Roth Ira Beneficiaries Options

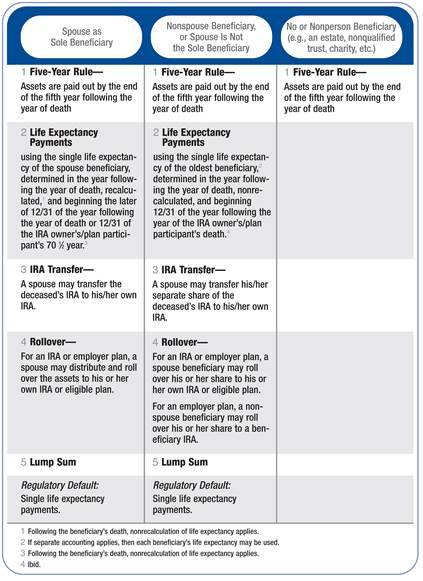

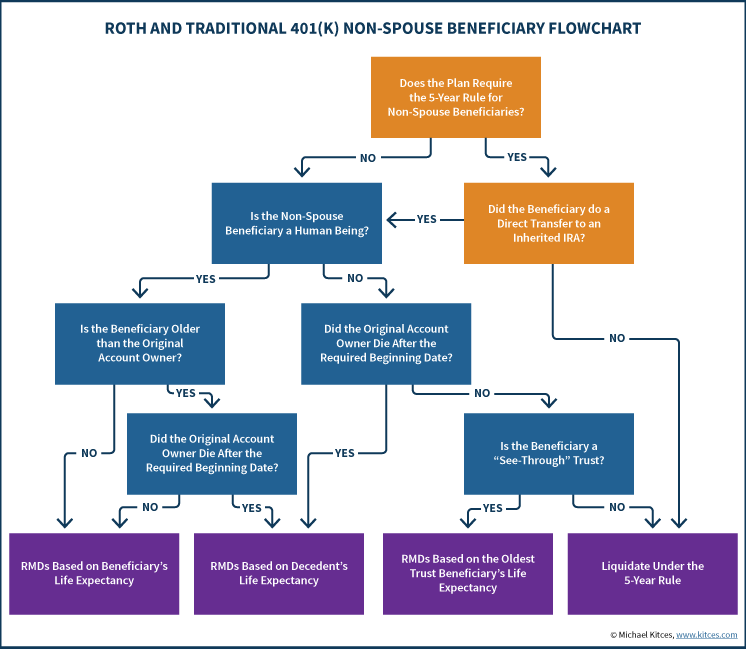

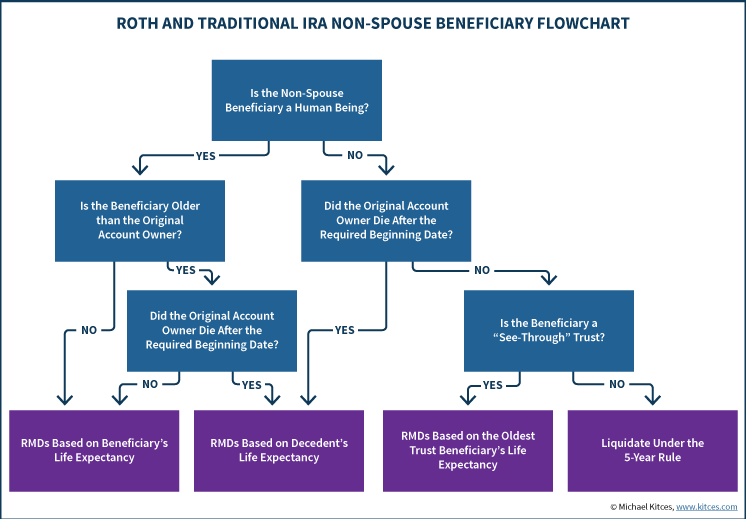

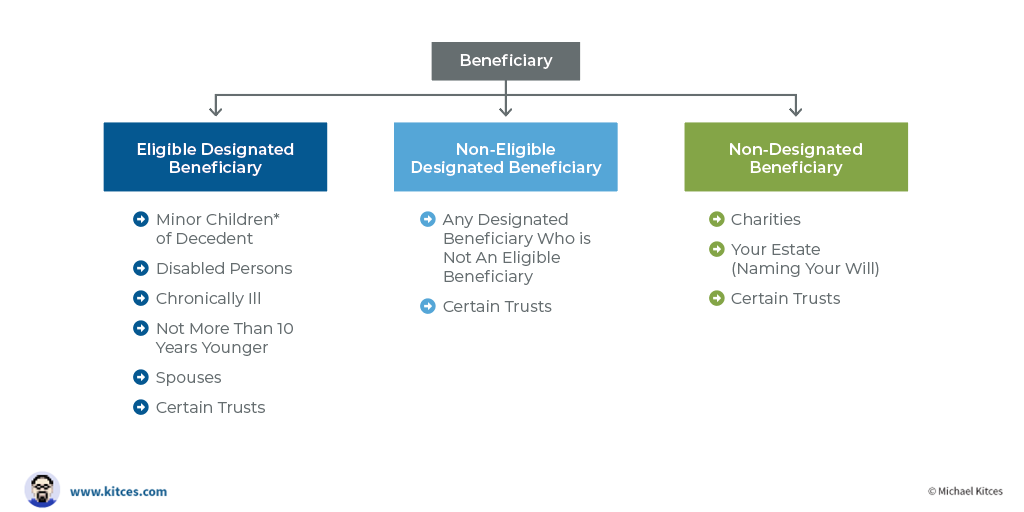

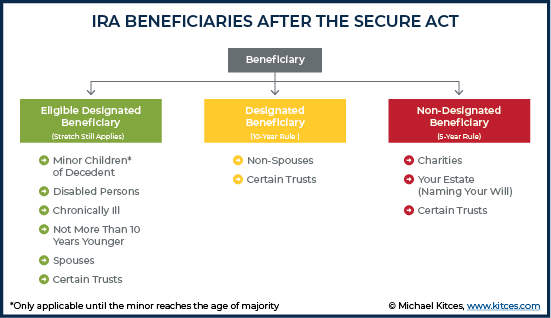

Beneficiaries of qualified plans.

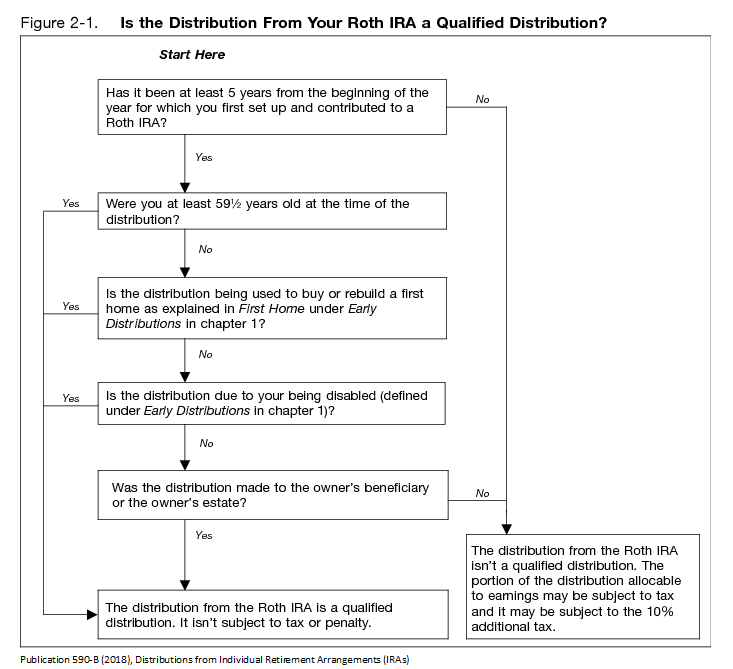

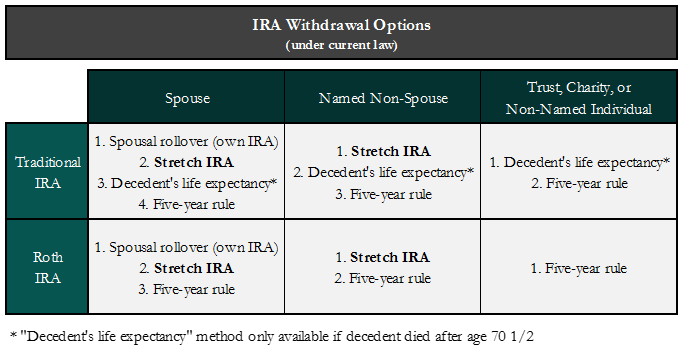

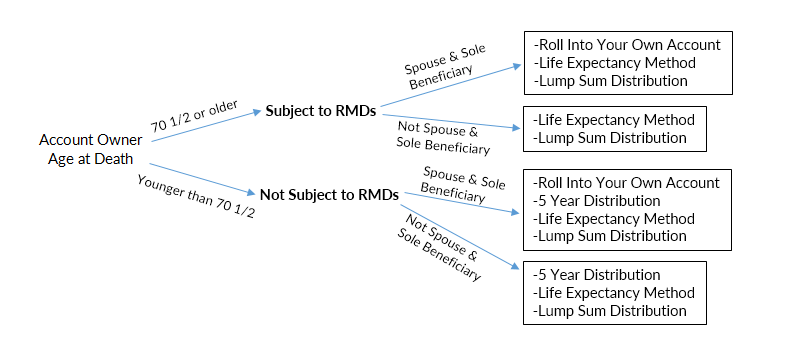

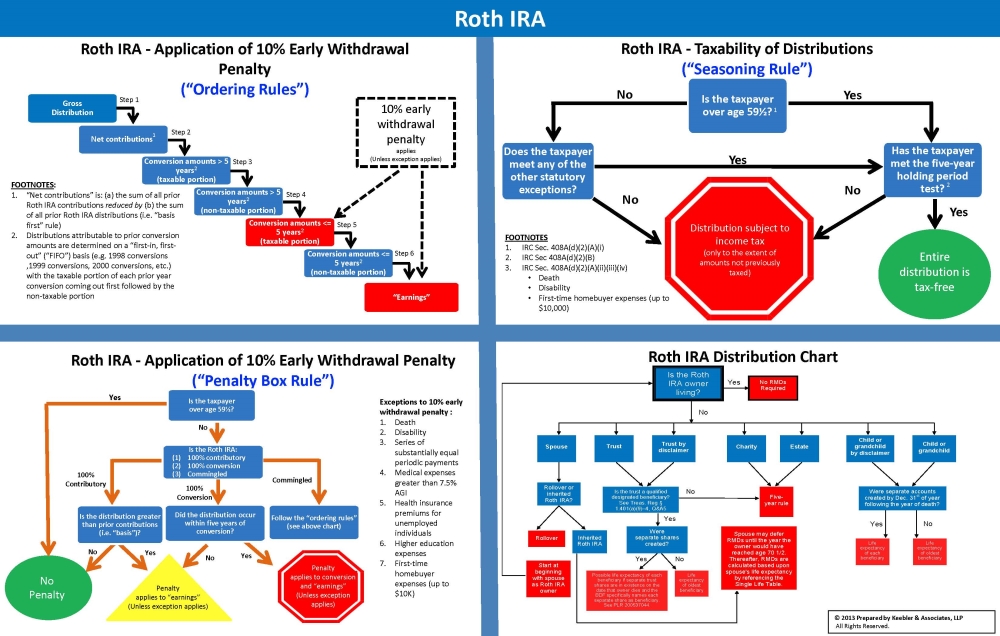

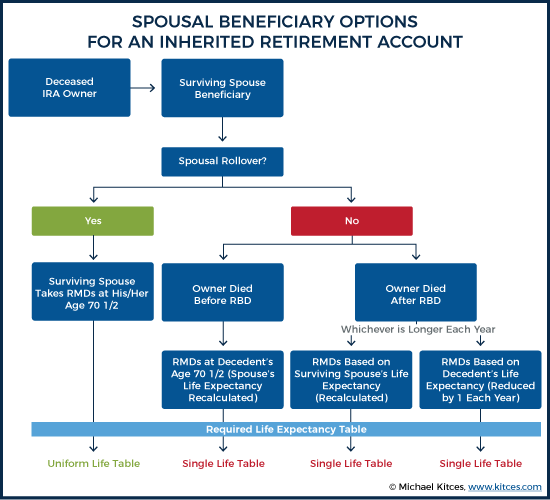

Roth ira beneficiaries options. The five year rule is an available option for a beneficiary only when an ira owner passes away before his her required beginning date or rbd i e april 1 of the year after attainment of age 70. Non spouse beneficiaries who inherit a roth ira are usually required to begin taking distributions from it by december 31 of the year after the year in which the original account owner died. Roth ira owners regardless of age at the time of death are always considered to have died before the rbd. Distributions from another roth ira cannot be substituted for these distributions unless the other roth ira was inherited from the same decedent.

Roth iras also allow for tax free and penalty free withdrawals as long as the account is at least five years old and the original owner is at least 59 5. If you re the beneficiary of a roth ira you may have several options including opening an inherited roth ira. Inherited iras present many complications even more so than the already strict rules of an ira plan. The act imposes a new rule on inherited iras if the account owner died after dec.

But you have several options including some free ones that can get you going in the right. Going the vegas or bust option could leave you owing a hefty sum when it s time to file your taxes. If the original ira owner died on or after january 1 2020 the secure act which eliminated the stretch ira requires non spousal beneficiaries to withdraw all assets from an inherited ira or 401 k plan by december 31 of the 10th year following the ira owner s death. Beneficiaries must empty the account within 10 years of the owner s death unless they qualify for an.

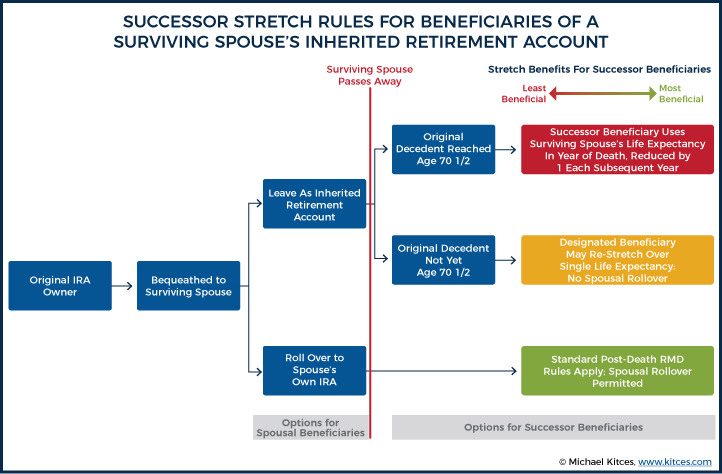

Similar to traditional ira rules the lump sum option does not require you to set up a separate account. Roth ira beneficiaries can withdraw contributions tax free at any time. If the sole beneficiary is the spouse he or she can either delay distributions until the decedent would have reached age 70 or treat the roth ira as his or her own. But your relationship to the original owner and the age of the account determine.

If the original ira owner died before december 31 2019 the stretch ira option is available.