What Is Invoice Finance Uk

Through invoice factoring a company sells its accounts.

What is invoice finance uk. The term invoice finance is an umbrella one covering three specialisms. 1 invoice finance in a nutshell. It s a simple way to release the cash that s tied up in unpaid invoices. Why would i use invoice finance at all.

Invoice finance lets you use your sales ledger as an asset which you can borrow against. Invoice financing is a form of short term borrowing that is extended by a lender to its business customers based on unpaid invoices. This type of finance uses invoices as a way for businesses to unlock cash tied up invoices and therefore speeding up cash flow. The standards framework sets and enforces the standards that clients of uk finance s ifabl members can expect when using them.

Below we ll explore the different types of invoice finance available the costs involved and explain how you can pick a suitable provider for your business. The basic invoice factoring and discounting charges are as follows. Invoice finance is a collective term for the various types of invoice based lending such as invoice discounting selective invoice discounting invoice factoring and spot factoring. Factoring factoring allows businesses to generate money against unpaid invoices.

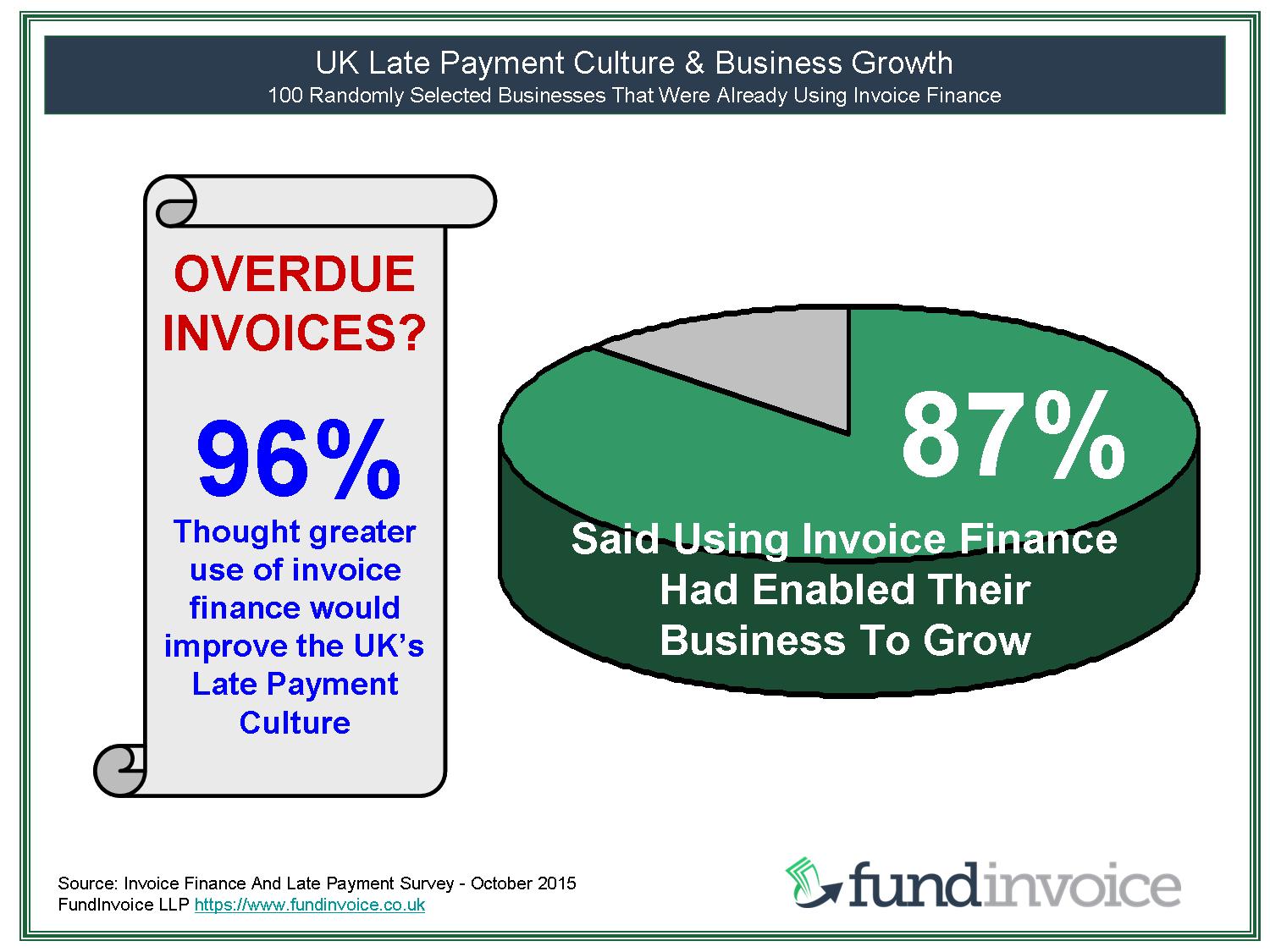

In laymans terms invoice finance is when a finance company advances a loan to you against sales invoices. This form of finance whilst expensive is ideal for companies with a high cost of sales such as a recruitment company with temporary staff and companies with long payment terms. Invoice finance is growing in popularity among uk smes particularly those with long cash collection cycles like manufacturing retail and transport there are two main types of invoice finance. Invoice finance involves selling your unpaid invoices to a third party which advances you some of the cash tied up in those invoices for a small fee.

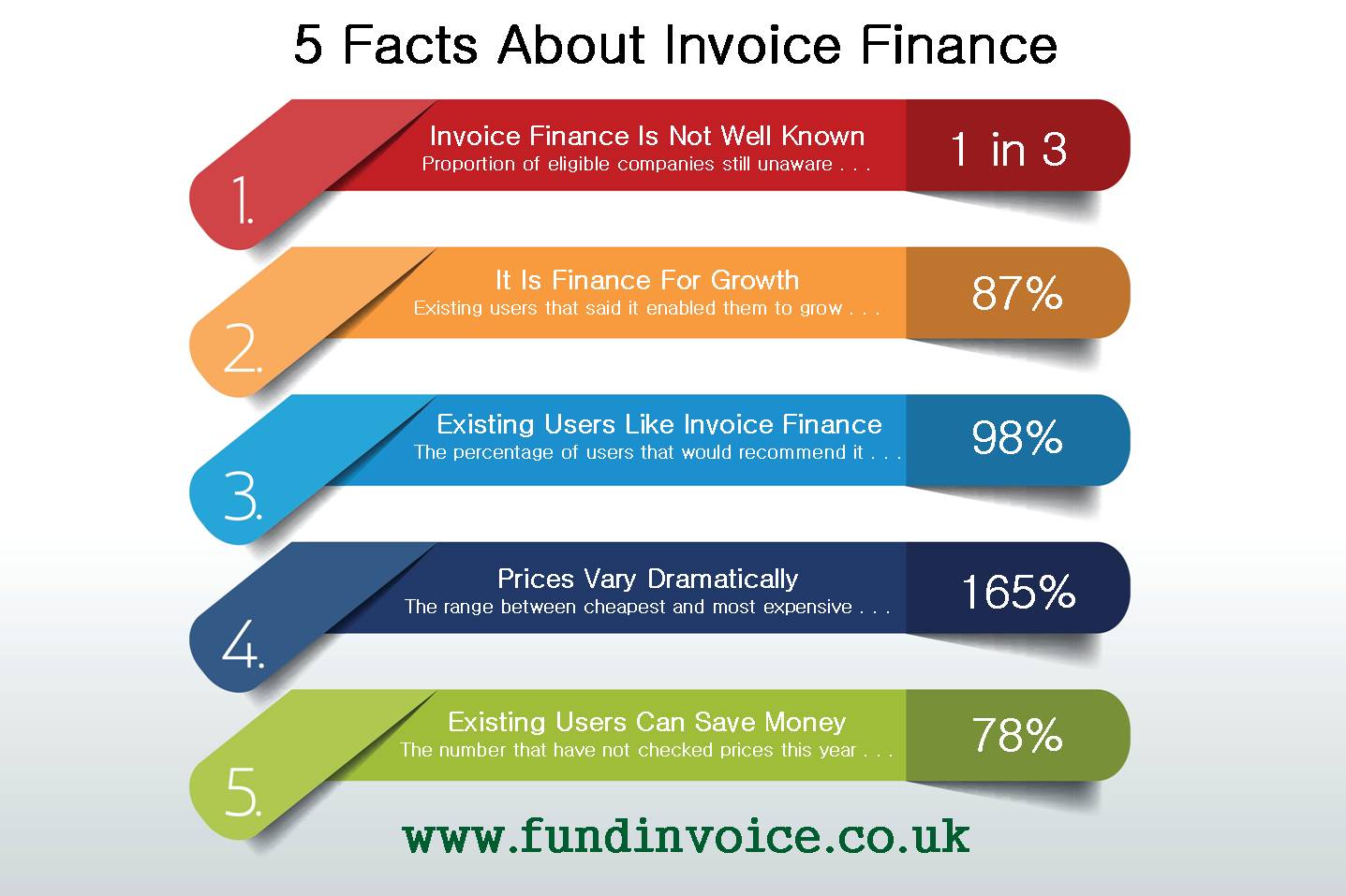

Invoice finance and asset based lending are types of finance used by over 40 000 businesses of all sizes in the uk. What is invoice finance. Invoice finance is an extremely popular alternative financial product as it is taken out against the value of a company s unpaid invoices. Instead of waiting weeks or even months to be paid the cash can be in your account within 24 hours.

Since invoice finance is currently unregulated in the uk you need to be careful to understand all of the costs fees and charges levied by the providers and especially to avoid hidden fees.