.

Day trading taxes how to file. However you need not worry about calculating stamp duty as it is dealt with by your broker when you enter a trade. London stock exchange is one of the world s oldest stock exchanges and can trace its history back to the coffee houses of 17th century london. Stamp duty reserve tax sdrt is automatically collected where due on the purchase of shares electronically settled in crest.

However there may be exceptions to these rules as outlined below. For many decades london stock exchange provided a trading floor where members could buy and sell shares. Alternatively stamp duty is due on non electronic settlements where the transaction is over 1000. Uk trading taxes are a minefield.

Shares and investments you may need to pay tax on include. Check out our list of uk forex brokers many of whom offer forex commodity and stock trading as spread betting. Shares in a uk company. Day trading taxes are anything but straightforward and it s the last thing you want to deal with after a roller coaster year that s hopefully ending in the black.

However with day trading promising an enticing lifestyle and significant profit potential you shouldn t let the uk s obscure tax rules deter you. Sdrt stamp duty apply primarily to transactions when you buy.