Reverse Mortgage Calculator Aarp

The hecm program is being cut please call now 1 516 900 3332 before it is too late to qualify.

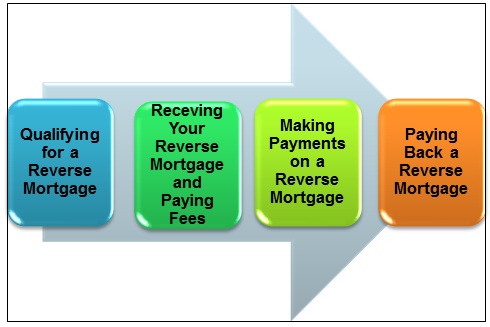

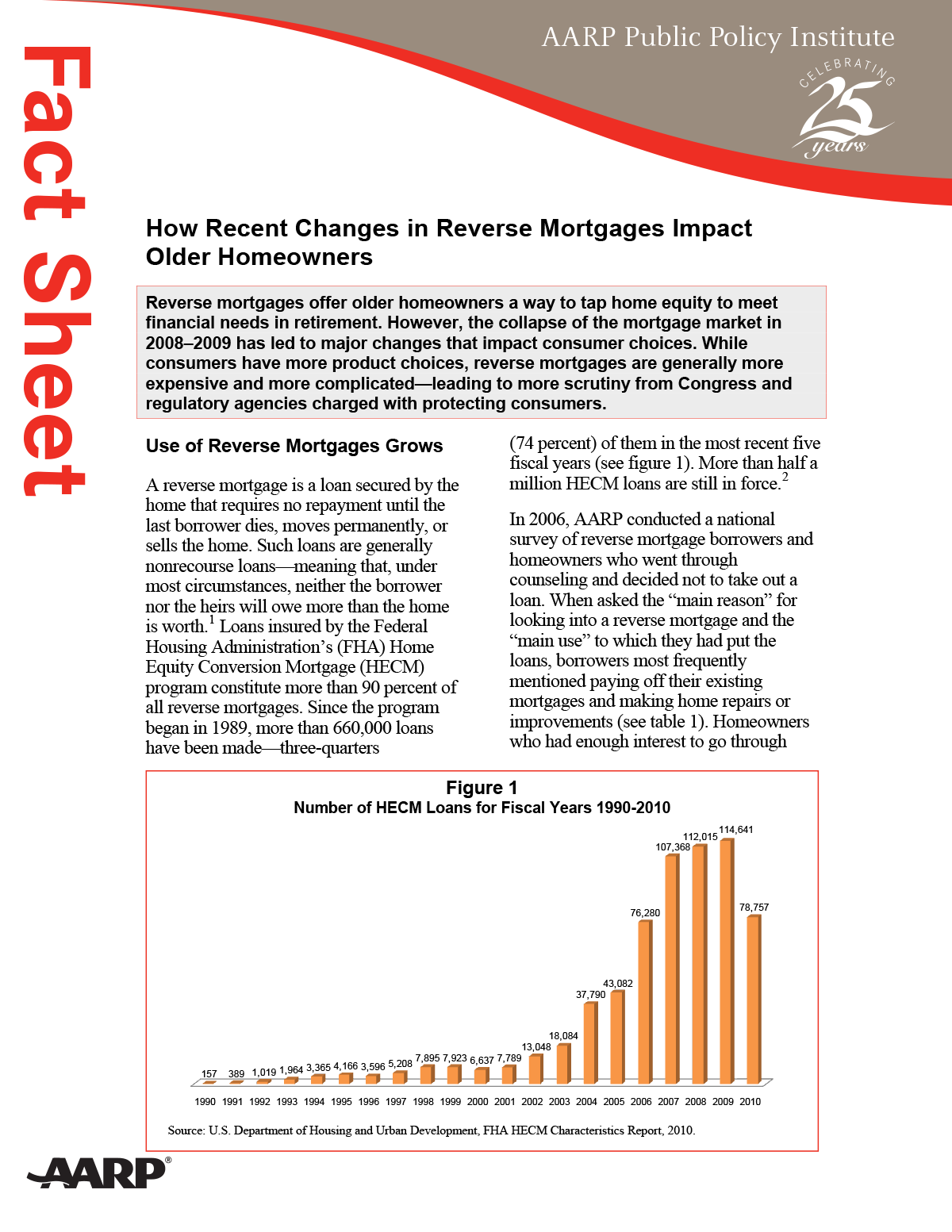

Reverse mortgage calculator aarp. Unlike a conventional mortgage your lender pays you in monthly payments through a variable line of credit or in a lump sum. A reverse mortgage is a loan based on the paid up current value or equity in your home. Upon choosing a lender and applying for a hecm the consumer will receive from the loan originator additional required cost of credit disclosures providing further explanations of the costs and terms of the reverse mortgages offered by that originator and or. Find reverse mortgage financial information tools reverse mortgage calculator and tips.

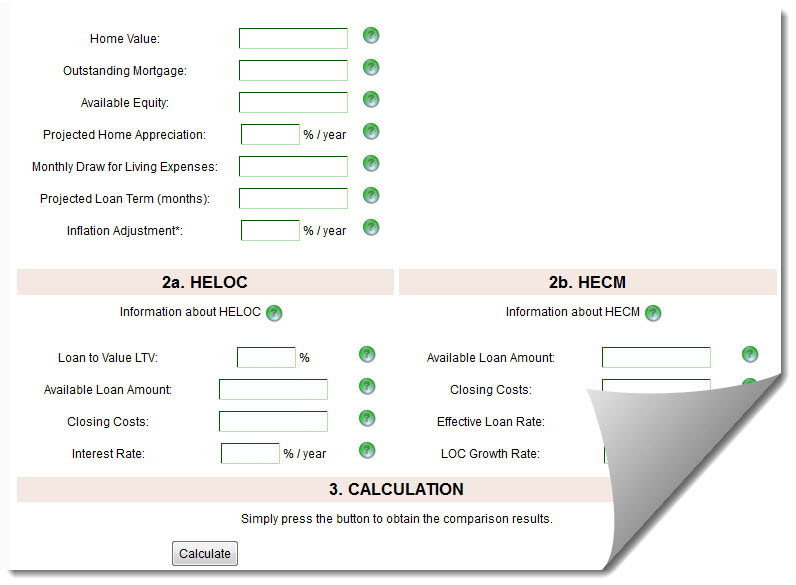

Please note that this is just an estimate and you will need to speak to a lender to find out exactly how much you are eligible to receive. You might find reverse mortgage originators that offer higher or lower margins and various credits on lender fees or closing costs. Reverse mortgage payment calculator. Younger borrowers living in high tax states will have to determine whether a set aside makes a reverse mortgage worthwhile or if they would be better off financially with other alternatives such as selling their house.

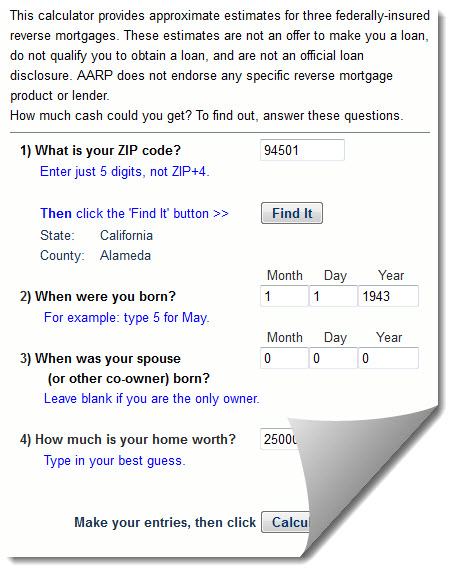

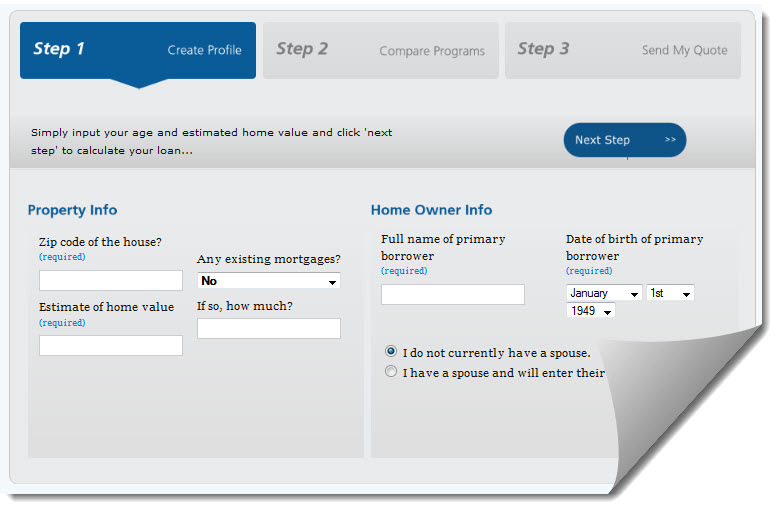

Aarp podcast on reverse mortgages your home as a piggy bank. Screenshot of https reverse mortgage calculator this calculator is an example of those hosted on reverse mortgage lenders websites and it s a little more detailed than aarp s. The american association of retired persons aarp is a large independent nonprofit organization dedicated to helping people ages 50 plus to achieve independence including financial independence while the organization which serves 37 million older americans and counting doesn t offer reverse mortgage products directly it does weigh in on them in some very important ways. I have created a calculator that allows users to get a sense of the principal limit available with a hecm reverse mortgage on their homes using the most popular one month variable rate option.

Get discounts on insurance and banking services with your aarp member advantages. Skip to content the aarp eye center has answers to your questions about vision health. In a reverse mortgage the payments that the bank makes accumulate in the form of a loan but in this case the borrower isn t obligated to pay it back while they live in the home. Consumers are asked to enter their zip code mortgage balance if any home value name and date of birth for themselves and any co owners.

/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg)