Working Capital Loan

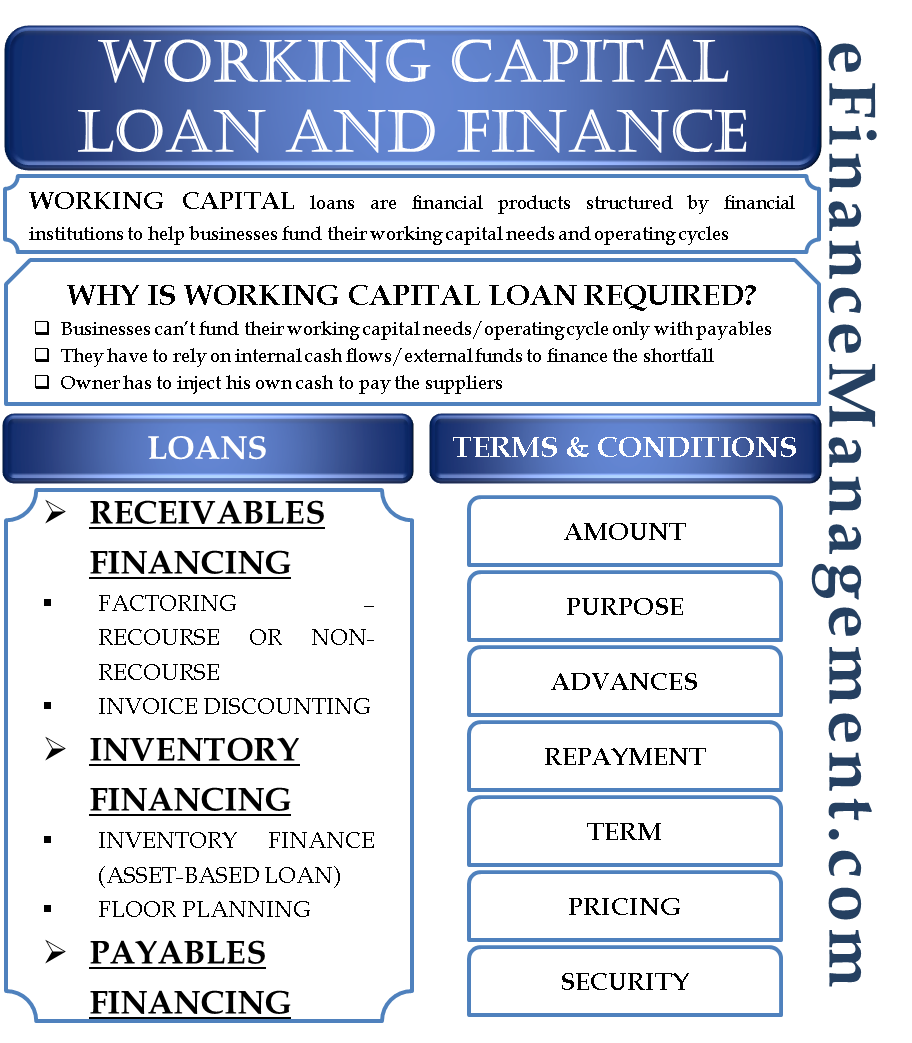

Remember working capital loans work best for short term needs as opposed to investments that may take years to produce results.

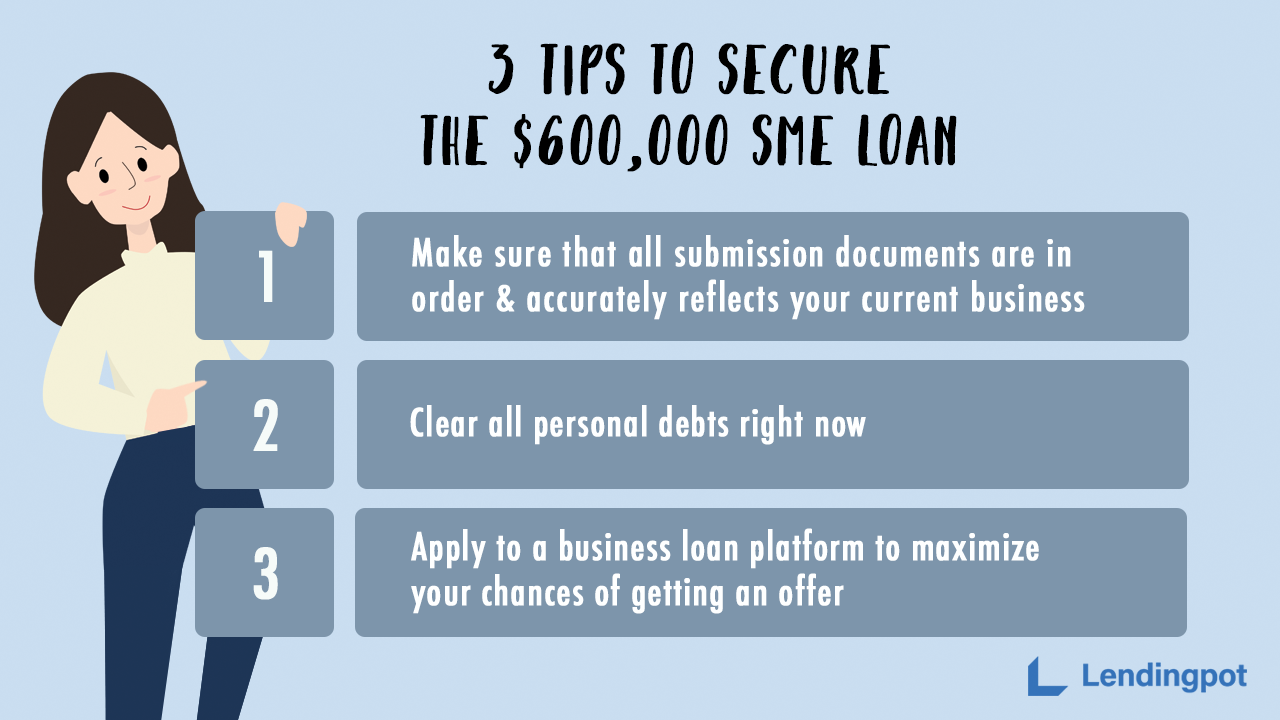

Working capital loan. A working capital loan is designed to cover short term business expenses such as payroll and inventory. Finance daily operational cashflow needs. Collateral free funding of up to s 1 000 000. The enhanced scheme in the solidarity budget 2020 helps smes access financing till march 2021.

Enhanced sme working capital loan. A working capital loan is used to finance the everyday operations of a business such as sales and marketing product development wages and other activities. Expand your operations or fund an upcoming business with the enhanced sme working capital loan. As announced at solidarity budget 2020 the enterprise financing scheme sme working capital loan efs wcl is enhanced to help smes with their working capital needs the maximum loan quantum was raised from 300 000 to 1 million.

Save time by retrieving your details via anytime anywhere. For this reason you can t use a working capital loan for expensive initiatives like developing a new product renovating your physical space adding a new division etc. Risk share was also increased to 90 from 50 and 70 for young companies for new applications initiated from 8 april 2020 until 31 march 2021. Working capital loans are not used to buy long term assets or investments.

High loan amount of up to s 1 000 000 with competitive rates. Complimentary 12 months insurance. Under enterprise singapore sme working capital loan scheme local enterprises can get access to working capital loan if they meet the following criteria. First ever business loan with loan repayment insurance.

The short term financing provided by working capital loans helps companies bridge financial gaps for example the time between the collection. Enterprise singapore will share the loan default risk in the event of enterprise insolvency with the participating financial institutions. Stretch your repayment period of up to 5 years. The sme working capital loan is a government assisted financing loan under the enterprise financing scheme efs wcl.

They are used to provide working. Finance the investment of domestic and overseas fixed assets. Working capital loans also offer lower borrowing amounts than business term loans and sba loans. Sme fixed assets loan.

Under the new enhanced sme working capital loan access up to 1 million to finance cash flow needs. S 50 vouchers with min. A working capital loan is a loan taken to finance a company s everyday operations.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-82960071-5665a84b5f9b583dc39362d4.jpg)