Are Insurance Claims Taxable

The situation may be different if you profit from the insurance claim.

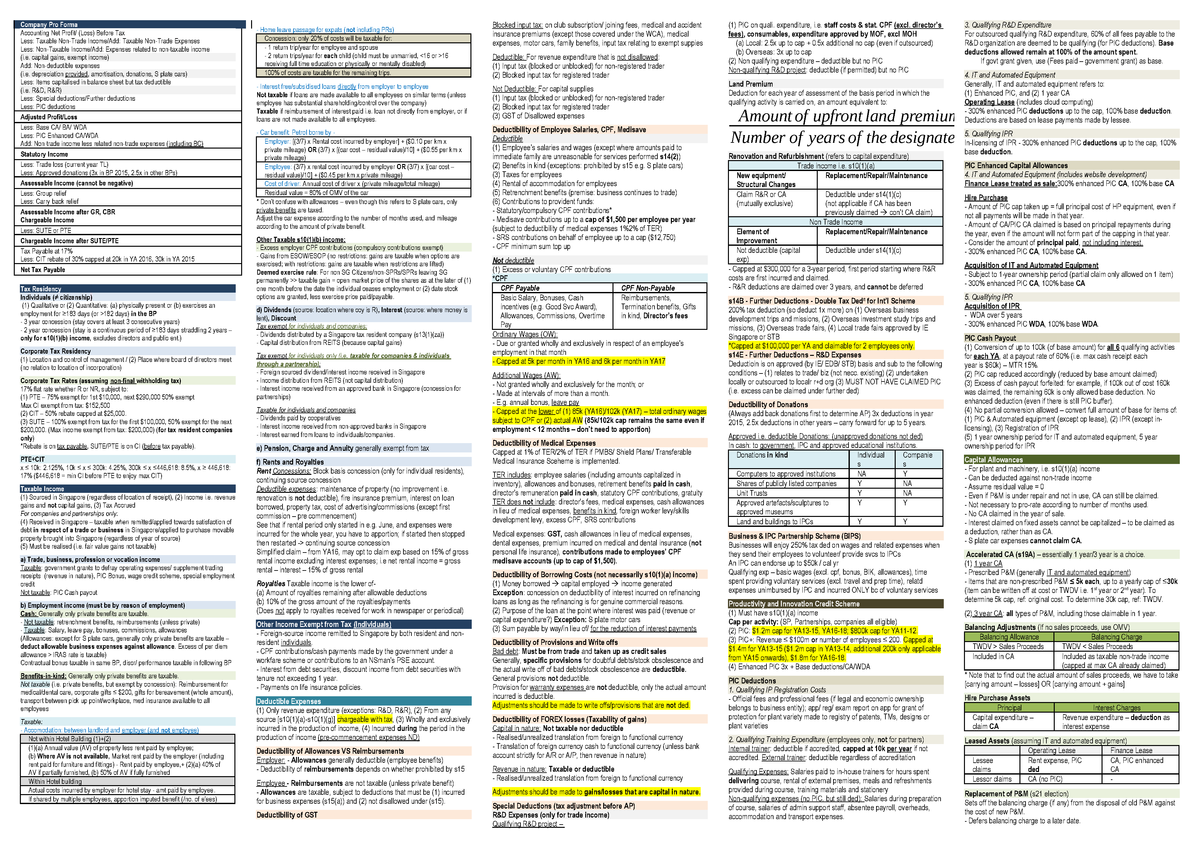

Are insurance claims taxable. Claimants both individuals and businesses may wonder how their insurance settlements will impact their tax liabilities. If you do have to pay taxes on an insurance claim you ll receive a 1099 form to help you file. The big shift to practice efficiency. Are business insurance claims tax deductible.

Instead you have received an adjustment to the cost basis you have in. You may want to consult a tax professional to determine the implications of your particular settlement but most property insurance settlements are not taxable income. The employee is taxable on the premium as he receives benefits in the form of an insurance protection. Employer pays premium on life or personal accident of employees.

Administrative concession effective ya 2013. The question is is the insurance claim taxable income or does it need to be deducted from profits in the computation. Car accident insurance settlements are generally not taxable although there are certain exceptions according to the internal revenue service irs. Why dumping spreadsheets can supercharge business.

If there s nothing to indicate what the payment is for it s likely that it s meant to cover medical expenses and pain and suffering if this is the case you don t have to include the amount in your income. Generally the proceeds of casualty insurance are not considered taxable income so you don t have to worry about the tax bill. Employees are the beneficiaries or have the contractual right 1 to the insurance payouts from a group insurance policy. If you receive insurance money for damage to your car the irs does not consider that taxable income.

In the event of a claim the insurance payout is not taxable as it is a capital receipt. In addition to wanting to know if your business insurance claims are taxable you are likely asking are business insurance premiums tax deductible after all if there is a chance that your insurance claims can be taxed it only seems fair that the premiums you pay for your taxes would be deductible. If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years the full amount is non taxable. Employer pays the premium but elects not to claim tax deduction on the premium under the administrative.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)