Tax On Bonus Payments

If you cannot apply the rules contained in this tax table immediately you may continue to use the old tax table until 30 june 2005.

Tax on bonus payments. The problem with this approach is that instead of taxes being withheld at a flat 25 and having that 25 rate applies only to the bonus amount taxes are withheld at what is almost certainly a higher rate on the combined amount of your normal pay and the bonus. The employees must pay federal and state income taxes and fica taxes social security and medicare on bonus pay. For example a bonus paid to an employee at the time of hire sometimes called a signing bonus is subject to all employment taxes. This means that in march 2016 thandi paid r5 698 33 r68 380 12 tax on her payment of salary and bonus.

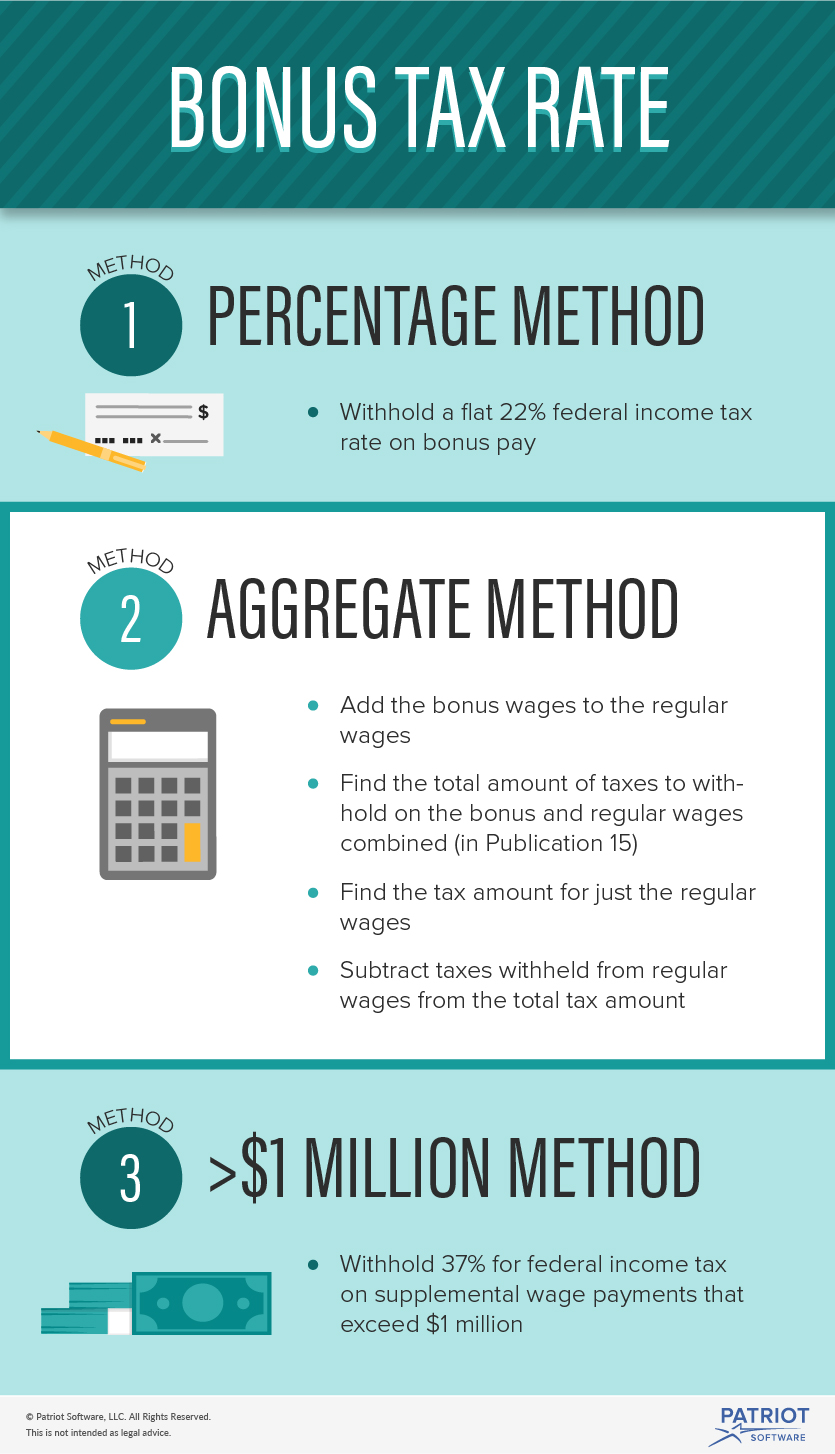

How to work out the amount to withhold if the bonus or similar payment relates to work performed in a single pay period. This rate was put in place after 2017 and is expected to be in effect until the end of 2025. When it comes to bonuses employers can calculate your tax withholding in one of two ways. The downfall of this method is that the calculation assumes that you ll be receiving the higher income for every month of the tax year which is obviously not the case.

In the last four weeks jay has earned 2 695 from her second job. X research source for example a one time bonus of 5 000 added to your paycheck of say 35 000 could throw you into a different tax bracket making the amount of income tax you owe higher since your total income is higher. For payments made on or after 1 july 2018. Certain qualifying retroactive lump sum payments are eligible for a special tax calculation when an individual files their income tax and benefit return.

Just like that your bonus shrinks to 1 280 000 because 220 000 goes to the irs right off the top. Following steps one to five jay s employer can work out the amount of paye on her 40 000 bonus. This applies to bonuses and supplemental wages paid in the 2019 tax year as well as in the 2020 tax year. There is a withholding limit of 47 on tax withheld from any additional payments calculated using an annualised method.

Jay has a second job and uses the st tax code. Withholding tax tables bonuses and similar payments nat 7905 6 2003. In 2020 you will only pay fica taxes on the first 137 700 you earn. Schedule 5 tax table for back payments commissions bonuses and similar payments.