Vanguard Vs Etrade Vs Fidelity

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

Does e trade or fidelity offer a wider range of.

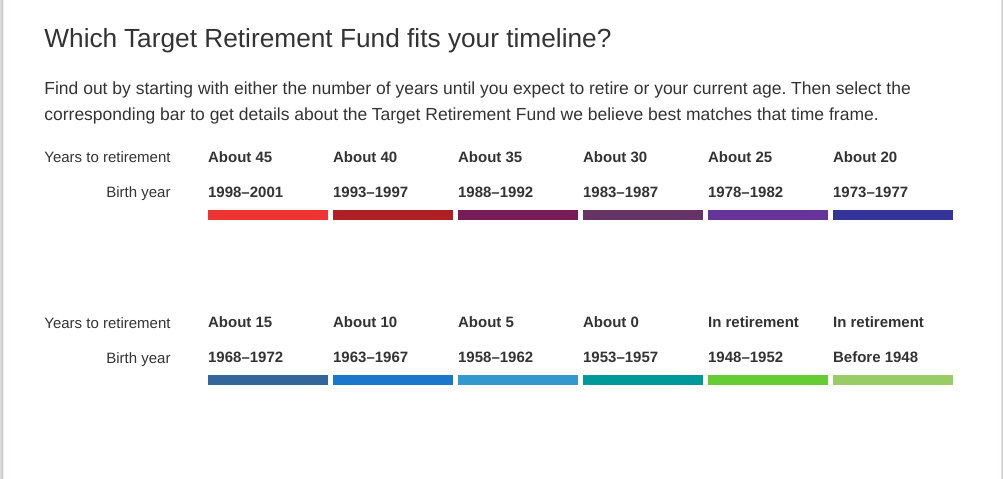

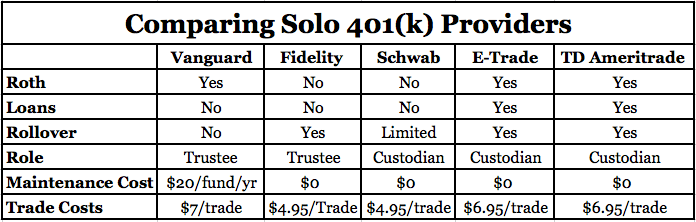

Vanguard vs etrade vs fidelity. For options trading both e trade and fidelity charge the same base fee of 0. E trade and vanguard also offer managed investment options but allow you to invest in individual stocks bonds funds options and other investments too. Td ameritrade vs fidelity vs vanguard vs etrade. Commissions fees and account minimums.

Let s make a detailed analysis of these brokers and try to determine which firm delivers the best value. Brokerage ira account fees commissions ratings and rankings. Option contracts run 0 65 a piece at both brokerages. Overview vanguard e trade fidelity td ameritrade and ally invest collectively have the lion s share of investment dollars in america.

Wealthfront charges an annual advisory fee. It charges 0 69 on average for actively managed funds which is in line with the industry. E trade is an online broker with one of the best user interfaces. Fidelity has a 0 65 per contract option fee.

For passively managed mutual funds schwab charges an average of 0 04. It s 1 at vanguard. Read our comparison chart below. What about e trade vs fidelity pricing.

Fidelity will set you back more for broker assisted stock trades 32 95 versus vanguard s sliding fee of 0 to 25 depending on. E trade and fidelity both cost 0 per trade. For a complete commissions summary see our best discount brokers guide. How does it compare to vanguard.

There is a 500 minimum deposit no maintenance fee and no inactivity fee. Td ameritrade vs charles schwab vs fidelity vs vanguard vs etrade vs ally invest 2020 discount stock broker comparison.

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)

:max_bytes(150000):strip_icc()/etrade_productcard-5c61eddac9e77c000159c8fc.png)