Accounts Receivable Factoring With Recourse

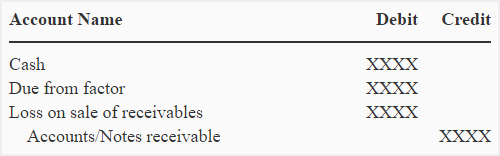

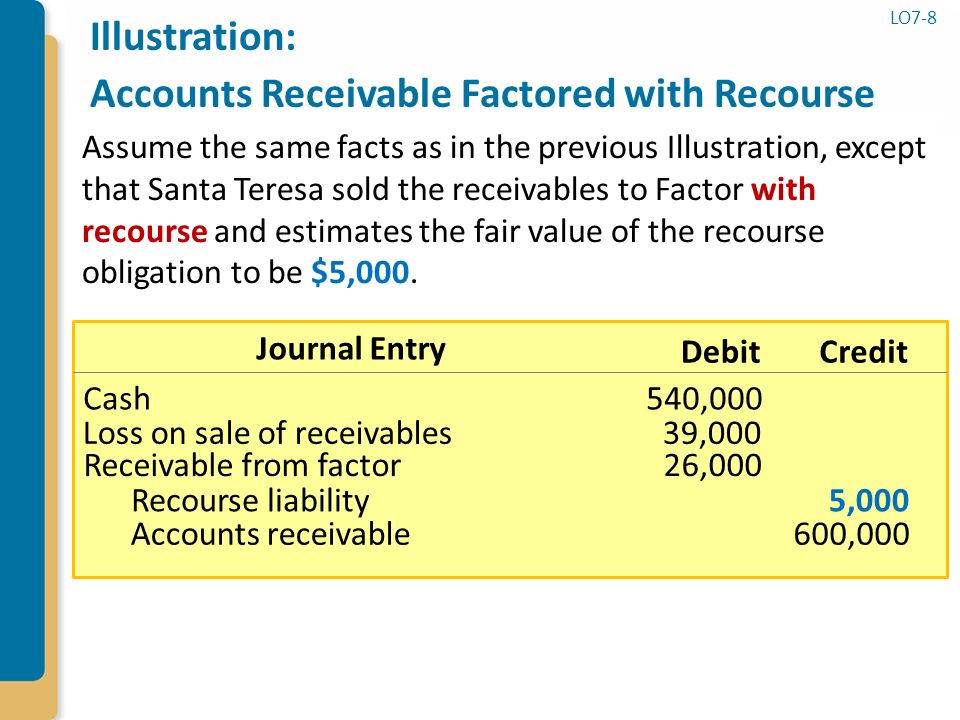

With recourse factoring means that the business has to refund the factor if the accounts receivable cannot be collected from the customer and the business bears the loss.

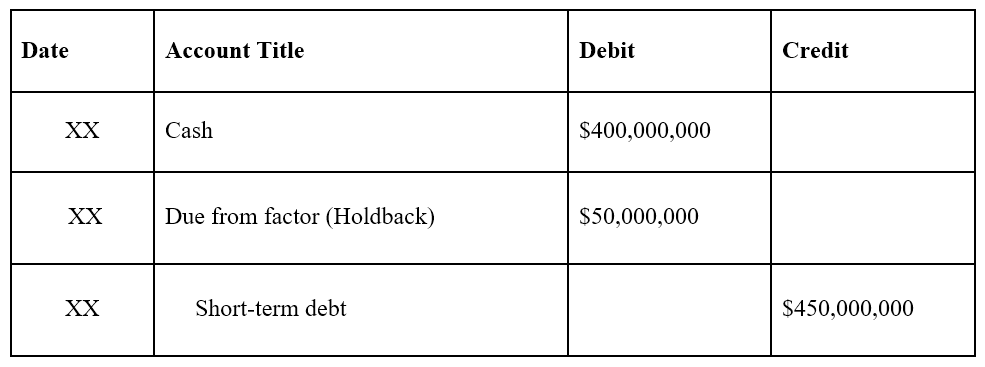

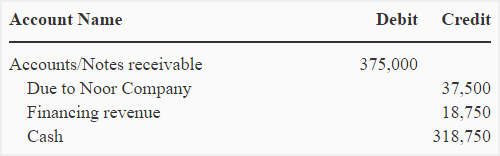

Accounts receivable factoring with recourse. Types of accounts receivable factoring. Factor offered an 80 cash advance and a 3 fee provided that it would pay any excess of the retained amount over uncollected accounts receivable on november 15 20x8. 1 recourse factoring. If subsequently the accounts are not collected from the customers under a with recourse factoring arrangement the business buys the accounts back from the factoring company.

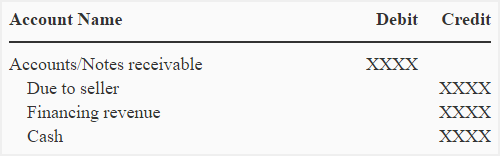

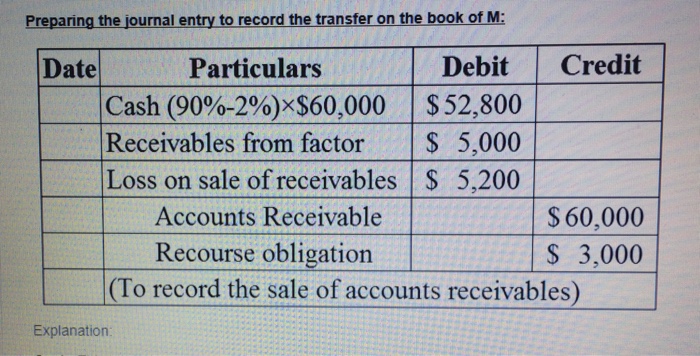

There are usually stipulations associated with non recourse factoring and the situations in which you are not responsible for customer non payment are very specific. As without recourse factoring passes the liability for the uncollectible accounts on to the factor the fees tend to be higher than those paid on with recourse factoring. Non recourse does not necessarily protect your company from all risk though. Pass journal entries to record the above transancts for impatient inc.

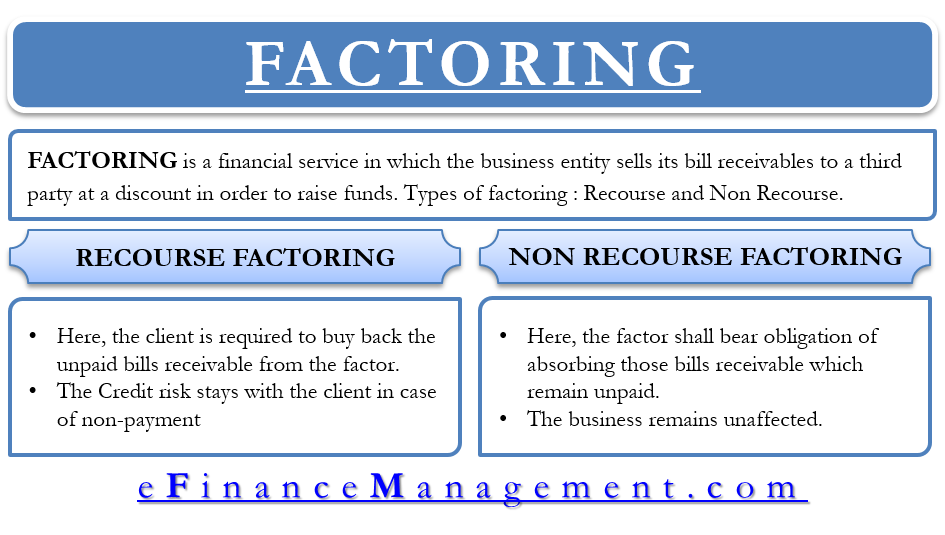

In the above example the factoring company owed the business the retention balance of 5 105 the with recourse liability of 1 000 is deducted from this and the balance of 4 105 paid over. As the recovery is guaranteed by the seller a recourse liability is determined and recorded by him. Non recourse factoring means the factoring company assumes most of the risk of non payment by your customers. Accounts receivable factoring can be without recourse or with recourse.

Let s discuss the types. Under this invoice factoring arrangement only early payment of invoices is provided by the accounts receivables factoring companies in return for factor fees to the business. Example 2 accounting of factoring with recourse. Recourse factoring and non recourse factoring.

With factoring accounts receivables without recourse the factoring company assumes the credit risk on invoices when there s non payment because of the debtor s insolvency effectively insulating the client from this. In transfer with recourse the factor can demand money back from the company that transferred receivables if it cannot collect from customers. In a factoring with recourse transaction the seller guarantees the collection of accounts receivable i e if a receivable fails to pay to the factor the seller will pay. Both under factoring with recourse and factoring without recourse.

Here is a comparison between the two. The non recourse factoring has increased fees that reflect the transfer of the risk to the factor. Had already provided allowance for doubtful debts in the factored accounts receivable and a bad debts expense was recognized in the income statement of year ended december 31 20x4.