Setting Up Bank Account For Rental Property

So i strongly recommend that your rental have its own bank account.

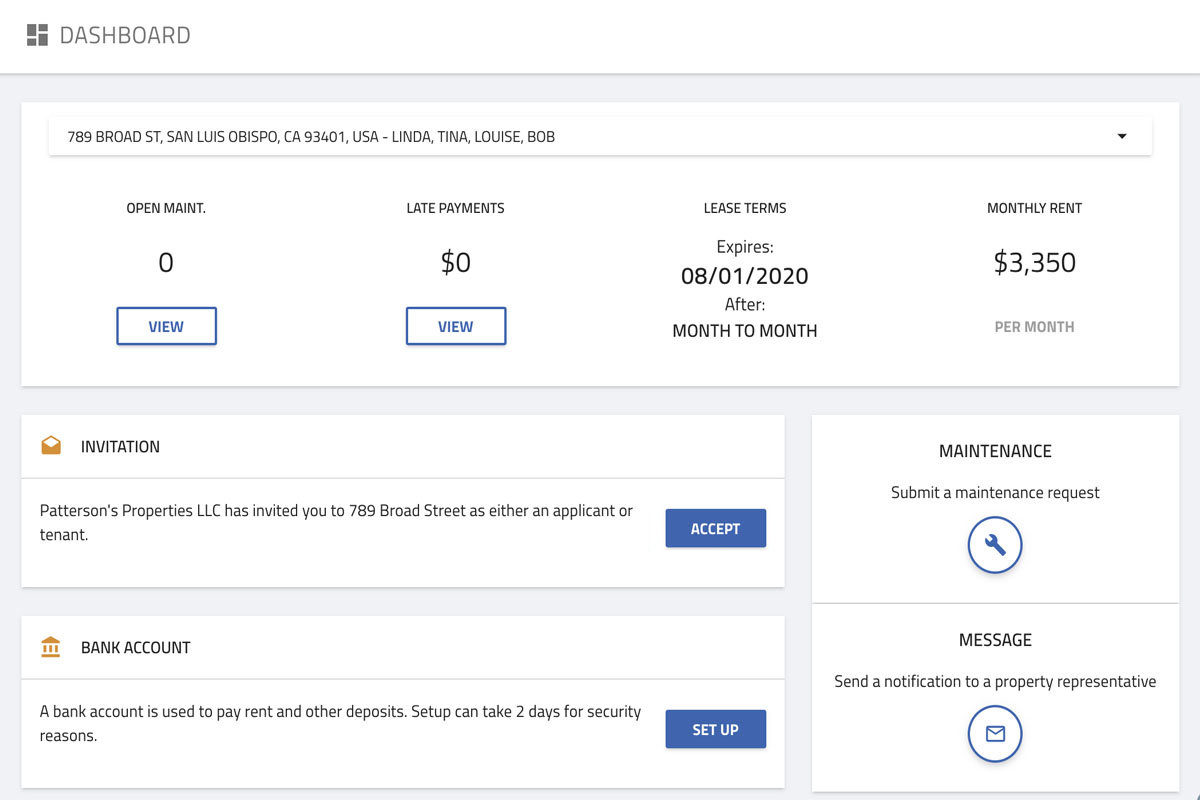

Setting up bank account for rental property. Owner deposits rental income for each property separately and expenses separately all to one bank account. I set up one rental checking account and one savings account. Just because something is easy doesn t always mean it s a good idea though. How to create an account for a rental deposit.

Real estate investors are small business owners including side hustlers who work a. As for worries about the mortgage bouncing. Expenses can be set up for maintenance etc paid from the same bank account. Even though they are both under the same llc can i set up multiple dba s so that i can open separate bank accounts for each property to help keep the accounting separate.

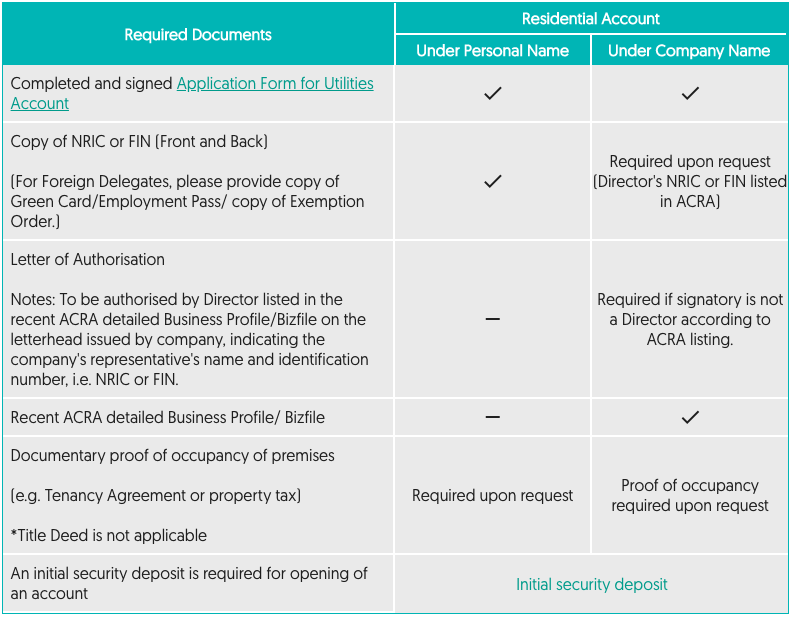

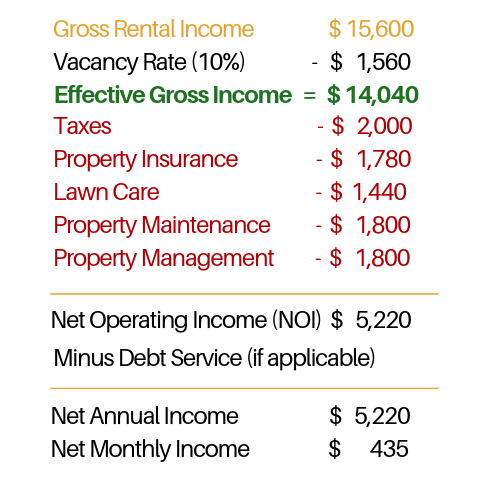

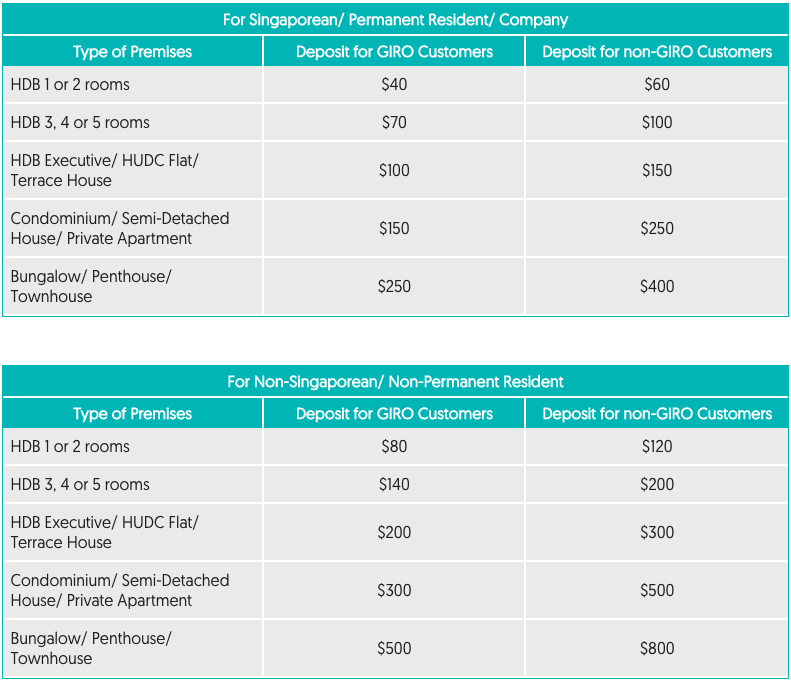

If you only have one bank account for all of your rental properties it s much harder to keep track of income and expenses. Some property management companies choose to set up two accounts one account established as an operating trust account and one serves as a tenant security deposit trust account. In our case it was navy federal. Quickly and easily setting up your rental accounts.

So i am in process of setting up coa and was setting up each property separately. Obviously i need to provide the cpa with p l for each property. Brian davis is a real estate investor who has owned dozens of investment properties over the last 15 years. If not regulated by the state it is up to the property manager to decide between one or multiple accounts for accounting and tracking purposes.

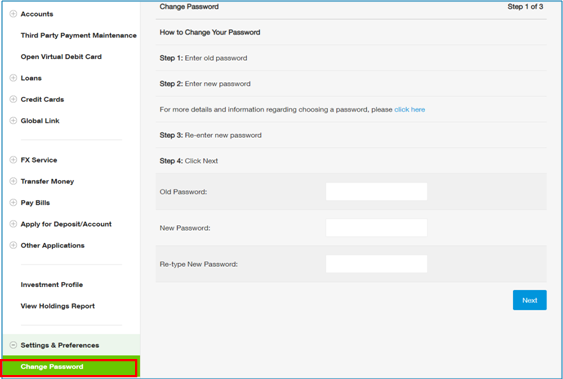

However setting up a strong rental property accounting system is a must for running a well oiled real estate business and making sure you get the most out of your investments. One of the easiest ways to collect rent is by setting up direct deposit rent to the landlord. Hi i have 2 rental properties that were purchased through traditional mortgage and then transferred to a single llc. Simple limited to just two accounts at a bank that i already routinely used so.

By separating your finances by rental property you re able to easily identify income and expenses for each rental property and keep track of the profitability of each of your investments plus all of your income and expenses will be organized when the time comes. Furthermore learning accounting basics and setting up an efficient accounting system early on will give you the time to focus on profit making activities. In the beginning i just create separate checking and savings accounts at our local bank.