Negotiate With Irs Payment Plan

A lot of people look forward to a nice tax refund at the end of the year but some of us are unfortunate enough to owe the irs instead.

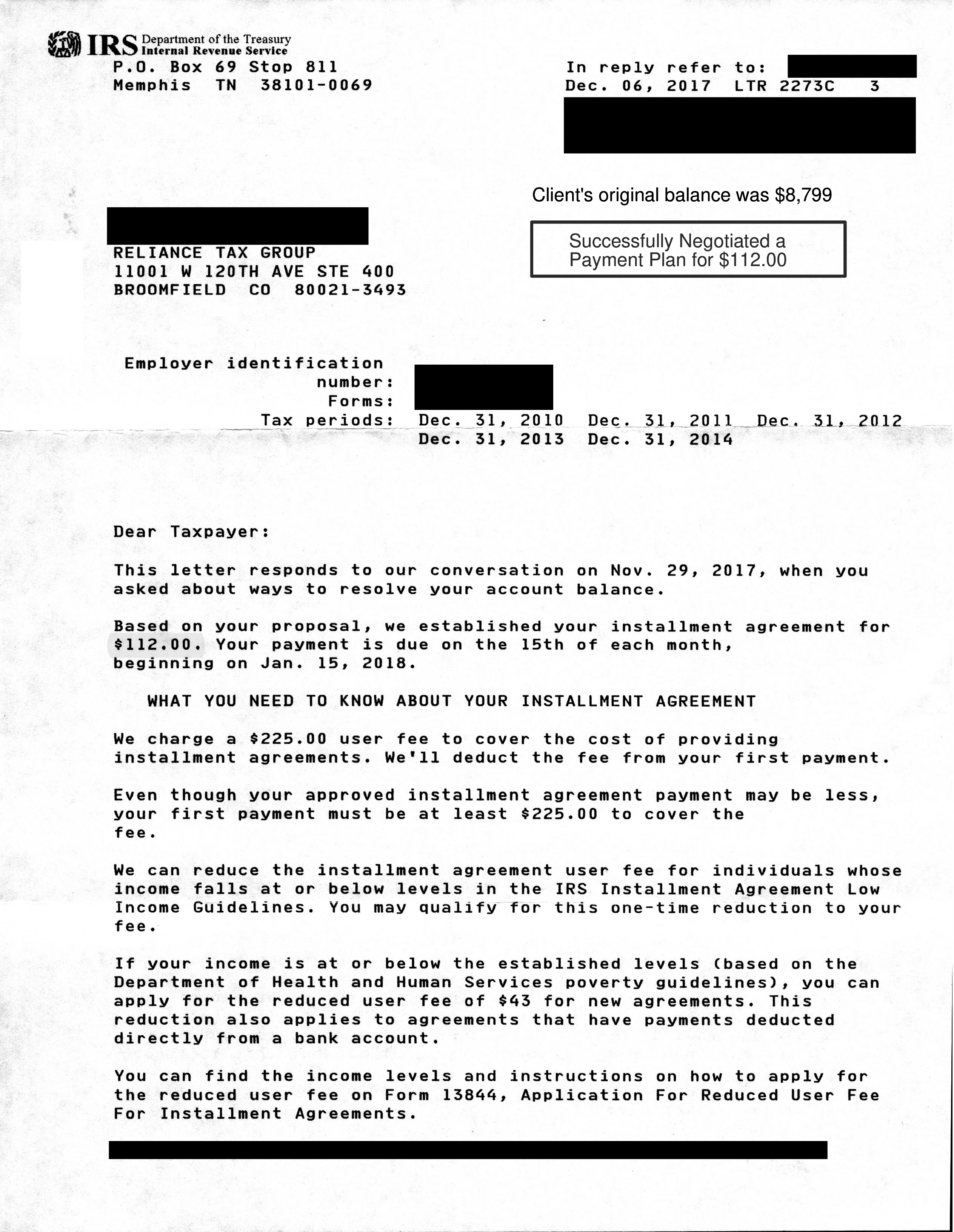

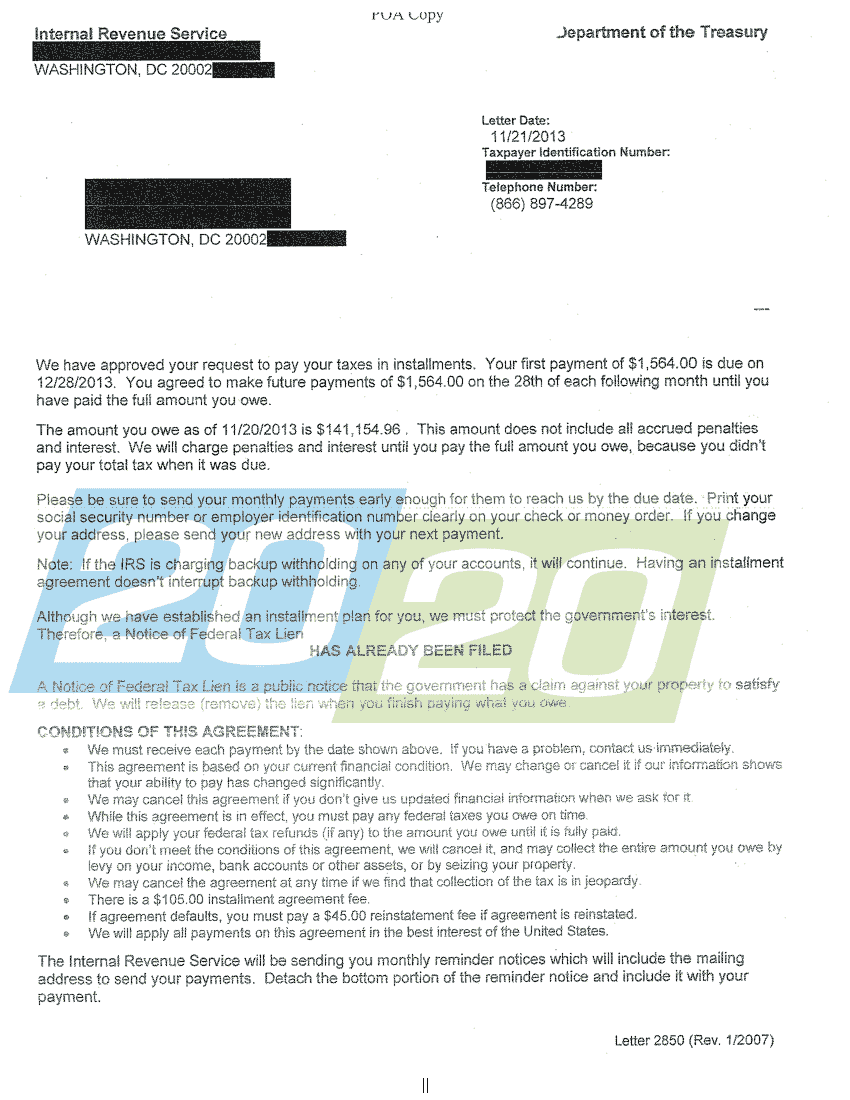

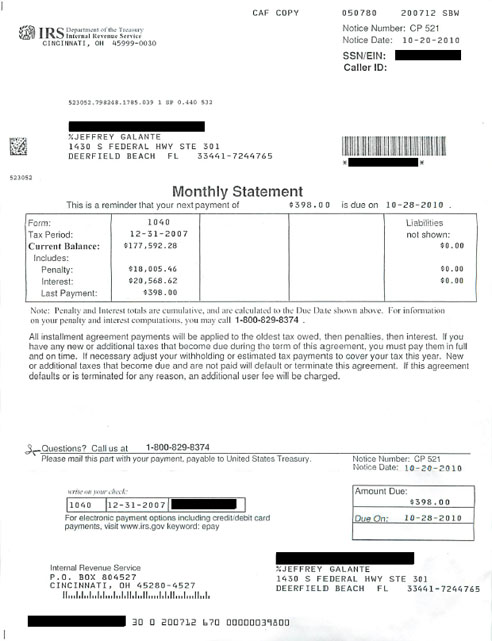

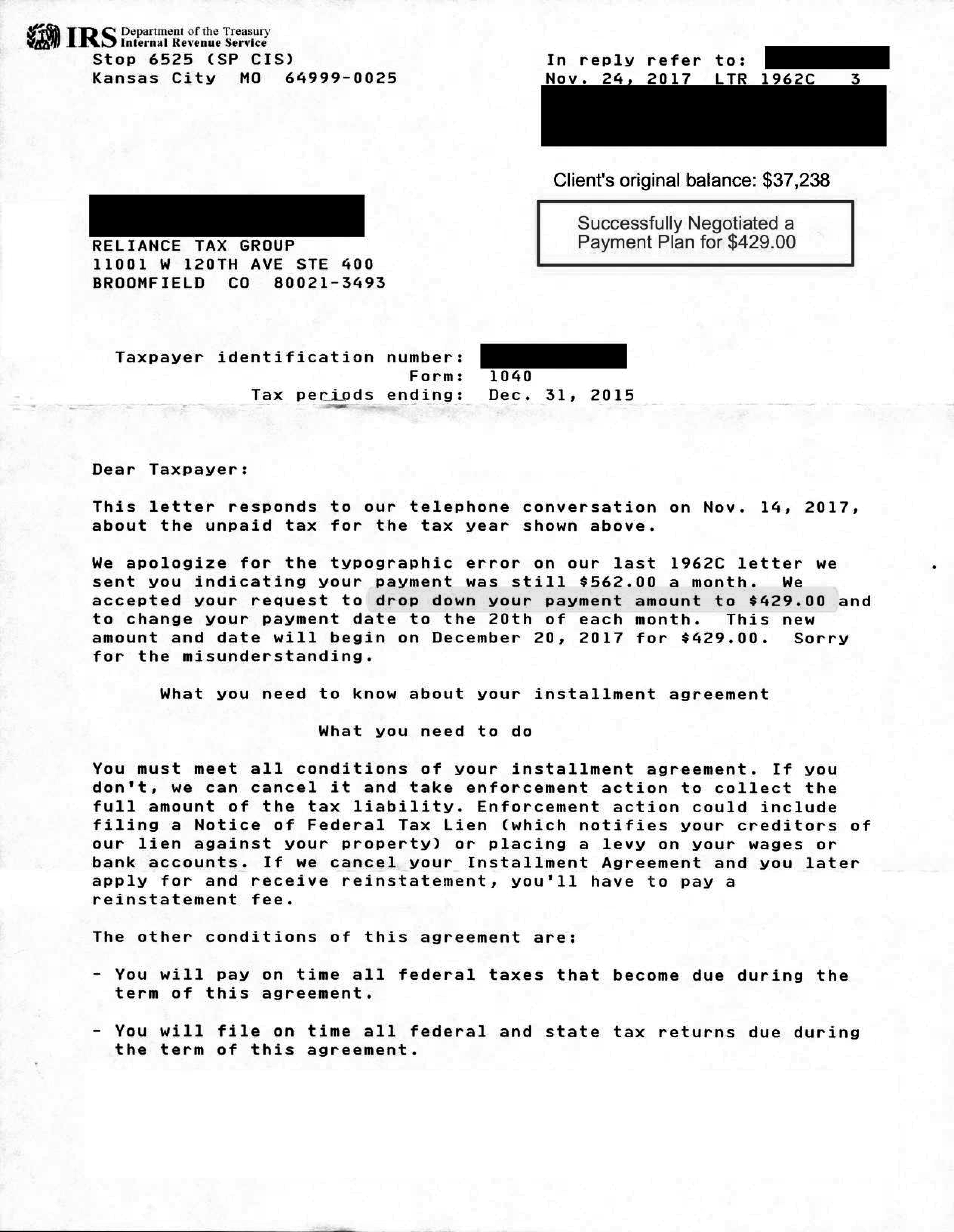

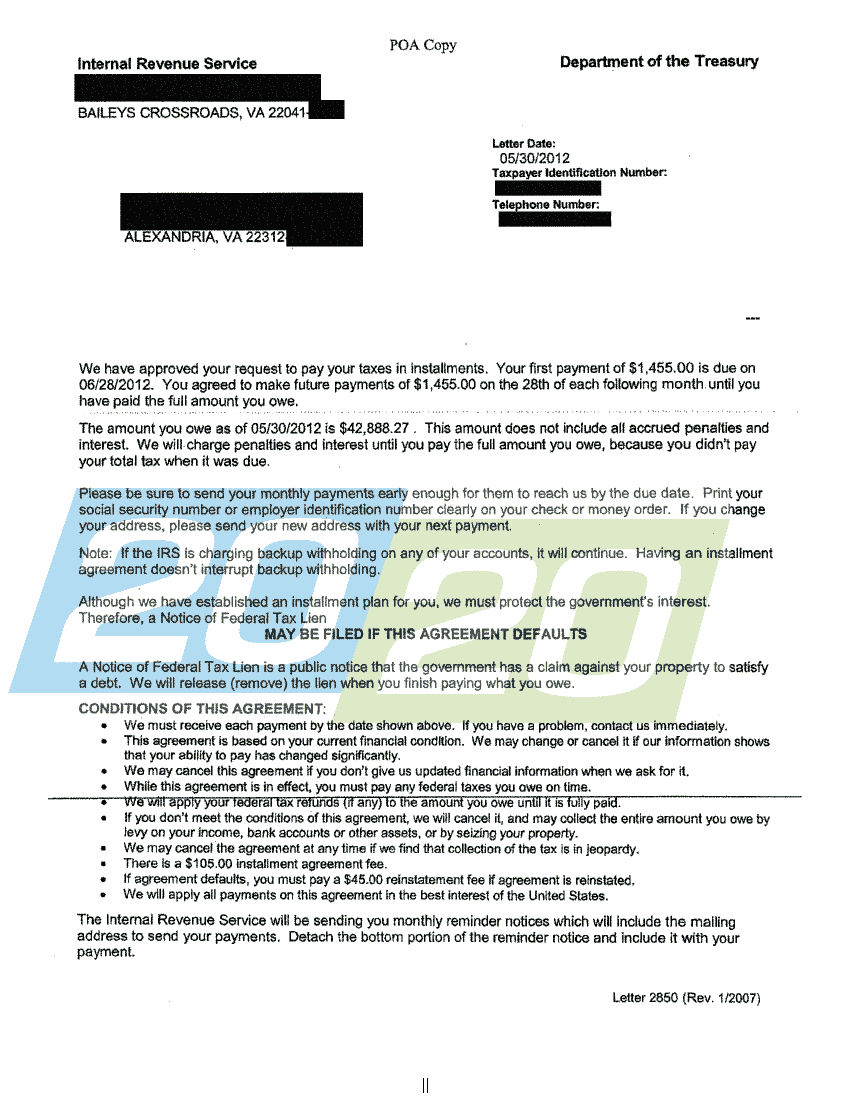

Negotiate with irs payment plan. A payment plan is an agreement with the irs to pay the taxes you owe within an extended timeframe. This can be done by negotiating an ato payment plan. This is done by filling out form 9465 installment agreement request. If accepted continue to pay monthly until it is paid in full.

Continue to pay the remaining balance in monthly installments while the irs considers your offer. While this is a major drawback from a negotiating perspective we were able to use this to our advantage. Using your income and expenses they can help figure out either a payment plan or put you into the currently uncollectible status. Negotiating payment plans with the irs.

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. It s what the irs asks you for when you re trying to negotiate a lower payment. What is an ato payment plan. Under its fresh start program the irs offers several options for repaying back taxes.

They allow the taxpayer to pay tax debts through instalments. Use the payment plan estimator to work out a suitable payment plan. You ll use this irs payment plan if you ve looked into all the options above and none of them work. With an offer in compromise you make an agreement with the irs to pay less than the full amount owed.

The best way forward is to be pro active and take control of the situation. To request a payment plan you must offer the irs a minimum of 20 of what you owe and the balance within five months or five payments. Before you call you should fill out form 433a. If you qualify for a short term payment plan you will not be liable for a user fee.

The interest free period will start from the date you enter into the new plan. That s the collection information statement. The longest repayment period it will negotiate is 24 months. An ato payment plan is a formal agreement between a taxpayer and the australian tax office.

You can ask us to change your existing payment plan to an interest free payment plan if you satisfy the eligibility criteria. Form 1127 application for extension of time of payment of tax due to undue hardship. The taxpayer has to come up with a payment plan then the irs can choose to accept it or not. Some people miscalculate their tax bracket or deductions and incorrectly assume they will owe less.

An installment payment plan an offer in compromise and a temporary delay in.

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/10167119-F-56a9382e3df78cf772a4e072.jpg)

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

/GettyImages-505872588-5bca34b346e0fb0051748309.jpg)