Small Business Working Capital Grant

Collateral free funding of up to s 1 000 000.

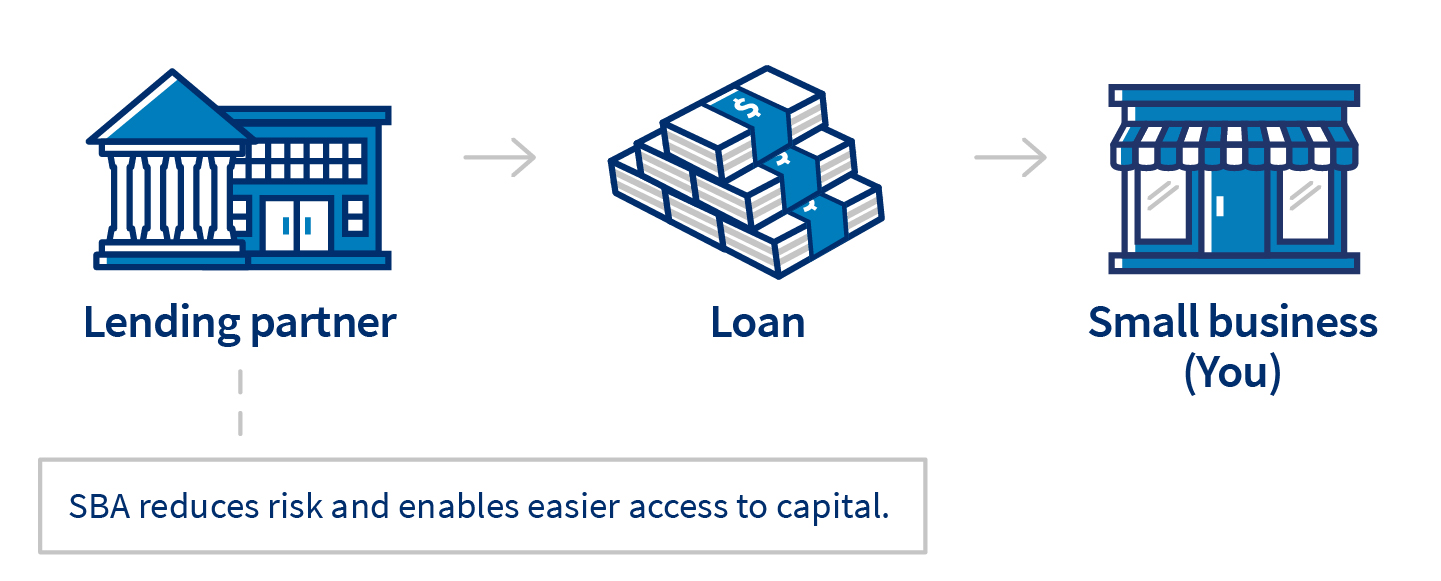

Small business working capital grant. No collateral is required for our working capital loans or short term funding the required documentation is limited and perfect credit not needed. Working capital loans are not used to buy long term assets or investments. Funds can be used to pay working capital expenses such as payroll insurance rent mortgage payments utilities inventory and more. Enhanced sme working capital loan.

Who qualifies over 900 industries and counting. Working capital loans can help you take care of immediate needs in your business whether that is a cash flow shortfall or a new business opportunity. Working capital financing puts small businesses in a prime position to capitalize on time sensitive opportunities like last minute inventory discounts. Nearly every industry can get a working capital.

This is a great way to translate your projected sales into an immediate or almost immediate at least cash injection. A working capital loan is a loan taken to finance a company s everyday operations. Critical infrastructure grant cip business grants the critical infrastructure program cip offers a grant at rates that vary between 15 and 50 when you need to invest in infrastructure in order to make further productive investment possible you are eligible for a. Funding details 10 000 5mm working capital 250 000 equipment.

It can assist with helping businesses harness their full potential. Working capital loans act as unsecured debt which means you as the business owner will not need to provide collateral as with traditional loan methods. We would like to show you a description here but the site won t allow us. Who qualifies 10 000 5mm working capital 250 000 equipment term.

Working capital fuels business growth and expansion which is arguably the biggest factor in driving clients to seek out our short term funding projects. They are used to provide working. Achieving business working capital funding from fdf. Small business working capital grants kansas businesses with fewer than 500 employees are eligible to apply for small business working capital grants.

A small business working capital loan is one of the easiest solutions for business owners. Funding details 5 99 35 of the loan amount varies on credit cashflow risk factors.