How To Rollover Ira To Fidelity

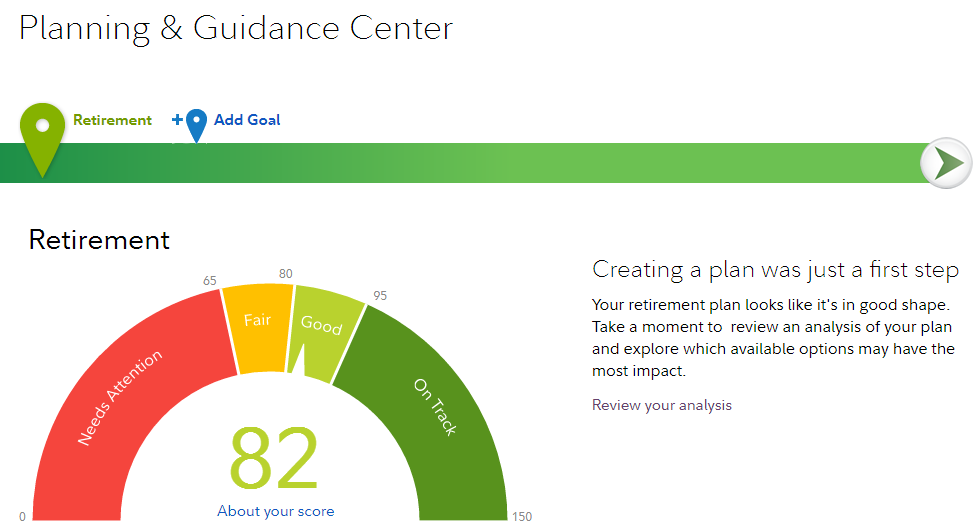

A fidelity ira is a traditional ira that is often used by those who have changed jobs or retired and have assets accumulated in their employer sponsored retirement plan such as a 401 k.

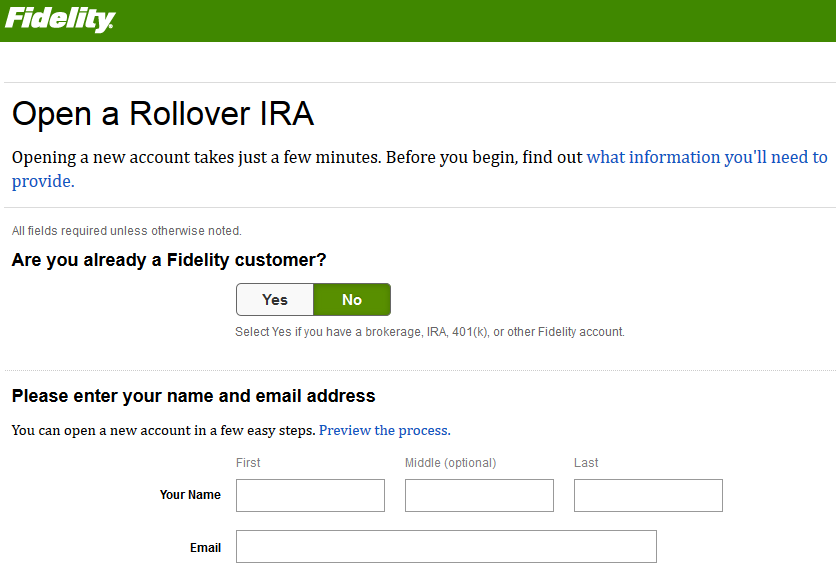

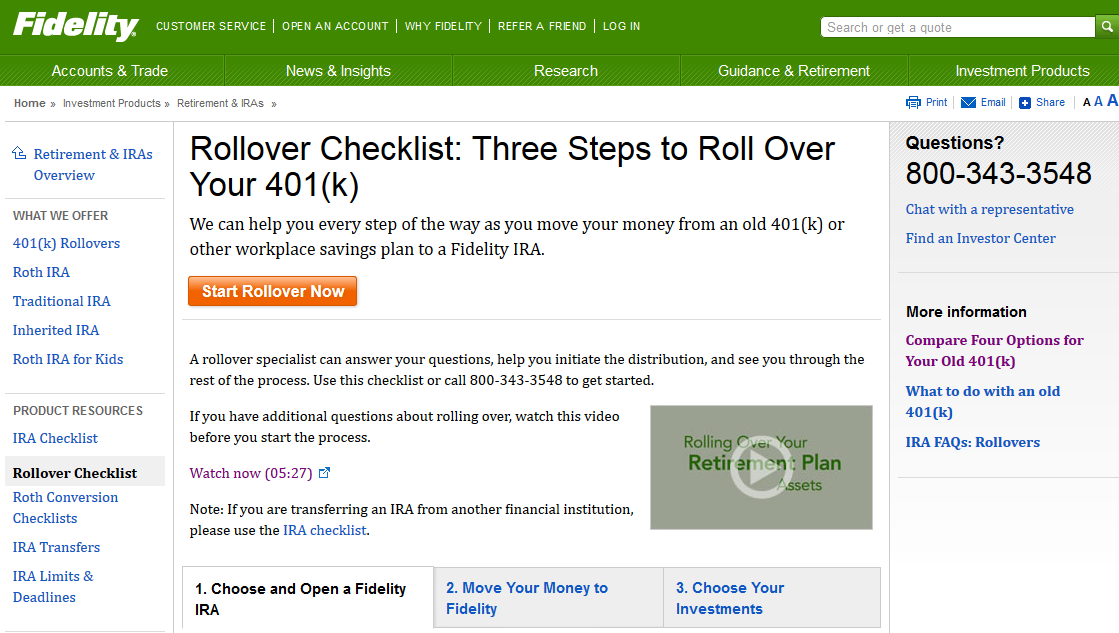

How to rollover ira to fidelity. Open the appropriate ira move your money to fidelity to do this you will need to initiate a rollover from your former employer s plan. Rollover bda and or roth ira fidelity is hereby authorized to directly roll over all of such distributions to the applicable ira s. Select yes if you have a brokerage ira 401 k or other fidelity account. Choose your investments in the rollover ira.

There s more than 7 7 billion in unclaimed retirement savings floating out there in 2015 according to the national association of unclaimed property administrators. I took a picture of the check and uploaded after business hours on a friday. Call 800 343 3548 and a rollover specialist will help you every step of the way. You can convert your employer sponsored 401k to an ira or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

Be sure to ask your former ira custodian to include your account number on the check. Fidelity rollover ira step by step in the u s. This form may be used to authorize the ira custodian or its agent to initiate a transfer of an ira directly from another custodian and to invest the transferred assets in a fa ira or to make a direct rollover. Accept this as your authority to directly roll over my eligible retirement plan distribution to my fidelity advisor traditional rollover or roth ira.

My 401k was with fidelity and my plan was to move it over to an existing ira at vanguard. What i really was impressed with was how i was able to deposit the rollover check once it was mailed to me. In fidelity s app they have a mobile check deposit feature. I also did a rollover from an old 401k to a fidelity ira a few weeks ago.

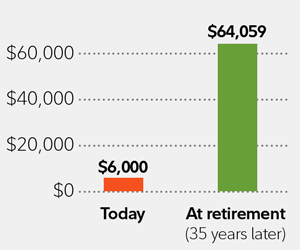

The good news is if your 401k is with fidelity the process for completing your rollover is actually simple and quite painless. If your former ira account custodian sends you a check you can deposit the money directly into your fidelity ira. Eligible distributions from such plans can be rolled over directly into a fidelity rollover ira without incurring any tax penalties and assets remain invested tax deferred. And as part of the transition i decided to rollover my 401k from my old employer to a rollover ira.