Casualty Loss Income Statement

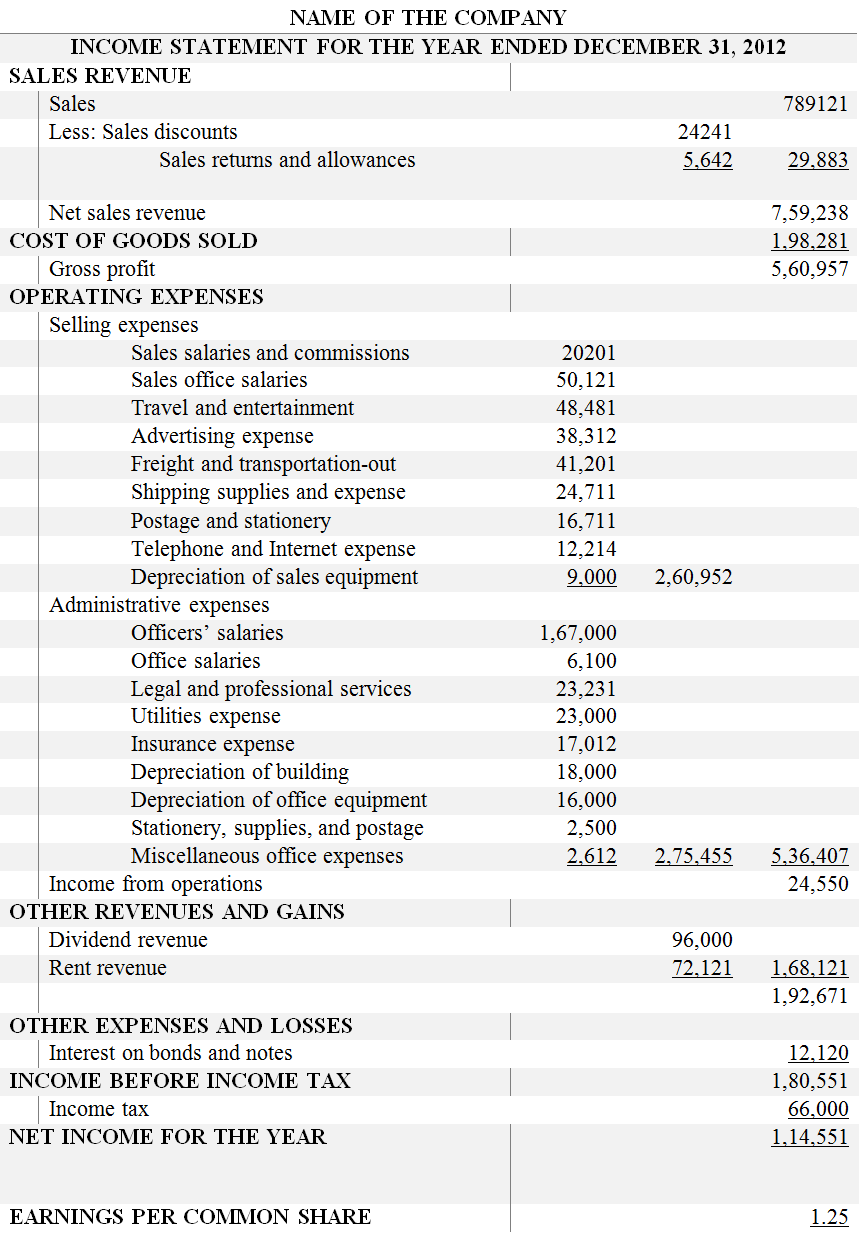

Loss from the sale or abandonment of property plant or equipment.

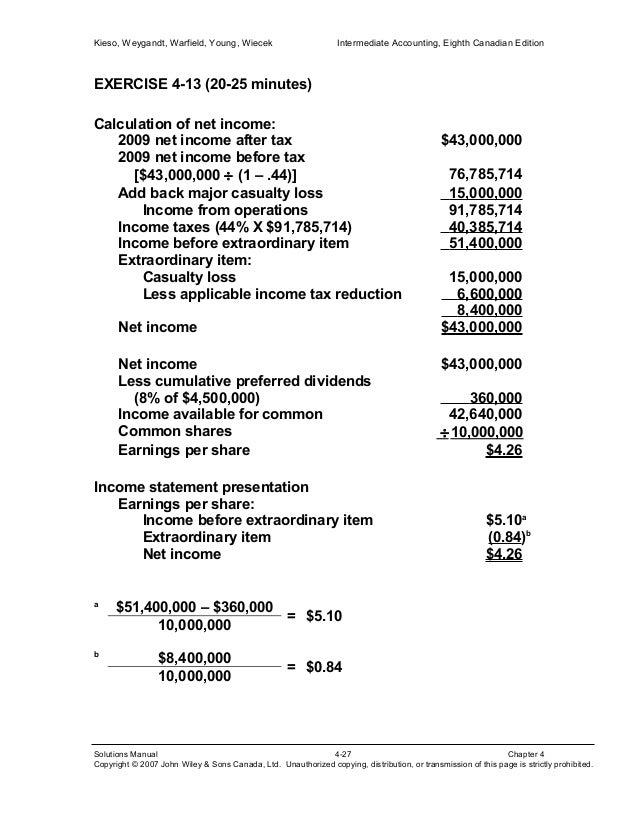

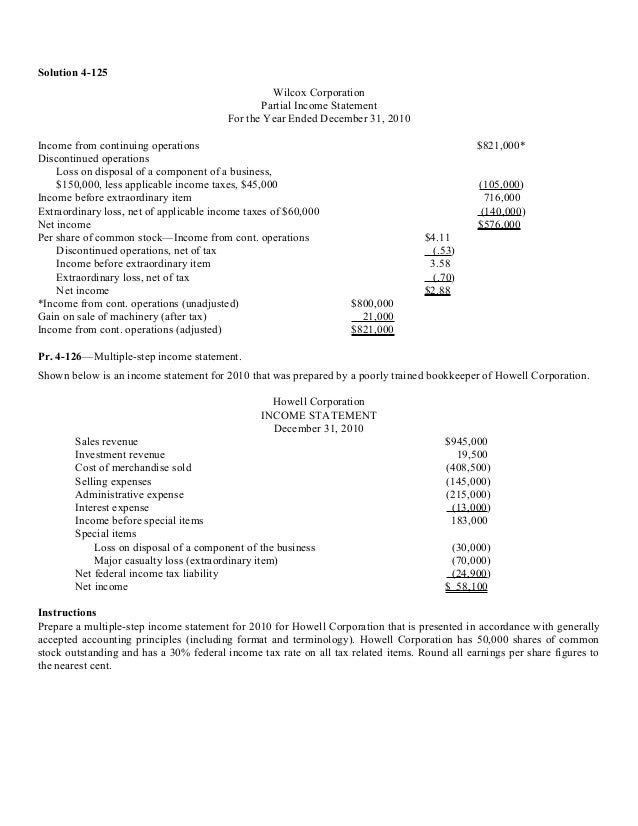

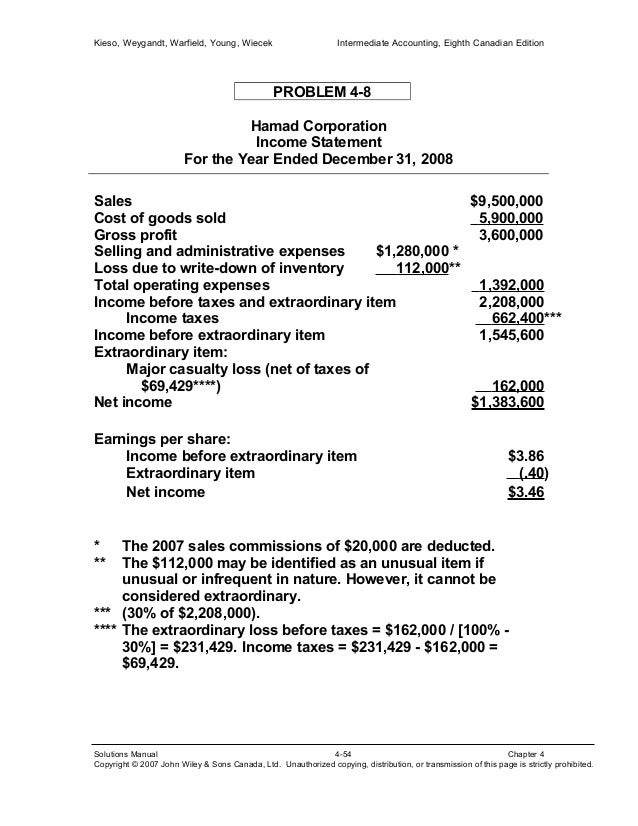

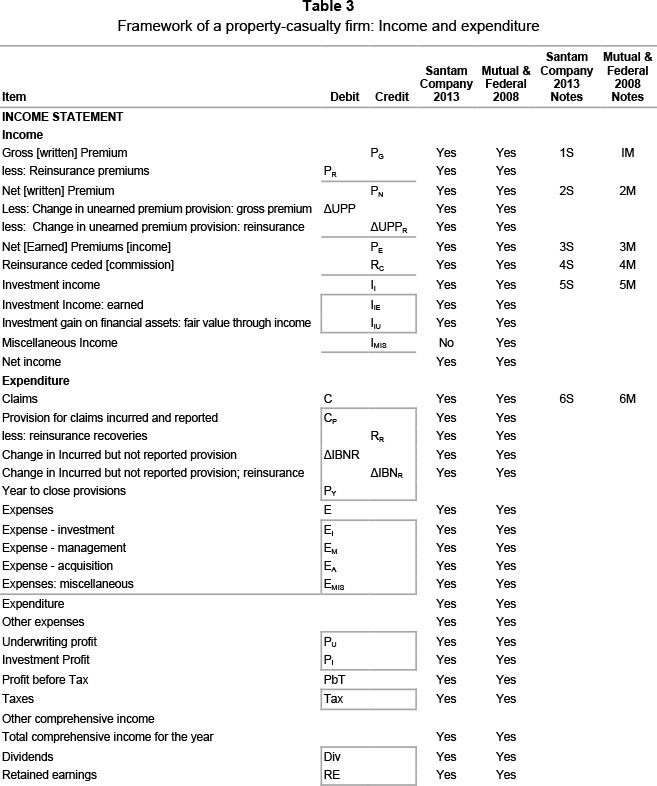

Casualty loss income statement. You usually find explanations for income or expenses from nonoperating activities in the notes to the financial statements. For example if the casualty loss is 10 000 and the company is in the 34 tax bracket the after tax loss presented in the income statement is 6600 10 000 1 34. Financial statement disclosure requirements are addressed based on the nature of the material financial item being disclosed e g asset impairments or casualty loss. They are subject to a 10 adjusted gross income agi.

Casualty and theft losses are limited to a 100 threshold per loss. For example when a casualty loss is recognized a description of the facts and circumstances leading to the loss are needed. Dictionary of business terms for. A casualty loss is calculated by subtracting any insurance or other reimbursement received or expected from the smaller of 3 the decrease in fair market value of the property as a result of the casualty.

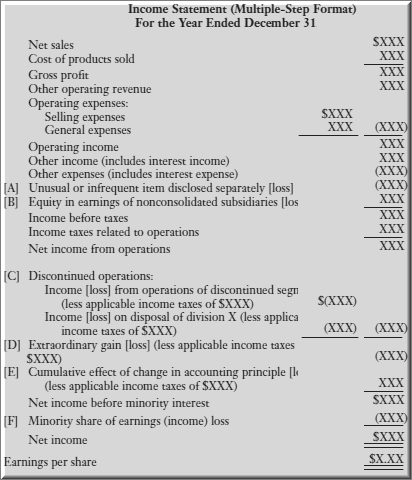

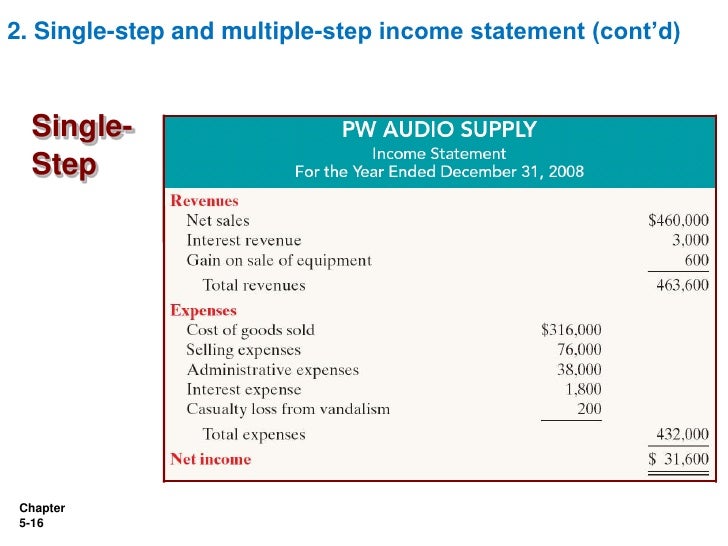

Other types of expenses include casualty losses from theft vandalism or fire. Below this line each significant nonrecurring gain or loss appears. The loss must additionally exceed 10 of your adjusted gross income agi in order for you to be able to take this deduction. If a business has no unusual gains or losses in the year its income statement ends with one bottom line usually called net income.

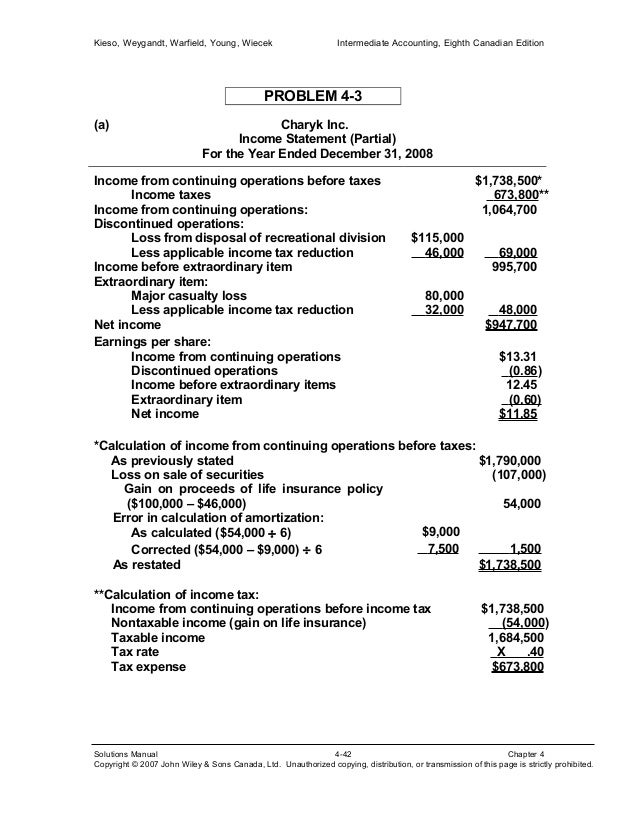

In a business casualty losses are typically shown as an extraordinary item net of tax in the income statement. And loss from strikes. 515 casualty disaster and theft losses generally you may deduct casualty and theft losses relating to your home household items and vehicles on your federal income tax return if the loss is caused by a federally declared disaster declared by the president. Casualty insurance benefits protect against property losses.

Moreover your net casualty loss from these qualified disasters doesn t need to exceed 10 of your adjusted gross income to qualify for the deduction but the 100 limit per casualty is increased to 500 see disaster area losses for more information on the special relief provided as part of the disaster tax relief and airport and airway extension act of 2017 the tax cuts and jobs act of. When an income statement includes a second layer that line becomes net income from continuing operations before unusual gains and losses. Or the adjusted basis in the property before the event.