Why Is Auto Insurance So Expensive In Michigan

Approximately 1 in 5 michigan drivers do not have any car insurance.

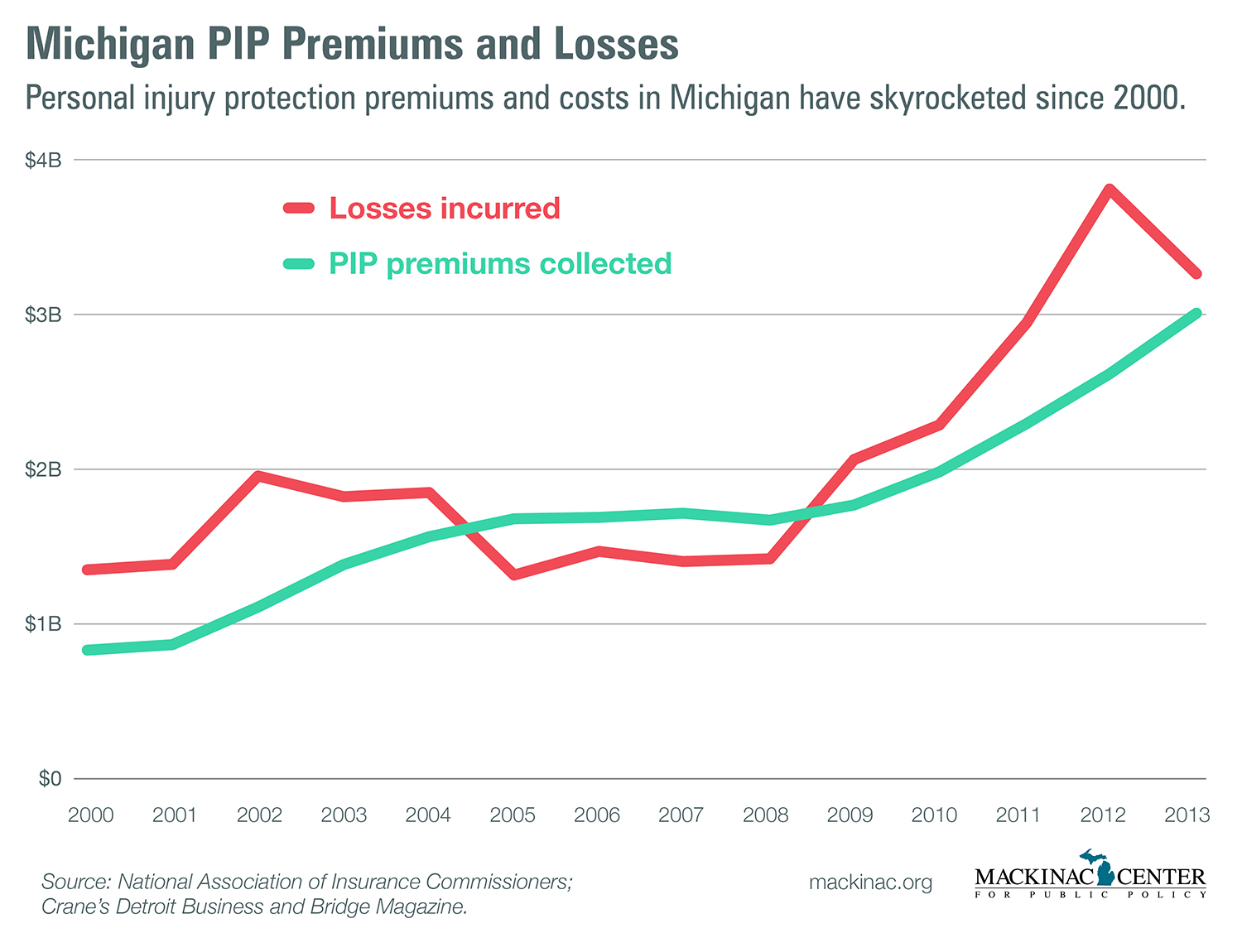

Why is auto insurance so expensive in michigan. People always ask why the cost of insuring an automobile is so expensive in michigan. Michigan lawyers know a large measure of the blame belongs to the state s no fault automobile insurance companies. Why car insurance is so expensive in michigan and what s being done to fix it. Every policy includes unlimited medical coverage also known as personal injury protection or pip for auto accident victims.

You can read some of the great facebook comments here. In turn the average auto insurance rates are projected to drop by 16 5. Why is auto insurance so expensive. Auto theft in detroit largely explains why insurance is so expensive there.

Many people are just frustrated and want to know why their car insurance is so high and they want action taken to stop it now. Today i wanted to share a particularly insightful comment i received from one of our readers nick weatherhead who is an insurance agent. For a better idea of why auto insurance rates are so high in michigan listen to a michigan lawyer explain the insurance situation in the. However there are a few other factors that you may have not known about that contribute to the state s high insurance premium.

Michigan auto insurance has a unique and very expensive feature. The top 3 reasons why car insurance is so expensive in michigan. This seems like an exorbitant amount of money to pay for insurance but really those costs are born out of the practical setup of michigan s no fault insurance scheme. All together these reforms should make a significant difference in the costs of michigan auto insurance.

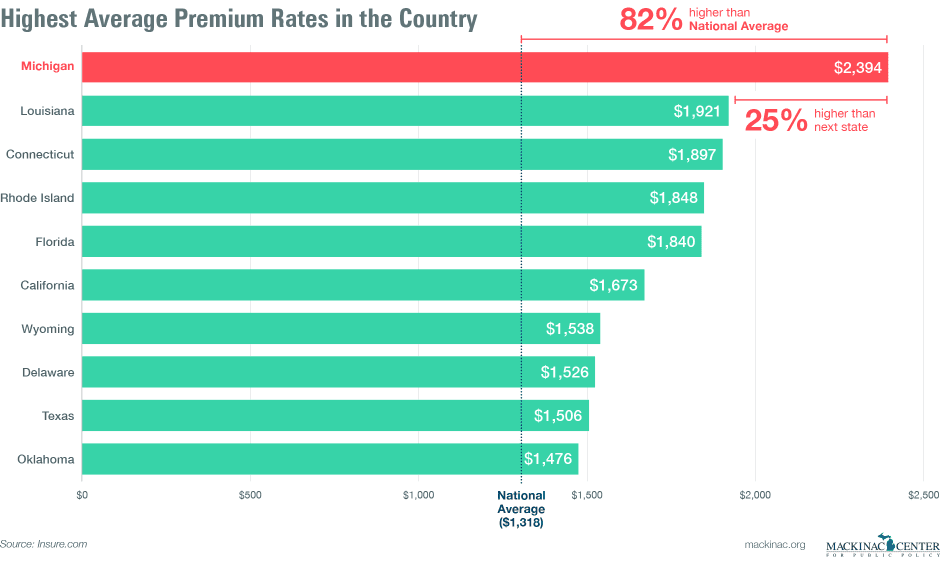

Get a lower rate on your michigan car insurance. So why is michigan insurance so high. Michigan s average annual premium for 2018 was 2 394 which is 1 076 higher than the national average. These car insurance companies blame the cost of insurance in cities like detroit which they say are more expensive to insure.

This means the pool of normal law abiding drivers are paying higher insurance rates to cover the pool of those driving without insurance.